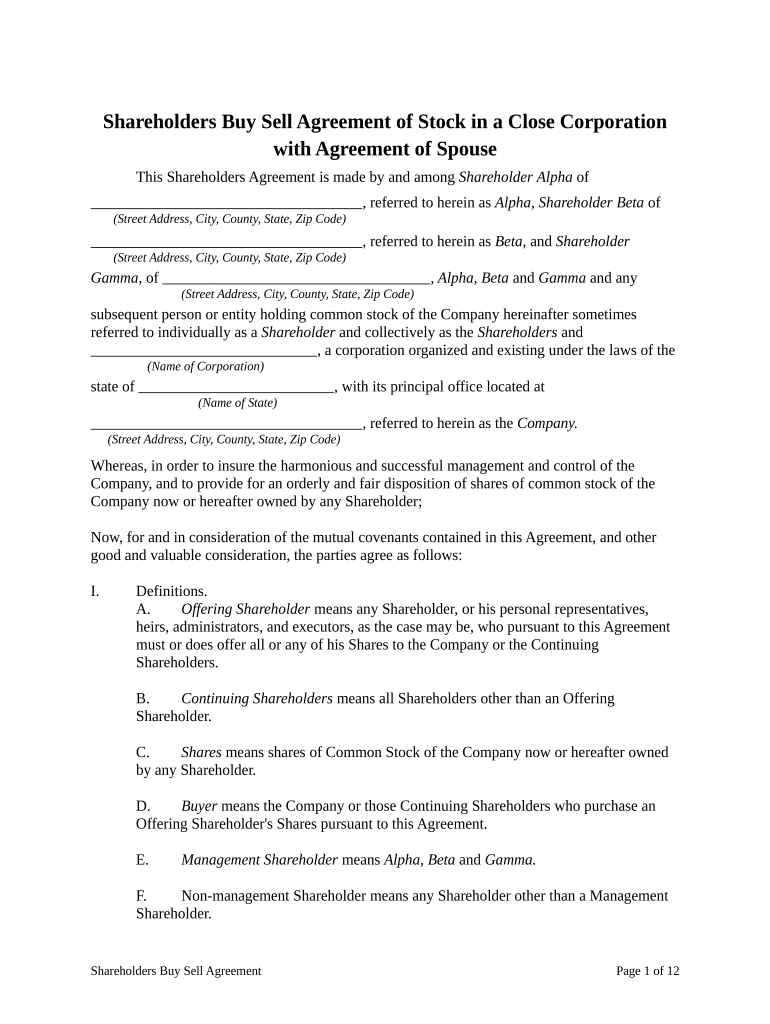

Stock in Corporation Form

What is the stock in corporation?

The stock in corporation refers to the ownership shares issued by a corporation, representing a claim on the corporation's assets and earnings. In the United States, corporations can issue different classes of stock, such as common and preferred stock, each with distinct rights and privileges. Common stock typically grants voting rights and the potential for dividends, while preferred stock often provides fixed dividends and priority in asset distribution during liquidation. Understanding the nuances of stock in a corporation is essential for shareholders, as it impacts their investment and decision-making processes.

Key elements of the stock in corporation

Several key elements define the stock in a corporation, including:

- Ownership Rights: Shareholders possess rights to vote on corporate matters, receive dividends, and participate in the distribution of assets upon liquidation.

- Classes of Stock: Corporations may issue various classes of stock, each with specific rights, such as voting power and dividend preferences.

- Transferability: Shares can typically be bought and sold, allowing shareholders to transfer ownership interests easily.

- Market Value: The value of stock is determined by market conditions, influencing investment decisions and corporate financing.

Steps to complete the stock in corporation

Completing the stock in corporation involves several steps, which may vary depending on the corporation's structure and state regulations:

- Determine Stock Structure: Decide on the number of shares and classes of stock to be issued.

- Draft Corporate Bylaws: Outline the rules governing the corporation, including stock issuance and shareholder rights.

- File Articles of Incorporation: Submit the necessary documents to the state, detailing the corporation's structure and stock information.

- Issue Stock Certificates: Provide physical or digital certificates to shareholders, documenting their ownership.

Legal use of the stock in corporation

The legal use of stock in a corporation is governed by federal and state laws, ensuring compliance with regulations. Key legal considerations include:

- Registration Requirements: Depending on the type of stock and the number of shareholders, certain stocks may need to be registered with the Securities and Exchange Commission (SEC).

- Disclosure Obligations: Corporations must provide accurate information to shareholders regarding financial performance and corporate governance.

- Compliance with Securities Laws: Corporations must adhere to securities regulations to protect investors and maintain market integrity.

State-specific rules for the stock in corporation

Each state in the U.S. has its own regulations regarding stock issuance and management. It is crucial for corporations to understand these state-specific rules, which may include:

- Minimum Capital Requirements: Some states require a minimum amount of capital to be raised through stock issuance.

- Reporting Requirements: States may mandate regular reporting on stock ownership and corporate activities.

- Tax Implications: Different states may impose varying taxes on stock transactions and corporate income.

Examples of using the stock in corporation

Understanding practical applications of stock in a corporation can clarify its significance. Examples include:

- Raising Capital: Corporations issue stock to raise funds for expansion, research, or operational costs.

- Employee Compensation: Companies may offer stock options or shares as part of employee compensation packages, aligning employee interests with corporate performance.

- Mergers and Acquisitions: Stock can be used as currency in mergers, allowing companies to acquire others without immediate cash outlay.

Quick guide on how to complete stock in corporation

Prepare Stock In Corporation effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents promptly without delays. Handle Stock In Corporation on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign Stock In Corporation with ease

- Locate Stock In Corporation and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent portions of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Stock In Corporation and ensure effective communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sell agreement in airSlate SignNow?

A sell agreement in airSlate SignNow is a legally binding document that outlines the terms of a sale between two parties. This document can be easily created, shared, and signed electronically, streamlining the selling process. By using airSlate SignNow, you ensure that your sell agreements are efficient and secure.

-

How do I create a sell agreement in airSlate SignNow?

Creating a sell agreement in airSlate SignNow is simple. You can start by choosing a template or uploading your own document. From there, use the intuitive drag-and-drop interface to customize the agreement, add fields for signatures, and send it to the involved parties for their electronic signature.

-

What features does airSlate SignNow offer for managing sell agreements?

airSlate SignNow offers a range of features for managing sell agreements, including customizable templates, real-time tracking, and automated reminders. These features enhance the efficiency of document management and ensure that all parties stay informed throughout the signing process. You also gain access to advanced security options to protect sensitive information.

-

Is there a cost involved in using airSlate SignNow for sell agreements?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost depends on the number of users and features you require. Overall, it provides a cost-effective solution for creating, sending, and managing sell agreements in comparison to traditional paper methods.

-

Can I integrate airSlate SignNow with my existing tools for sell agreements?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, including CRMs and project management tools. This integration ensures that you can manage your sell agreements alongside other business processes without any hassle, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for sell agreements?

Using airSlate SignNow for sell agreements provides numerous benefits, including increased efficiency, reduced errors, and faster turnaround times. The electronic signing feature eliminates the need for printing and scanning, saving you both time and resources. Additionally, you can track the progress of your agreements in real-time, ensuring transparency.

-

Is airSlate SignNow secure for handling sell agreements?

Yes, airSlate SignNow prioritizes security and employs industry-leading encryption methods to protect your sell agreements. With features like audit trails and user authentication, you can rest assured that your documents remain confidential and tamper-proof. Compliance with legal standards further enhances the trustworthiness of the platform.

Get more for Stock In Corporation

Find out other Stock In Corporation

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online