Foreclosure Collection Form

What is the foreclosure collection?

The foreclosure collection refers to the process and documentation involved when a lender attempts to recover the outstanding debt from a borrower who has defaulted on their mortgage payments. This process typically includes various legal and financial steps, culminating in the potential sale of the property to satisfy the debt. Understanding the foreclosure collection is crucial for both lenders and borrowers, as it outlines the rights and responsibilities of each party involved. The collection process can vary based on state laws and regulations, making it essential to be informed about local statutes.

Steps to complete the foreclosure collection

Completing the foreclosure collection requires several key steps to ensure legal compliance and proper documentation. Here are the main steps involved:

- Notification of Default: The lender must notify the borrower of the default status, typically after missed payments.

- Collection Attempts: The lender may attempt to collect the overdue payments through various means, including phone calls and letters.

- Legal Action: If the borrower fails to respond, the lender may initiate legal proceedings to begin the foreclosure process.

- Filing the Foreclosure Collection Form: The lender must complete and file the appropriate foreclosure collection form with the court.

- Court Proceedings: A court hearing may be scheduled to allow both parties to present their cases.

- Property Sale: If the court rules in favor of the lender, the property may be sold at auction to recover the owed amount.

Legal use of the foreclosure collection

The legal use of the foreclosure collection is governed by federal and state laws that dictate how lenders can proceed with recovering debts. It is essential for lenders to follow these regulations to avoid legal repercussions. The process must adhere to the Fair Debt Collection Practices Act (FDCPA) and other relevant laws to ensure that borrowers' rights are protected. Proper documentation and adherence to legal procedures are critical to maintaining the validity of the foreclosure collection.

Key elements of the foreclosure collection

Several key elements are essential for a successful foreclosure collection. These include:

- Documentation: Accurate records of payments, defaults, and communication with the borrower must be maintained.

- Legal Compliance: All actions taken must comply with local and federal laws governing foreclosure processes.

- Timeliness: The lender must act promptly to initiate the foreclosure collection after a default occurs.

- Clear Communication: Lenders should communicate clearly with borrowers regarding their status and options available to avoid foreclosure.

State-specific rules for the foreclosure collection

Each state has its own laws and regulations governing foreclosure collections, which can significantly impact the process. These rules may dictate the timeline for notifications, the required documentation, and the legal procedures that must be followed. It is important for both lenders and borrowers to familiarize themselves with the specific rules in their state to ensure compliance and protect their rights during the foreclosure process.

Required documents for the foreclosure collection

Several documents are typically required to complete a foreclosure collection. These may include:

- Loan Agreement: The original mortgage or loan agreement outlining the terms and conditions.

- Default Notice: Documentation proving that the borrower has defaulted on their payments.

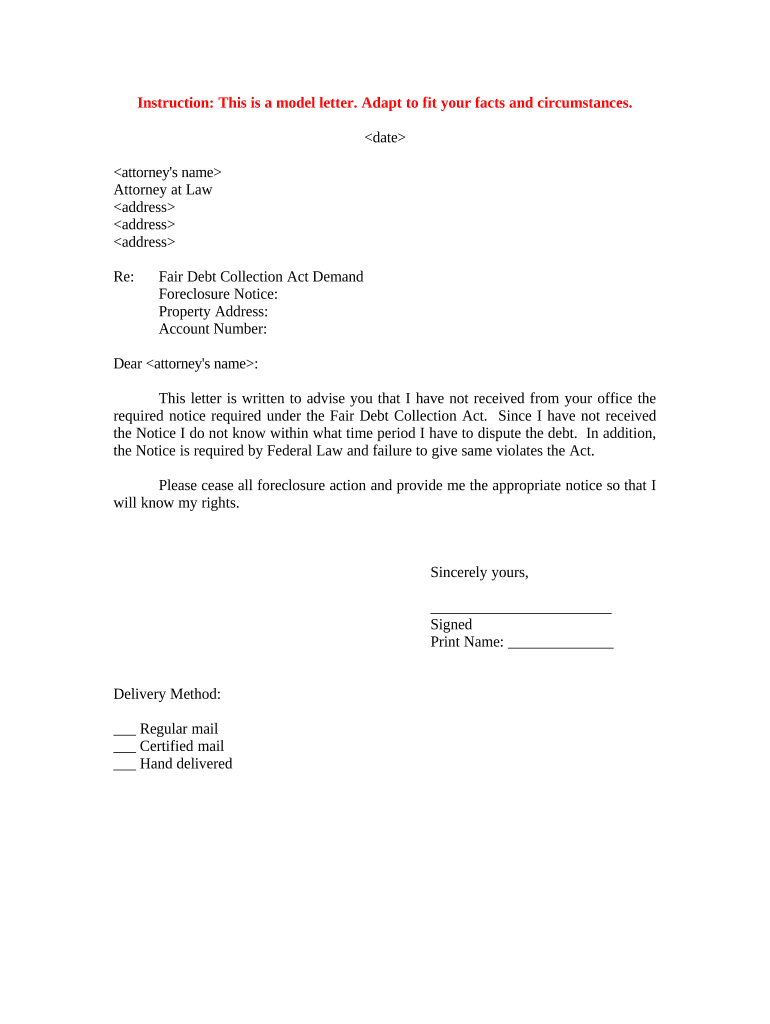

- Foreclosure Collection Form: The specific form that must be filed with the court to initiate the foreclosure process.

- Proof of Communication: Records of any attempts made to contact the borrower regarding the default.

Quick guide on how to complete foreclosure collection

Complete Foreclosure Collection effortlessly on any device

Digital document management has gained increasing popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without any delays. Handle Foreclosure Collection on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest method to alter and electronically sign Foreclosure Collection without any hassle

- Find Foreclosure Collection and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Foreclosure Collection and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is foreclosure collection?

Foreclosure collection refers to the process of collecting debts from borrowers who have defaulted on their mortgages, leading to foreclosure. It involves legal and financial steps to recover owed amounts. Understanding this process is vital for businesses to manage their finances effectively.

-

How can airSlate SignNow assist with foreclosure collection?

airSlate SignNow provides an efficient method for sending, signing, and managing documents related to foreclosure collection. With its easy-to-use interface, businesses can streamline documentation processes and ensure compliance, improving overall operational efficiency during collection efforts.

-

What features does airSlate SignNow offer for managing foreclosure collection?

Key features of airSlate SignNow for foreclosure collection include customizable templates, automated workflows, and secure eSignature capabilities. These tools simplify the documentation required in collection processes, making it easier and faster to manage foreclosure-related paperwork.

-

How does pricing work for airSlate SignNow in relation to foreclosure collection?

airSlate SignNow offers competitive pricing plans that cater to businesses handling foreclosure collection. Customers can select a plan that best fits their needs, ensuring they only pay for the features required to facilitate efficient collection processes. It's a cost-effective solution for businesses of all sizes.

-

Can airSlate SignNow integrate with other tools for foreclosure collection?

Yes, airSlate SignNow integrates seamlessly with various CRMs and document management systems, enhancing the efficiency of foreclosure collection processes. These integrations allow users to synchronize data and automate tasks, ensuring effective communication throughout the collection lifecycle.

-

What benefits does airSlate SignNow provide for foreclosure collection teams?

By utilizing airSlate SignNow, foreclosure collection teams can enjoy faster document turnaround times, improved accuracy through templates, and enhanced compliance with legal standards. These benefits help streamline the collection process, allowing teams to focus on recovery rather than paperwork.

-

Is airSlate SignNow user-friendly for those new to foreclosure collection?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for those new to foreclosure collection. The intuitive interface guides users through document preparation, eSigning, and workflow management, reducing the learning curve and supporting a swift implementation.

Get more for Foreclosure Collection

Find out other Foreclosure Collection

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe