Closure Estate Form

What is the Closure Estate

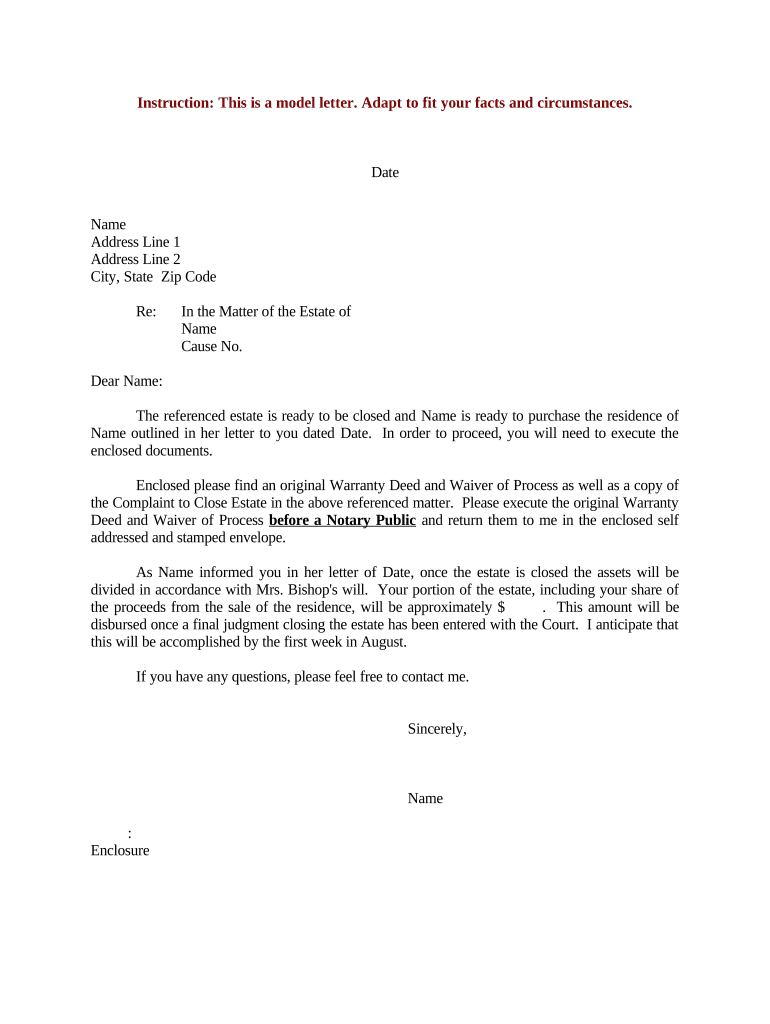

The closure estate refers to the legal process involved in settling an estate after a person's death. It encompasses the distribution of assets, payment of debts, and resolution of any outstanding financial obligations. This process ensures that the deceased's wishes, as outlined in their will or through state laws, are honored. Understanding the closure estate is crucial for executors, beneficiaries, and legal representatives involved in estate management.

Steps to complete the Closure Estate

Completing the closure estate involves several key steps to ensure a smooth process. These steps typically include:

- Gathering documentation: Collect all relevant documents, including the will, death certificate, and financial records.

- Identifying assets: Compile a comprehensive list of the deceased's assets, including real estate, bank accounts, and personal property.

- Paying debts: Settle any outstanding debts or obligations of the estate before distributing assets to beneficiaries.

- Filing necessary paperwork: Submit required forms to the appropriate probate court to initiate the closure process.

- Distributing assets: Once debts are settled, distribute the remaining assets according to the will or state law.

Legal use of the Closure Estate

The legal use of the closure estate is governed by various laws that dictate how estates should be managed and settled. These laws ensure that the deceased's wishes are respected and that beneficiaries receive their inheritance in a lawful manner. Compliance with these laws is essential to avoid disputes among heirs and potential legal challenges. Engaging a qualified attorney can help navigate the complexities of estate law and ensure that all legal requirements are met.

Required Documents

When managing a closure estate, several documents are essential for a successful process. These typically include:

- Last will and testament: Outlines the deceased's wishes regarding asset distribution.

- Death certificate: Official document confirming the individual's death.

- Financial statements: Provides a clear picture of the deceased's financial situation, including debts and assets.

- Tax returns: Necessary for understanding any tax obligations that may need to be addressed.

Who Issues the Form

The forms related to the closure estate are typically issued by the probate court in the jurisdiction where the deceased resided. These forms may vary by state and can include petitions for probate, inventory forms, and final accounting documents. It is important to check with local court rules to ensure compliance with specific requirements and to obtain the correct forms for the closure estate process.

Examples of using the Closure Estate

Understanding practical applications of the closure estate can provide clarity on its importance. Common examples include:

- Settling family estates: Families often use the closure estate process to divide inherited property and assets among heirs.

- Managing business interests: If the deceased owned a business, the closure estate may involve transferring ownership or liquidating assets.

- Addressing tax obligations: The closure estate process ensures that any taxes owed by the deceased are settled before asset distribution.

Quick guide on how to complete closure estate

Complete Closure Estate effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Closure Estate on any device with airSlate SignNow Android or iOS applications and simplify any document-based tasks today.

How to modify and eSign Closure Estate effortlessly

- Obtain Closure Estate and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Closure Estate and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample closure in airSlate SignNow?

A sample closure in airSlate SignNow refers to the process of completing a document transaction securely and efficiently. It involves utilizing electronic signatures and document management features, ensuring that all parties can finalize the agreement quickly. This process enhances productivity and reduces the turnaround time for crucial documents.

-

How does airSlate SignNow ensure the security of sample closure?

airSlate SignNow prioritizes the security of every sample closure by employing advanced encryption and authentication techniques. Each document is protected throughout its lifecycle, ensuring that sensitive information remains safe. With features like secure cloud storage and compliance with industry standards, users can confidently close their documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, making sample closure accessible for all. Plans vary based on features, storage, and the number of users, allowing businesses to choose a solution that fits their budget. For more information, visit our pricing page and discover the best option for your organization.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integration with numerous applications to streamline your workflow and enhance the sample closure process. Connect with popular tools like Google Drive, Salesforce, and Microsoft Office for seamless document management. These integrations allow for a more cohesive experience, making it easier to manage documents across platforms.

-

What features does airSlate SignNow offer to facilitate sample closure?

airSlate SignNow provides features such as drag-and-drop document creation, templates, and automated reminders to assist in the sample closure. These tools enable users to prepare and send documents effortlessly while ensuring timely completion. The user-friendly interface further simplifies the entire eSigning process, enhancing efficiency.

-

How does airSlate SignNow improve the efficiency of document signing?

By utilizing airSlate SignNow, businesses can signNowly enhance the efficiency of document signing and sample closure. The platform allows users to send documents for eSignature in just a few clicks, eliminating delays associated with traditional signing methods. With automation features like status tracking, teams can stay informed about the signing process in real time.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! AirSlate SignNow is designed to be a flexible solution for businesses of all sizes, including small enterprises. Its cost-effective pricing plans and user-friendly features make it an ideal choice for small businesses looking to streamline their document signing and sample closure processes. Start with our free trial to experience the benefits firsthand.

Get more for Closure Estate

Find out other Closure Estate

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word