Irrevocable Trust Which is a Qualifying Subchapter S Trust Form

What is the Irrevocable Trust Which Is A Qualifying Subchapter S Trust

An irrevocable trust which is a qualifying Subchapter S trust is a specific type of trust that allows for the income generated by the trust to be passed through to the beneficiaries without being taxed at the trust level. This structure is particularly beneficial for estate planning and tax purposes. The trust becomes irrevocable once it is established, meaning that the grantor cannot modify or terminate it without the consent of the beneficiaries. This type of trust must meet certain IRS requirements to qualify as a Subchapter S trust, ensuring that it can maintain its tax advantages.

Key elements of the Irrevocable Trust Which Is A Qualifying Subchapter S Trust

Several key elements define an irrevocable trust which is a qualifying Subchapter S trust. These include:

- Beneficiary Restrictions: The trust can have a limited number of beneficiaries, typically no more than 100, all of whom must be individuals or certain types of estates.

- Income Distribution: Income generated by the trust must be distributed to beneficiaries, ensuring that it is taxed at their individual income tax rates rather than at the trust level.

- Eligible Entities: Only certain types of entities can serve as trustees, such as individuals or certain types of trusts, which must comply with IRS guidelines.

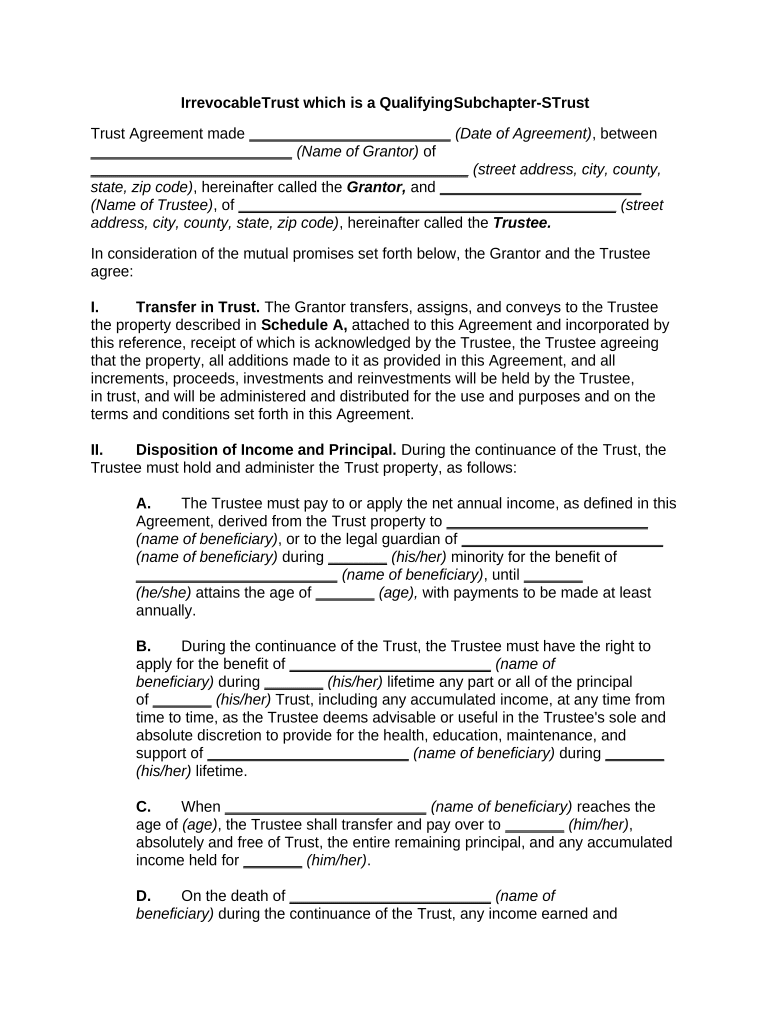

Steps to complete the Irrevocable Trust Which Is A Qualifying Subchapter S Trust

Completing an irrevocable trust which is a qualifying Subchapter S trust involves several steps:

- Consult a Legal Professional: Engage with an attorney specializing in estate planning to ensure compliance with all legal requirements.

- Draft the Trust Document: Outline the terms of the trust, including the grantor, beneficiaries, and trustee responsibilities.

- Transfer Assets: Move assets into the trust, which may include real estate, investments, or cash.

- File Necessary Tax Forms: Complete any required IRS forms to establish the trust's status as a qualifying Subchapter S trust.

Legal use of the Irrevocable Trust Which Is A Qualifying Subchapter S Trust

The legal use of an irrevocable trust which is a qualifying Subchapter S trust primarily revolves around estate planning and tax management. By transferring assets into this type of trust, individuals can effectively reduce their taxable estate while ensuring that income generated by the trust is taxed at the beneficiaries' lower tax rates. This structure can also provide asset protection from creditors and ensure that the grantor's wishes regarding asset distribution are honored after their passing.

IRS Guidelines

The IRS has specific guidelines that must be followed for an irrevocable trust to qualify as a Subchapter S trust. These guidelines include:

- The trust must have only eligible beneficiaries, which typically excludes non-resident aliens and corporations.

- The trust must distribute all its income to beneficiaries annually, avoiding accumulation of income within the trust.

- Compliance with all filing requirements, including the timely submission of Form 1041, is essential to maintain the trust's status.

Eligibility Criteria

To establish an irrevocable trust which is a qualifying Subchapter S trust, certain eligibility criteria must be met:

- The grantor must be a U.S. citizen or resident.

- All beneficiaries must be individuals or specific types of estates.

- The trust must comply with IRS regulations regarding income distribution and asset management.

Quick guide on how to complete irrevocable trust which is a qualifying subchapter s trust 497333692

Prepare Irrevocable Trust Which Is A Qualifying Subchapter S Trust effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents quickly without any holdups. Manage Irrevocable Trust Which Is A Qualifying Subchapter S Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Irrevocable Trust Which Is A Qualifying Subchapter S Trust with ease

- Locate Irrevocable Trust Which Is A Qualifying Subchapter S Trust and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Modify and eSign Irrevocable Trust Which Is A Qualifying Subchapter S Trust and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

An Irrevocable Trust Which Is A Qualifying Subchapter S Trust is a specialized legal arrangement that allows income generated within the trust to be passed on to beneficiaries without incurring additional tax liabilities. This structure combines the benefits of an irrevocable trust with those of a Subchapter S corporation. Understanding its mechanics is essential for effective estate and tax planning.

-

How can the airSlate SignNow platform assist with the management of an Irrevocable Trust Which Is A Qualifying Subchapter S Trust?

The airSlate SignNow platform enables businesses to efficiently manage documentation associated with an Irrevocable Trust Which Is A Qualifying Subchapter S Trust. Users can easily create, send, and eSign necessary documents, ensuring compliance and timely processing. This streamlines the trust management process for both trustees and beneficiaries.

-

What pricing options are available for airSlate SignNow services?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various users, from individuals to large organizations. Pricing is competitive and designed to provide value, especially for those managing an Irrevocable Trust Which Is A Qualifying Subchapter S Trust. For specific details, it's best to visit our pricing page or contact customer support.

-

What features does airSlate SignNow provide for signing trust documents?

airSlate SignNow features a user-friendly interface, advanced security measures, and integrations with popular applications to facilitate the signing of trust documents. It supports electronic signatures and allows document tracking, making it ideal for maintaining the legitimacy of an Irrevocable Trust Which Is A Qualifying Subchapter S Trust. This ensures all parties stay updated throughout the document lifecycle.

-

Are there any specific integrations beneficial for managing an Irrevocable Trust?

Yes, airSlate SignNow integrates seamlessly with various platforms such as CRM systems, cloud storage solutions, and accounting software. These integrations enhance the functionality of managing an Irrevocable Trust Which Is A Qualifying Subchapter S Trust by centralizing documentation and streamlining workflows. Users can connect their preferred tools to improve efficiency.

-

What are the benefits of using airSlate SignNow for trust administration?

AirSlate SignNow provides numerous benefits for trust administration, such as increased efficiency and better compliance management. By using an intuitive platform to manage an Irrevocable Trust Which Is A Qualifying Subchapter S Trust, users can save time, reduce paperwork errors, and ensure that documents are handled properly. This ultimately enhances the overall administration process.

-

Can airSlate SignNow help with secure document storage for trusts?

Absolutely! airSlate SignNow offers secure document storage solutions that protect sensitive information related to an Irrevocable Trust Which Is A Qualifying Subchapter S Trust. With advanced encryption and access controls, users can confidently store and retrieve critical trust documents while maintaining compliance with legal requirements.

Get more for Irrevocable Trust Which Is A Qualifying Subchapter S Trust

- Division courtroom consent or nomination of minor courts state co form

- Waiver of hearing waiver of final conservators report waiver of courts state co form

- 2 east 14th ave courts state co form

- Division courtroom order for expedited residential courts state co form

- Forms sealing of criminal records colorado judicial branch courts state co

- Parenting plan civil union colorado judicial branch courts state co form

- Jdf 1515 form

- Jdf 970 form

Find out other Irrevocable Trust Which Is A Qualifying Subchapter S Trust

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile