Pastor Independent Contractor Form

What is the Pastor Independent Contractor Form

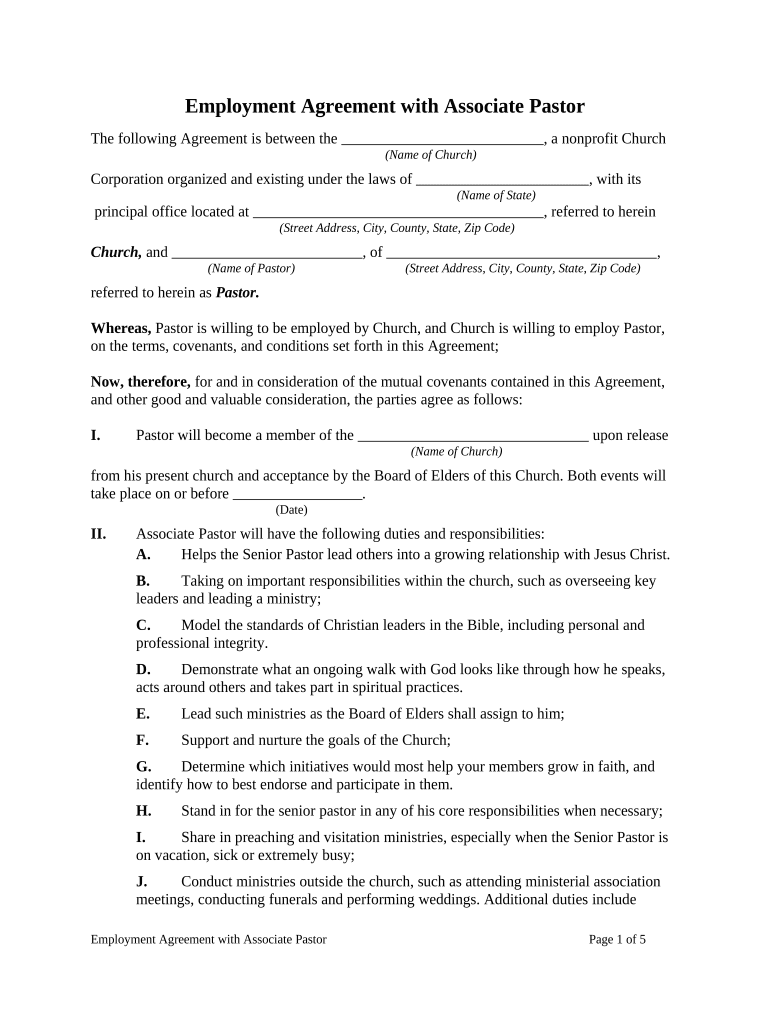

The pastor independent contractor form is a crucial document used to establish the relationship between a church or religious organization and an individual serving as a pastor. This form outlines the terms of engagement, including the nature of the work, compensation details, and the responsibilities of both parties. It is essential for ensuring clarity and legal compliance in the arrangement, particularly regarding tax obligations and employment classifications.

How to Use the Pastor Independent Contractor Form

Using the pastor independent contractor form involves several steps to ensure that all necessary information is accurately captured. First, gather relevant details about the pastor, including their name, contact information, and tax identification number. Next, specify the terms of the engagement, such as the duration of service, payment schedule, and any specific duties expected of the pastor. Finally, both parties should review the completed form for accuracy before signing it to formalize the agreement.

Key Elements of the Pastor Independent Contractor Form

Several key elements must be included in the pastor independent contractor form to ensure its effectiveness and legal validity. These elements typically include:

- Identification of Parties: Names and contact information of both the church and the pastor.

- Scope of Work: Detailed description of the services to be provided by the pastor.

- Compensation: Payment terms, including amounts and frequency.

- Duration: Start and end dates of the engagement.

- Signatures: Signatures of both parties to confirm agreement.

Steps to Complete the Pastor Independent Contractor Form

Completing the pastor independent contractor form requires careful attention to detail. Follow these steps:

- Gather necessary information about the pastor and the church.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Have both parties sign the document to make it legally binding.

- Store the completed form securely for future reference.

Legal Use of the Pastor Independent Contractor Form

The legal use of the pastor independent contractor form hinges on compliance with federal and state regulations. This includes understanding the implications of the IRS guidelines regarding independent contractors versus employees. Proper classification is vital to avoid potential penalties. The form should clearly outline the independent nature of the pastor's work to support this classification.

State-Specific Rules for the Pastor Independent Contractor Form

State-specific rules may affect the pastor independent contractor form, as different states have varying regulations regarding employment and taxation. It is important to research and understand these local laws to ensure that the form complies with state requirements. This may include specific language or additional disclosures that need to be included in the agreement.

Quick guide on how to complete pastor independent contractor form

Effortlessly Prepare Pastor Independent Contractor Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without hassle. Manage Pastor Independent Contractor Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign Pastor Independent Contractor Form effortlessly

- Obtain Pastor Independent Contractor Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant parts of the documents or conceal sensitive details using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, cumbersome form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and eSign Pastor Independent Contractor Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a pastor form and how can it be used?

A pastor form is a specialized document designed for religious leaders to provide essential information, manage records, or facilitate church-related processes. With airSlate SignNow, you can easily create, send, and eSign pastor forms, streamlining tasks such as ceremony approvals, membership applications, and more.

-

How does airSlate SignNow ensure the security of my pastor forms?

airSlate SignNow employs industry-leading security measures, including encryption and multi-factor authentication, to protect your pastor forms and sensitive data. This ensures that all transactions and communications remain confidential and secure, giving you peace of mind while using our eSigning service.

-

What features does airSlate SignNow offer for creating pastor forms?

Our platform offers a range of features for creating pastor forms, including customizable templates, drag-and-drop fields, and collaboration tools. You can easily design forms that fit the unique needs of your church, ensuring that all necessary information is captured efficiently.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore all features, including the creation and management of pastor forms. This trial gives you the opportunity to evaluate how our solution fits your needs without any financial commitment.

-

Are there any integration options for pastor forms with other software?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Microsoft Office. This allows you to manage your pastor forms efficiently within the tools you already use, enhancing your workflow.

-

What are the pricing options for using airSlate SignNow for pastor forms?

airSlate SignNow offers flexible pricing plans to accommodate different needs, starting with a free option and ranging to more comprehensive plans with advanced features for managing pastor forms. You can choose a plan that fits your budget while accessing the tools necessary for smooth document management.

-

Can I access my pastor forms on mobile devices?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage your pastor forms on smartphones and tablets. This ensures that you can handle important tasks on the go, making it easier to stay organized and responsive.

Get more for Pastor Independent Contractor Form

Find out other Pastor Independent Contractor Form

- How To Integrate eSign in Sports

- How To Use eSign in Sports

- How To Install eSign in Sports

- How To Add eSign in Sports

- How To Implement eSign in Sports

- How To Use eSign in Real Estate

- How To Install eSign in Police

- How Do I Implement eSignature in Plumbing

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer

- How To Install Electronic signature in Charity

- How To Add Electronic signature in Charity

- How To Set Up Electronic signature in Charity

- How To Save Electronic signature in Charity