Payoff Request Template Form

What is the payoff request template

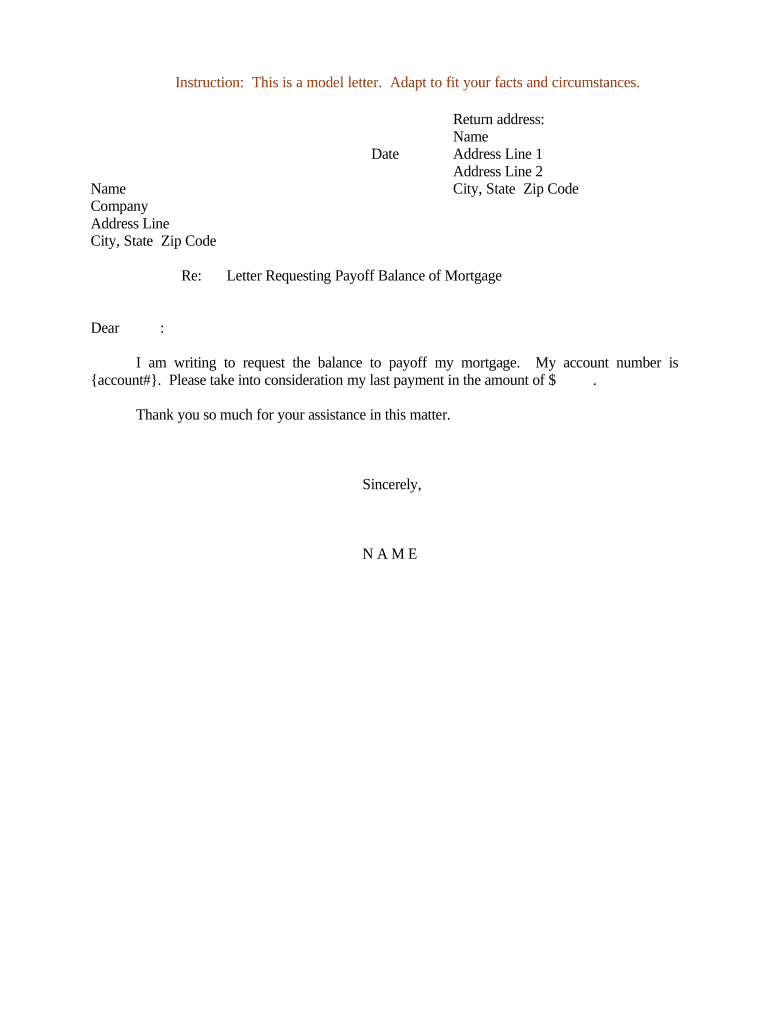

The payoff request template is a standardized document used by borrowers to formally request the total amount needed to pay off a loan, such as a mortgage. This template typically includes essential details such as the loan number, borrower’s information, and the lender's contact details. By utilizing this template, borrowers can ensure that they provide all necessary information, which helps streamline the process of obtaining a payoff statement.

Key elements of the payoff request template

When filling out a payoff request template, several key elements are crucial to include:

- Borrower Information: Full name, address, and contact information of the borrower.

- Loan Details: Loan number, type of loan, and any relevant account information.

- Request Date: The date on which the request is made.

- Payment Instructions: Specific details on how the payoff amount should be sent or received.

- Signature: A signature line for the borrower to validate the request.

Steps to complete the payoff request template

Completing the payoff request template involves a few straightforward steps:

- Gather Information: Collect all necessary information, including loan details and personal identification.

- Fill Out the Template: Accurately enter the required information into the template, ensuring clarity and correctness.

- Review the Document: Double-check all entries for accuracy to avoid delays in processing.

- Submit the Request: Send the completed template to your lender via the preferred method, which may include email, fax, or postal mail.

Legal use of the payoff request template

The payoff request template is legally recognized as a formal request for loan information. When completed correctly and submitted to the lender, it obligates the lender to provide the requested payoff amount. It is essential to ensure compliance with any applicable state and federal regulations regarding loan payoff requests to maintain the document's legal validity.

Examples of using the payoff request template

Utilizing the payoff request template can vary based on the situation. For instance:

- A borrower seeking to refinance their mortgage may use the template to obtain a payoff statement from their current lender.

- A homeowner planning to sell their property can request a payoff statement to determine the remaining balance on their mortgage before closing the sale.

- A borrower wishing to pay off their loan early may request a payoff statement to understand the total amount due, including any potential fees.

Form submission methods

The payoff request template can be submitted through various methods, depending on the lender's preferences:

- Online Submission: Many lenders allow electronic submissions via their websites or secure portals.

- Email: Sending the completed template as an attachment to the lender's designated email address.

- Postal Mail: Mailing the printed document to the lender's physical address.

- Fax: Some lenders may accept faxed requests, providing a quicker alternative to postal mail.

Quick guide on how to complete payoff request template

Complete Payoff Request Template effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without hold-ups. Manage Payoff Request Template on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Payoff Request Template with ease

- Obtain Payoff Request Template and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Payoff Request Template and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage payoff letter request?

A mortgage payoff letter request is a formal request sent to your mortgage lender to obtain a document stating the exact amount needed to pay off your mortgage. This document is essential for closing a mortgage or refinancing your loan. airSlate SignNow simplifies this process, allowing you to easily send and eSign your mortgage payoff letter request online.

-

How do I submit a mortgage payoff letter request using airSlate SignNow?

To submit a mortgage payoff letter request using airSlate SignNow, simply create an account, upload the necessary documents, and fill out the request form. Once completed, you can eSign the document and send it directly to your lender. Our platform streamlines the entire process, making it quick and efficient.

-

Are there any fees associated with sending a mortgage payoff letter request?

airSlate SignNow offers a cost-effective solution for managing your mortgage payoff letter request. Pricing details can vary based on your subscription plan, but we provide transparent pricing with no hidden fees. You can choose the plan that best fits your needs to effectively manage your documents.

-

What are the benefits of using airSlate SignNow for mortgage payoff letter requests?

Using airSlate SignNow for your mortgage payoff letter request provides numerous benefits, including faster processing, reduced paperwork, and enhanced security. Our user-friendly platform ensures that you can easily track the status of your requests. This efficiency can save you time and hassle during the mortgage payoff process.

-

Can I integrate airSlate SignNow with other software for mortgage payoff letter requests?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage your mortgage payoff letter request more efficiently. Whether you’re using CRM systems or accounting software, our integrations ensure that your documents are accessible and manageable in one place. This connectivity helps streamline your workflow.

-

Is my information safe when I submit a mortgage payoff letter request through airSlate SignNow?

Absolutely. airSlate SignNow prioritizes your security by implementing industry-standard encryption and compliance measures. When you submit a mortgage payoff letter request, your personal and financial information is protected, ensuring peace of mind throughout the process.

-

How long does it take to receive a response for a mortgage payoff letter request?

The response time for a mortgage payoff letter request can vary depending on your lender’s processing time. However, airSlate SignNow signNowly speeds up this process by allowing immediate communication with your lender. Most users report receiving their payoff amounts faster when using our platform.

Get more for Payoff Request Template

Find out other Payoff Request Template

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form