Letter Direct Debit Form

What is the Letter Direct Debit

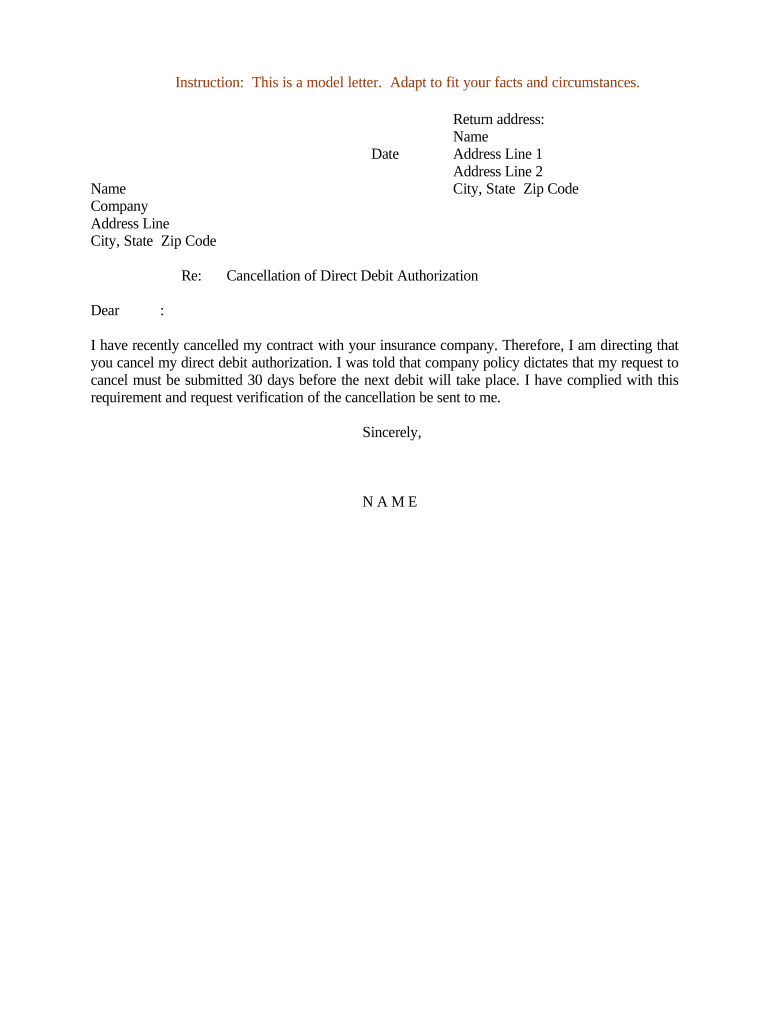

A letter direct debit is a formal document that authorizes a financial institution or service provider to withdraw funds directly from a bank account on a recurring basis. This method is commonly used for regular payments such as utility bills, subscriptions, or loan repayments. By providing this authorization, the account holder ensures that payments are made automatically, reducing the risk of late fees and missed payments. The letter typically includes essential information such as the account holder's name, account number, the amount to be debited, and the frequency of the transactions.

How to Use the Letter Direct Debit

To effectively use a letter direct debit, the account holder must first complete the letter with accurate details. This includes specifying the payee's information, the amount to be debited, and the payment schedule. Once the letter is filled out, it should be signed and submitted to the payee or financial institution. After submission, the account holder should monitor their bank statements to ensure that the debits occur as authorized. If any discrepancies arise, it is important to contact the financial institution promptly to resolve the issue.

Steps to Complete the Letter Direct Debit

Completing a letter direct debit involves several straightforward steps:

- Gather necessary information, including your bank account details and the payee's information.

- Clearly state the amount to be debited and the frequency of the payments.

- Sign the letter to authorize the direct debit.

- Submit the completed letter to the payee or financial institution.

- Keep a copy of the letter for your records.

Legal Use of the Letter Direct Debit

The legal use of a letter direct debit is governed by various regulations that ensure the protection of both the account holder and the payee. In the United States, the Electronic Fund Transfer Act (EFTA) provides guidelines on electronic payments, including direct debits. It is crucial that the letter includes clear consent from the account holder, as this consent serves as a legal basis for the transactions. Additionally, the account holder has the right to revoke the authorization at any time by submitting a cancellation letter to the payee.

Key Elements of the Letter Direct Debit

When drafting a letter direct debit, several key elements must be included to ensure its validity:

- Account Holder's Information: Full name, address, and contact details.

- Bank Account Details: Account number and routing number.

- Payee Information: Name and address of the entity receiving the payments.

- Payment Amount: The specific amount to be debited.

- Payment Frequency: How often the payments will occur (e.g., monthly, quarterly).

- Signature: The account holder's signature to authorize the debit.

Examples of Using the Letter Direct Debit

Examples of situations where a letter direct debit may be used include:

- Paying monthly utility bills, such as electricity or water.

- Settling subscription fees for services like streaming platforms or gym memberships.

- Making regular loan repayments for personal or auto loans.

- Contributing to retirement accounts or investment funds on a scheduled basis.

Quick guide on how to complete letter direct debit

Effortlessly Prepare Letter Direct Debit on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage Letter Direct Debit on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to modify and electronically sign Letter Direct Debit with ease

- Find Letter Direct Debit and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools specifically designed for that purpose available from airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your adjustments.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Letter Direct Debit and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter direct debit?

A letter direct debit is a written authorization that allows a company to withdraw funds directly from a customer's bank account. This form of payment simplifies transactions and ensures timely payments for services. By using airSlate SignNow, businesses can easily create and send these letters for a smooth direct debit process.

-

How does airSlate SignNow facilitate letter direct debit approvals?

With airSlate SignNow, you can quickly generate and send letter direct debit requests for eSigning. The platform allows for easy tracking and management of approvals, ensuring you receive consent from your customers efficiently. This streamlined process enhances customer satisfaction and minimizes administrative burdens.

-

Are there any costs associated with using letter direct debit features on airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including features for managing letter direct debit requests. The costs are competitive and provide excellent value considering the wide range of capabilities offered. You can choose a plan that best suits your budget and volume of transactions.

-

What benefits does using a letter direct debit offer businesses?

Using a letter direct debit allows businesses to ensure regular payments from customers without the hassle of manual invoicing. This method improves cash flow, reduces late payments, and enhances overall customer experience. Additionally, airSlate SignNow simplifies the process, allowing you to focus more on your core business activities.

-

Can I customize my letter direct debit template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize letter direct debit templates to suit your branding and operational needs. You can add your logo, change colors, and edit the content to reflect your business message. Customization ensures your communications remain professional and aligned with your brand identity.

-

Does airSlate SignNow integrate with other financial management tools for letter direct debit?

Absolutely! airSlate SignNow offers integrations with a variety of financial management tools to enhance its letter direct debit functionality. This allows for seamless synchronization of data, saving time and reducing errors when processing transactions with your existing systems.

-

How secure is the process of sending a letter direct debit using airSlate SignNow?

airSlate SignNow prioritizes security in its document management processes, including the handling of letter direct debit requests. The platform employs advanced encryption and compliance measures to protect sensitive financial information, ensuring both your business and your customer's data remain safe.

Get more for Letter Direct Debit

Find out other Letter Direct Debit

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later