Florida Lien Form 6

What is the Florida Lien Form?

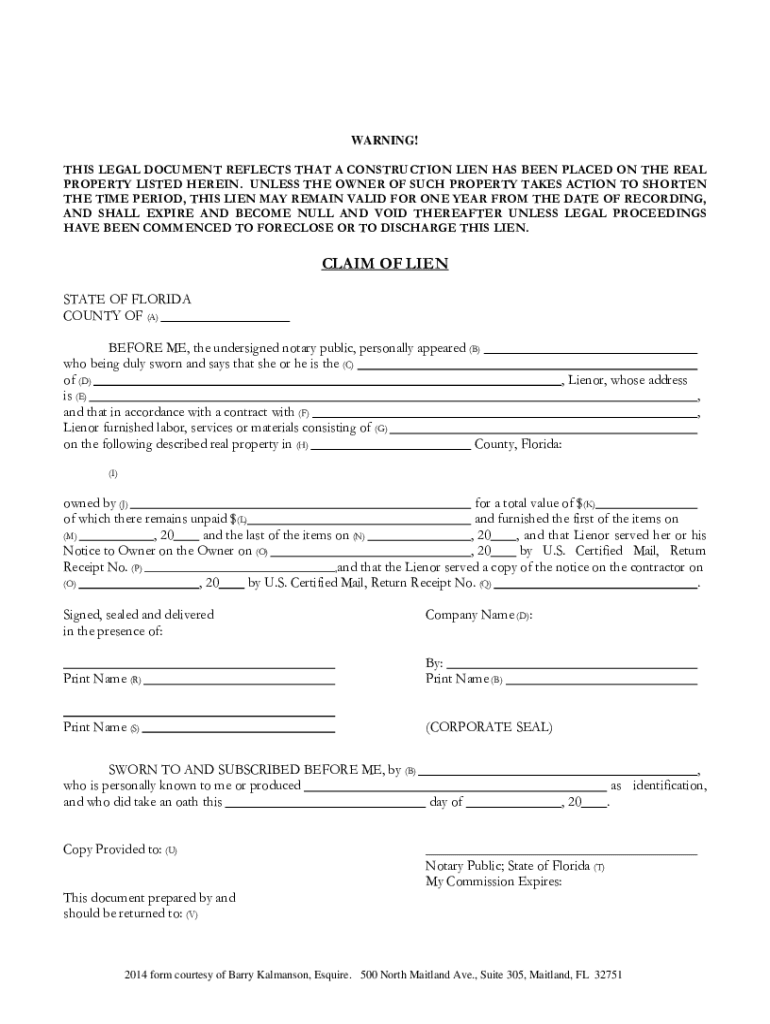

The Florida claim of lien form is a legal document that allows a contractor, subcontractor, or supplier to assert a claim against a property for unpaid work or materials provided. This form is essential in the construction industry, as it provides a mechanism for those who have not been compensated to secure their right to payment. By filing this form, the claimant can establish a lien on the property, which can affect the owner's ability to sell or refinance until the debt is resolved.

Steps to Complete the Florida Lien Form

Completing the Florida claim of lien form involves several key steps to ensure accuracy and compliance with state regulations. Here are the main steps:

- Gather Information: Collect all necessary details, including the property owner's name, property description, and the amount owed.

- Fill Out the Form: Accurately complete the form, ensuring all sections are filled in. Include your name, address, and contact information as the claimant.

- Sign and Date: Ensure that the form is signed and dated. This step is crucial for the validity of the document.

- File the Form: Submit the completed form to the appropriate county clerk's office where the property is located.

Key Elements of the Florida Lien Form

The Florida claim of lien form contains several important elements that must be included for it to be valid. These elements include:

- Claimant Information: Name and address of the individual or business filing the lien.

- Property Owner Information: Name and address of the property owner.

- Property Description: A legal description of the property where the work was performed.

- Amount Due: The total amount owed for services or materials provided.

- Date of Work: The date when the work was completed or materials were supplied.

Legal Use of the Florida Lien Form

The legal use of the Florida claim of lien form is governed by state laws, which outline the rights and responsibilities of both the claimant and the property owner. It is important for claimants to understand that filing a lien is a formal legal action that can have significant implications. If the lien is not resolved, it may lead to foreclosure proceedings. Therefore, it is advisable to consult with a legal professional to ensure compliance with all legal requirements and to understand the implications of filing a lien.

Form Submission Methods

The Florida claim of lien form can be submitted through various methods, depending on the preferences of the claimant and the requirements of the local county clerk's office. Common submission methods include:

- Online Submission: Many counties offer online filing options through their official websites.

- Mail: Claimants can mail the completed form to the appropriate county clerk's office.

- In-Person: Submitting the form in person at the county clerk's office is also an option for those who prefer direct interaction.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Florida claim of lien form is crucial for maintaining the validity of the lien. Generally, the form must be filed within a specific timeframe following the completion of work or delivery of materials. In Florida, the deadline is typically within ninety days after the last date of work performed. Failure to file within this period may result in the loss of the right to claim a lien.

Quick guide on how to complete claim of lienform florida

Complete and submit your Florida Lien Form 6 quickly

Robust tools for digital document transfer and authorization are essential for enhancing processes and the ongoing advancement of your forms. When managing legal documents and signing a Florida Lien Form 6, the right signature option can conserve considerable time and resources with every submission.

Locate, fill out, modify, authorize, and distribute your legal documents with airSlate SignNow. This service provides everything necessary to create efficient document submission workflows. Its extensive library of legal forms and easy navigation will assist you in finding your Florida Lien Form 6 swiftly, and the editor featuring our signature tool will enable you to finalize and approve it without delay.

Authorize your Florida Lien Form 6 in a few straightforward steps

- Obtain the Florida Lien Form 6 you need from our library using search or catalog options.

- Review the form details and preview it to confirm it meets your requirements and state regulations.

- Click Get form to access it for alteration.

- Fill out the form using the detailed toolbar.

- Verify the information you entered and click the Sign option to endorse your document.

- Select one of three methods to append your signature.

- Complete your edits and save the document in your records, then download it to your device or share it right away.

Simplify each phase of your document preparation and authorization with airSlate SignNow. Experience a more effective online solution that has all aspects of managing your paperwork carefully considered.

Create this form in 5 minutes or less

FAQs

-

How do you fill out the articles of organization for an LLC in Florida?

Quoting Instructions for Articles of Organization (FL LLC) :FILING ONLINE OR BY MAILThese instructions are for the formation of a Florida Limited Liability Company pursuant to s.605.0201, F.S., and cover the minimum requirements for filing Articles of Organization.Your Articles of Organization may need to include additional items that specifically apply to your situation. The Division of Corporations strongly recommends that legal counsel reviews all documents prior to submission.The Division of Corporations is a ministerial filing agency. We cannot provide any legal, accounting, or tax advice.Limited Liability Company NameThe name must be distinguishable on the records of the Department of State.You should do a preliminary search by name before submitting your document.The name must include:Limited Liability Company, LLC or L.L.C.; ORChartered, Professional Limited Liability Company, P.L.L.C. or PLLC if forming a professional limited liability company.Do not use or assume the name is approved until you receive a filing acknowledgment from the Division of Corporations.Principal Place of Business AddressThe street address of the LLC’s principal office.Mailing AddressThe LLC’s mailing address, if different from the principal address. (P.O. Box is acceptable.)Registered Agent Name and AddressThe individual or legal entity that will accept service of process on behalf of the business entity is the registered agent.A business entity with an active Florida filing or registration may serve as a registered agent.An entity cannot serve as its own registered agent. However, an individual or principal associated with the business may serve as the registered agent.The registered agent must have a physical street address in Florida. (Do not list a P.O. Box address.)Registered Agent’s SignatureThe registered agent must sign the application.The signature confirms the agent is familiar with and accepts the obligations of s.605.0113(3), F.S.If a business entity is designated as the Agent, a principal (individual) of that entity must sign to accept the obligations.If filing online:The registered agent must type their name in the signature block.Pursuant to s.15.16, F.S., electronic signatures have the same legal effect as original signatures.NOTE: Typing someone’s name/signature without their permission constitutes forgery pursuant to s.831.06, F.S.Limited Liability Company PurposeA Professional Limited Liability Company (which is formed under both Chapter 605 and Chapter 621, F.S.) must enter a single specific professional purpose. Example: the practice of law, accounting services, practicing medicine, etc.Non-professional companies are not required to list a purpose, but may do so.Manager/Authorized RepresentativeThe names and street addresses of the authorized representatives or managers are optional.Manager: a person designated to perform the management functions of a manager-managed limited liability company. Use MGR.Authorized Representative: a person who is authorized to execute and file records with the Division of Corporations. Use AR. See 605.0102(8), F.S., for more information.A Manager or Authorized Representative may be an individual or business entity.Do not list members.NOTE: If you are applying for workers’ comp exemption or opening a bank account, Florida’s Division of Workers’ Compensation and your financial institution may require this information to be designated in the Department of State’s records.Effective DateAn LLC’s existence begins on the date the Division of Corporations receives and files your Articles unless your Articles of Organization specify an acceptable alternate “effective” date.LLCs can specify an effective date that is no more than five business days prior to, or 90 days after, the date the document is received by our office.If you are forming your LLC between October 1 and December 31st, but don’t expect to transact business until the next calendar year, avoid filing an annual report form for the upcoming calendar year by listing an effective date of January http://1st.By specifying January 1st as the effective date, your LLC’s existence will not officially begin until January 1st of the following calendar year, even though your entity is already on the Division’s records.The January 1st effective date will allow you to postpone your LLC’s requirement to file an annual report form for one calendar year.SignatureMust be signed by at least one person acting as the authorized representative.If filing online: The authorized representative must type their name in the signature block. Electronic signatures have the same legal effect as original signatures.Correspondence Name and EmailPlease provide a valid email address.If filing online: The filing acknowledgment and certification (if any) will be emailed to this address.All future email communications will be sent to this address.Keep your email address up to date.Certificate of StatusYou may request a certificate of status.This item is not required.A certificate of status certifies the status and existence of the LLC and verifies the LLC has paid all fees due to this office through a certain date.Fee: $5.00 eachCertified CopyYou may request a certified copy of your Articles of Organization.This item is not required.A certified copy will include a filed stamped copy of your Articles of Organization and will verify that the copy is a true and correct copy of the document in our records.Fee: $30.00 eachAnnual Report NoticeEvery LLC is required to file an annual report to maintain an “active” status in our records.If the limited liability company fails to file the report, it will be administratively dissolved.The filing period for annual reports is January 1st to May 1st of the calendar year following the LLC’s date of filing or, if listed, its effective date.The annual report is not a financial statement.The report is used to confirm or update the entity’s information on our records.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

How do I fill out the disability forms so well that my claim is approved?

Contact Barbara Case, the founder of USA: Providing Free Advocacy & Support She's incredible!

-

What agreement is needed to buy out my partner after a quick claim deed in Florida?

What agreement is needed to buy out my partner after a quick claim deed in Florida?I do not practice in Florida and am not admitted in Florida. I do not know Florida law. I suggest you consult a Florida lawyer on the basis of a detailed and CONFIDENTIAL statement of your situation, for actual legal advice, not seek random responses from fellow Quorans on a public forum based on an extremely sketchy statement of your facts.That said, as long as you’re here anyway, the term is “QUIT” claim deed, not “quick” claim. It means the grantor — the person giving you the deed (which you must then record with the land records office in your county, usually accompanied by paying a fee) — “quits” any claim he has or may have to that piece of property, in favor of other rightful claimants (such as yourself). A “quitclaim” deed is to be distinguished from a “warranty” deed, in that the grantor of a quitclaim deed gives you NO PROMISES or guarantees that he has ANY colorable interest in the property in question AT ALL. The scammers who “sold” greenhorns the Brooklyn Bridge, back in the day, used quitclaim deeds. They didn’t make OR BREAK any promises, so they were not committing fraud and got away with it.Hopefully this will not apply if the facts of your situation are that you and your partner (did you mean DOMESTIC partner? Or BUSINESS partner?) are BOTH on the title deed of the property, as either Tenants In Common (TIC) or as Joint Owners with Right of Survivorship (JWROS), meaning that YOU (and he) are already the legitimate claimants to that property, so that, by means of his giving you a quitclaim deed, you will become the SOLE legal owner of the property. That’s the only situation in which I would recommend you pay anybody any money for a “quitclaim” deed.What kind of contract do you need? That depends on how you want to do the transaction. If you plan to finance the deal through a third party bank, or make installment payments directly to him, I STRONGLY advise you to use a local real estate lawyer to handle this transaction and draw up a contract. The few hundred dollars this is likely to cost will be money well spent to avoid major headaches (and possibly huge monetary losses) down the road if you screw up some apparently insignNow detail.If you are just going to give him “cash on the barrelhead” for his interest, though, and have signNowed an agreed and fair price, and get a form quitclaim deed from a legal-forms site that appears to do what you want, you MIGHT be able to do this without a lawyer, so long as nothing unusual in your fact situation requires something different than the plain-vanilla boilerplate deed form you can get from such a site. That’s what you pay a lawyer for — not just to draft boiler plate, which is the easy part, but to give you his EXPERTISE in knowledge and experience to see if you need anything ELSE to avoid disaster down the road.The “do it yourself” approach is a bit like changing your own oil, in your car. It’s not that hard, but if you took it to a mechanic he or she might discover some other major problem that needs fixing, and be able to fix it before it’s too late. You don’t want to wind up stranded by the side of the road because your timing belt should have been changed at your last oil change, and you forgot about it or didn’t even know it existed.Good luck!This answer is not a substitute for professional legal advice and does not create an attorney-client relationship, nor is it a solicitation to offer legal advice. If you ignore this warning and convey confidential information in a private message or comment, there is no duty to keep that information confidential or forego representation adverse to your interests. Seek the advice of a licensed attorney in the appropriate jurisdiction before taking any action that may affect your rights. If you believe you have a claim against someone, consult an attorney immediately, otherwise there is a risk that the time allotted to bring your claim may expire. Quora users who provide responses to legal questions are intended third party beneficiaries with certain rights under Quora’s Terms of Service.

Create this form in 5 minutes!

How to create an eSignature for the claim of lienform florida

How to make an eSignature for your Claim Of Lienform Florida online

How to generate an electronic signature for the Claim Of Lienform Florida in Google Chrome

How to make an electronic signature for signing the Claim Of Lienform Florida in Gmail

How to make an eSignature for the Claim Of Lienform Florida straight from your mobile device

How to create an electronic signature for the Claim Of Lienform Florida on iOS

How to make an electronic signature for the Claim Of Lienform Florida on Android devices

People also ask

-

What is a claim of lien form Florida?

A claim of lien form Florida is a legal document that secures a contractor's right to payment for services rendered to a property. It must be filed with the local government to protect the contractor’s financial interests. Understanding how to properly complete and file this form is essential for any contractor operating in Florida.

-

How can airSlate SignNow help with completing a claim of lien form Florida?

airSlate SignNow offers an easy-to-use platform where you can fill out and eSign your claim of lien form Florida quickly. Our intuitive interface allows for smooth document preparation, ensuring you don’t miss any critical information. With airSlate SignNow, you can streamline the filing process and minimize paperwork.

-

Is there a cost associated with using airSlate SignNow for the claim of lien form Florida?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing plans to suit different needs. Our plans are designed to be cost-effective, making it accessible for small businesses and contractors alike. You can choose a plan that fits your frequency of use for the claim of lien form Florida.

-

What features does airSlate SignNow provide for managing claim of lien forms Florida?

airSlate SignNow provides diverse features including templates for claim of lien forms Florida, easy eSigning capabilities, and secure cloud storage. You can also track the status of your documents and send reminders for signatures, simplifying your document management process. These features help ensure that your lien claims are handled efficiently.

-

Can airSlate SignNow integrate with other software for managing claim of lien forms Florida?

Yes, airSlate SignNow offers integrations with various productivity tools and software, enhancing the management of your claim of lien forms Florida. Whether you're using project management tools or accounting software, our platform can seamlessly connect and improve your workflow. This integration capability helps ensure a smoother process across your operations.

-

How does eSigning a claim of lien form Florida enhance legal compliance?

eSigning your claim of lien form Florida through airSlate SignNow enhances legal compliance by providing a secure way to sign documents electronically. This method meets the legal requirements set forth in Florida, ensuring that your lien is enforceable. You also receive a detailed audit trail for each signature to further substantiate the legality of your filing.

-

What benefits can I expect from using airSlate SignNow for my claim of lien form Florida?

Using airSlate SignNow for your claim of lien form Florida can signNowly improve efficiency and reduce administrative burdens. The platform allows you to prepare and send documents quickly, saving you time and money. Additionally, you'll enjoy enhanced security and compliance features, giving you peace of mind during the lien filing process.

Get more for Florida Lien Form 6

- Minnesota application name change form

- Minnesota criminal history check form

- Name change notice form

- Minnesota name change 497312774 form

- Application for name change of minor minnesota form

- Name change of form

- Parent name change form

- Affidavit in support of order for publication and order in minor name change minnesota minnesota form

Find out other Florida Lien Form 6

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple