Payroll Deduction Authorization Form

What is the Payroll Deduction Authorization Form

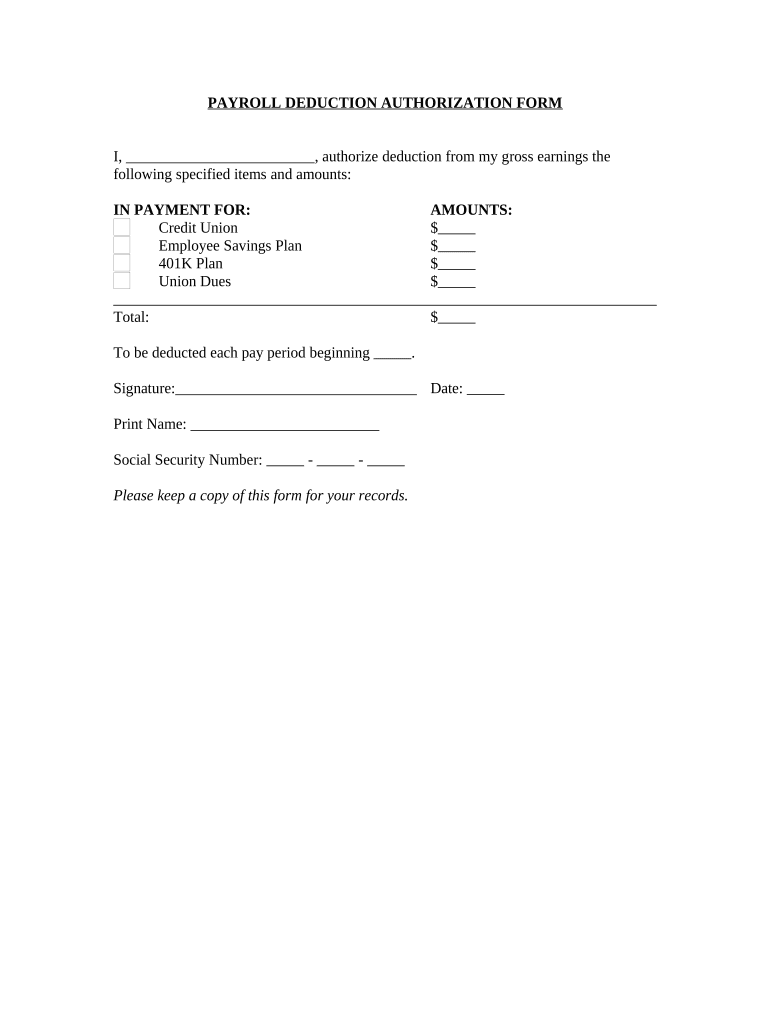

The Payroll Deduction Authorization Form is a critical document that allows employees to authorize their employer to deduct specific amounts from their paychecks. This form is commonly used for various purposes, including contributions to retirement plans, health insurance premiums, and other benefits. By completing this form, employees provide their consent for the employer to manage these deductions, ensuring that the funds are allocated correctly and in a timely manner.

How to use the Payroll Deduction Authorization Form

Using the Payroll Deduction Authorization Form involves several straightforward steps. First, employees should obtain the form from their employer or human resources department. Next, they need to fill out the required fields, which typically include personal information, the specific deduction amounts, and the purpose of the deductions. Once completed, the form should be submitted to the appropriate department for processing. It is essential to keep a copy of the form for personal records and to confirm that the deductions are being made as authorized.

Steps to complete the Payroll Deduction Authorization Form

Completing the Payroll Deduction Authorization Form involves the following steps:

- Obtain the form from your employer or HR department.

- Fill in your personal details, including your name, employee ID, and contact information.

- Specify the type of deduction, such as retirement contributions or health insurance premiums.

- Indicate the amount to be deducted from each paycheck.

- Sign and date the form to validate your authorization.

- Submit the completed form to your HR department or payroll office.

Legal use of the Payroll Deduction Authorization Form

The Payroll Deduction Authorization Form is legally binding when completed correctly. For it to be enforceable, it must include the employee's consent, clear details about the deductions, and comply with applicable labor laws. Employers are required to maintain records of these forms to ensure compliance with regulations and to protect both the employer and employee in case of disputes regarding deductions.

Key elements of the Payroll Deduction Authorization Form

Several key elements must be included in the Payroll Deduction Authorization Form to ensure its effectiveness:

- Employee Information: Name, employee ID, and contact details.

- Deduction Purpose: Clearly state what the deductions are for, such as retirement plans or insurance.

- Deduction Amount: Specify the exact amount to be deducted from each paycheck.

- Signature and Date: The employee's signature and the date of authorization.

Examples of using the Payroll Deduction Authorization Form

There are various scenarios where the Payroll Deduction Authorization Form is utilized. For instance, an employee may use the form to authorize deductions for a 401(k) retirement plan, allowing them to save for the future while benefiting from potential tax advantages. Another example includes setting up automatic payments for health insurance premiums, ensuring that coverage remains uninterrupted. These examples highlight the form's flexibility and importance in managing employee benefits effectively.

Quick guide on how to complete payroll deduction authorization form

Accomplish Payroll Deduction Authorization Form effortlessly on any gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Payroll Deduction Authorization Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Payroll Deduction Authorization Form without hassle

- Obtain Payroll Deduction Authorization Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Payroll Deduction Authorization Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a supt wage agreement?

A supt wage agreement is a contract that outlines the agreed-upon wages between employees and employers. It ensures transparency and clarity in compensation terms, making it easier for both parties to understand their rights and obligations regarding wages.

-

How can airSlate SignNow help with supt wage agreements?

airSlate SignNow simplifies the process of creating and signing supt wage agreements by providing a digital platform for document management. Users can easily customize templates, collect eSignatures, and securely store their agreements, ensuring a streamlined workflow.

-

Is there a cost associated with using airSlate SignNow for supt wage agreements?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the features and number of users required for managing supt wage agreements, you can choose a plan that fits your budget while enjoying a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools for managing supt wage agreements?

Yes, airSlate SignNow integrates seamlessly with numerous applications such as Google Drive, Dropbox, and Salesforce. These integrations allow for easy management and retrieval of your supt wage agreements, enhancing your overall document workflow.

-

What features does airSlate SignNow offer for supt wage agreements?

airSlate SignNow provides features like customizable templates, secure eSignature options, and real-time tracking of agreement statuses. These tools enhance the efficiency of managing supt wage agreements, helping businesses save time and reduce paperwork.

-

How does airSlate SignNow ensure the security of supt wage agreements?

Security is a priority at airSlate SignNow. The platform employs advanced encryption and authentication protocols to protect your supt wage agreements from unauthorized access, ensuring that sensitive information remains confidential and secure.

-

Can I track the status of my supt wage agreements with airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking of document statuses, allowing you to monitor whether your supt wage agreements have been viewed, signed, or are still pending. This feature ensures you stay informed throughout the signing process.

Get more for Payroll Deduction Authorization Form

- Adult ages 18 and up form

- Update interview nc department of health and human services ncdhhs form

- Focused risk management program form medication review communication form ncdhhs

- Ncdhs form

- Nc health assessment transmittal form 2020

- Nc hcpr contact us nc health care personnel registry form

- Qp first initial amp last name sign lme assigned consumer record number 11 ncdhhs form

- Nc daas 6218 save fillable form

Find out other Payroll Deduction Authorization Form

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast