Limited Liability Partnership Form

What is the professional limited partnership?

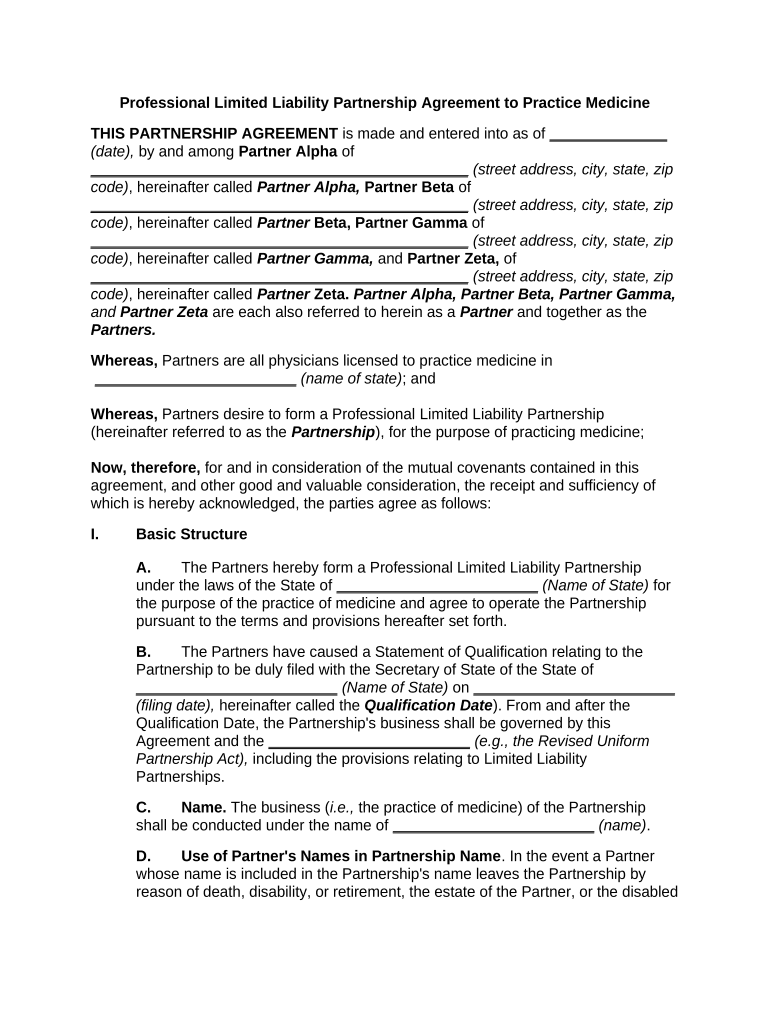

A professional limited partnership (PLP) is a specific type of partnership formed by licensed professionals, such as doctors, lawyers, or accountants, to provide professional services. Unlike a general partnership, a PLP limits the personal liability of its partners for the debts and obligations of the partnership. This structure allows professionals to collaborate while protecting their personal assets from business liabilities. Each partner in a PLP typically shares in the profits and losses of the partnership according to the partnership agreement.

Key elements of the professional limited partnership

Several essential components define a professional limited partnership:

- Partnership Agreement: A formal document outlining the roles, responsibilities, and profit-sharing arrangements among partners.

- Limited Liability: Partners are protected from personal liability for the partnership's debts, except in cases of malpractice or negligence.

- Professional Licensing: All partners must hold the necessary licenses to practice their profession in the state where the PLP is formed.

- Compliance with State Laws: Each state has specific regulations governing professional limited partnerships, which must be adhered to for legal recognition.

Steps to complete the professional limited partnership

Establishing a professional limited partnership involves several steps:

- Choose a Name: Select a unique name that complies with state regulations, typically including "Professional Limited Partnership" or its abbreviation.

- Draft a Partnership Agreement: Create a detailed agreement that specifies each partner's rights, responsibilities, and profit-sharing methods.

- File Formation Documents: Submit the necessary formation documents to the appropriate state agency, often the Secretary of State.

- Obtain Licenses: Ensure that all partners possess the required professional licenses to operate legally.

- Comply with Tax Requirements: Register for an Employer Identification Number (EIN) and understand the tax obligations for the partnership.

Legal use of the professional limited partnership

The legal framework surrounding professional limited partnerships is crucial for their operation. PLPs must adhere to specific state laws that govern their formation and operation. This includes maintaining compliance with professional licensing requirements and ensuring that all partners are duly licensed. Additionally, the partnership agreement must comply with state regulations to be enforceable. Legal counsel is often advisable to navigate these requirements effectively.

Required documents for a professional limited partnership

To establish a professional limited partnership, several documents are typically required:

- Partnership Agreement: A comprehensive document detailing the terms of the partnership.

- Certificate of Limited Partnership: A form filed with the state to officially register the partnership.

- Professional Licenses: Proof of licensure for each partner in their respective professions.

- Employer Identification Number (EIN): A tax identification number obtained from the IRS.

State-specific rules for the professional limited partnership

Each state in the U.S. has its own regulations governing professional limited partnerships. These rules can dictate the formation process, naming conventions, and compliance requirements. It is essential for partners to research the specific laws in their state to ensure proper adherence. Some states may have additional requirements, such as annual reporting or specific tax obligations, that must be followed to maintain the partnership's legal status.

Quick guide on how to complete limited liability partnership

Effortlessly Prepare Limited Liability Partnership on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It serves as a fantastic eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and safely store it in the cloud. airSlate SignNow offers all the features you require to create, edit, and electronically sign your documents promptly without hassles. Handle Limited Liability Partnership on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The Simplest Way to Edit and eSign Limited Liability Partnership with Ease

- Obtain Limited Liability Partnership and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Modify and eSign Limited Liability Partnership and guarantee seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a professional limited partnership?

A professional limited partnership (PLP) is a type of business entity designed for licensed professionals to work together while limiting their personal liability. In a PLP, partners can share resources and expertise while protecting their personal assets from business debts. This structure is especially beneficial for attorneys, accountants, and consultants.

-

How does airSlate SignNow benefit professional limited partnerships?

AirSlate SignNow offers professional limited partnerships a streamlined solution for sending and eSigning important documents securely. The platform enhances collaboration by enabling partners to share, sign, and manage documents in real-time. This efficiency can lead to improved productivity and reduce the time spent on paperwork.

-

What features does airSlate SignNow provide for professional limited partnerships?

AirSlate SignNow includes features such as customizable templates, automated workflows, and advanced security measures tailored for professional limited partnerships. These tools help streamline document management and ensure compliance with professional regulations. Additionally, users can track document status and receive notifications for timely follow-ups.

-

Is airSlate SignNow cost-effective for professional limited partnerships?

Yes, airSlate SignNow provides a cost-effective solution for professional limited partnerships looking to reduce overhead costs associated with traditional document management. With flexible pricing plans and features designed for efficiency, businesses can save money while ensuring secure and compliant document handling. This makes it accessible for partnerships of all sizes.

-

Can airSlate SignNow integrate with other tools for professional limited partnerships?

Absolutely, airSlate SignNow integrates seamlessly with a variety of tools commonly used by professional limited partnerships, such as CRM systems, cloud storage solutions, and project management software. This integration capability enhances productivity by allowing users to manage all aspects of their business from a single platform. By connecting tools, partnerships can optimize their workflows effectively.

-

How does airSlate SignNow ensure document security for professional limited partnerships?

AirSlate SignNow prioritizes security with end-to-end encryption, secure access controls, and comprehensive audit trails, making it ideal for professional limited partnerships handling sensitive information. These security features ensure that all documents are protected against unauthorized access and alterations. This commitment to security helps build trust with clients and partners.

-

What is the process for eSigning documents in a professional limited partnership using airSlate SignNow?

The process for eSigning documents in a professional limited partnership with airSlate SignNow is simple and user-friendly. Partners can upload documents, specify signers and order, and send them for eSignature within minutes. The platform guides users through each step, making it easy to complete transactions quickly while ensuring compliance with legal standards.

Get more for Limited Liability Partnership

- Report of completion of candidacy examination student has form

- 2018 process for minor box lacrosse release requests form

- To print in full format use legal page layout canadian

- Appendix a 1 services payment instructions amp declaration form

- Direct deposit form rbc

- Scholastic book fairs receipt form

- Bridging entry immunization requirement form part time

- Encephalitis questionnaire form

Find out other Limited Liability Partnership

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy