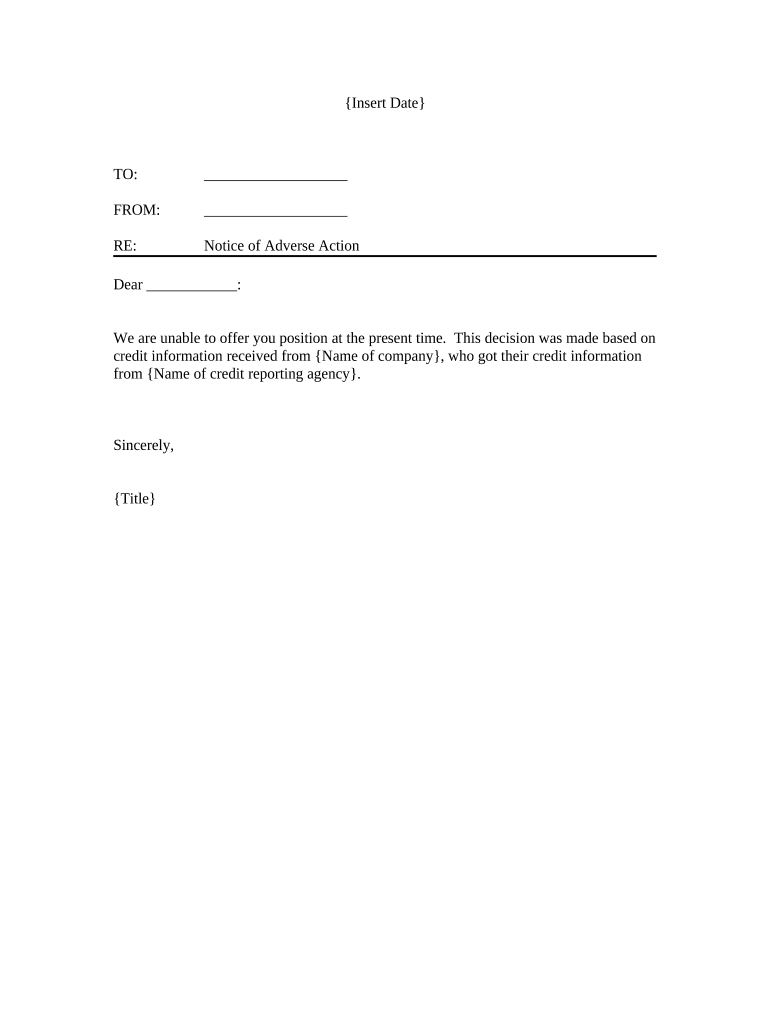

Notice of Adverse Action Non Employment Due to Credit Report Form

What is the Notice Of Adverse Action Non Employment Due To Credit Report

The Notice Of Adverse Action Non Employment Due To Credit Report is a formal document that informs individuals when an adverse decision has been made based on their credit report. This notice is typically issued by financial institutions, landlords, or other entities that utilize credit reports to assess an individual's creditworthiness. Under the Fair Credit Reporting Act (FCRA), these entities are required to provide this notice to ensure transparency and allow individuals to understand the basis of the decision made against them.

How to use the Notice Of Adverse Action Non Employment Due To Credit Report

This notice serves as a crucial communication tool for individuals who have been denied credit or other services due to their credit history. Upon receiving this notice, individuals should carefully review the information provided, including the name of the credit reporting agency that supplied the report and details on how to obtain a free copy of their credit report. Understanding the contents of the notice can help individuals identify any inaccuracies in their credit report and take appropriate steps to rectify them.

Steps to complete the Notice Of Adverse Action Non Employment Due To Credit Report

Completing the Notice Of Adverse Action Non Employment Due To Credit Report involves several key steps:

- Gather the necessary information, including the recipient's name, address, and the specific adverse action taken.

- Include details about the credit reporting agency used, along with their contact information.

- Clearly state the reasons for the adverse action, referencing the relevant information from the credit report.

- Provide instructions on how the individual can obtain their credit report for free.

- Ensure the notice is signed and dated by the appropriate authority within the issuing organization.

Key elements of the Notice Of Adverse Action Non Employment Due To Credit Report

Essential elements of this notice include:

- The name and address of the individual receiving the notice.

- The name of the creditor or organization that took the adverse action.

- A clear explanation of the adverse action taken, such as denial of credit.

- Details of the credit reporting agency that provided the report.

- Information on how to obtain a free copy of the credit report.

- A statement regarding the individual's rights under the FCRA.

Legal use of the Notice Of Adverse Action Non Employment Due To Credit Report

The legal use of this notice is governed by the Fair Credit Reporting Act, which mandates that individuals must be informed when adverse actions are taken based on their credit reports. Compliance with these regulations is crucial for organizations to avoid potential legal repercussions. Failure to provide this notice can lead to penalties and lawsuits, emphasizing the importance of adhering to legal requirements when issuing the notice.

Examples of using the Notice Of Adverse Action Non Employment Due To Credit Report

Examples of situations where this notice may be used include:

- A bank denying a loan application due to poor credit history.

- A landlord refusing to rent an apartment based on an applicant's credit report.

- A credit card issuer declining a new credit card application due to negative credit information.

Quick guide on how to complete notice of adverse action non employment due to credit report

Prepare Notice Of Adverse Action Non Employment Due To Credit Report effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Notice Of Adverse Action Non Employment Due To Credit Report on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Notice Of Adverse Action Non Employment Due To Credit Report with ease

- Locate Notice Of Adverse Action Non Employment Due To Credit Report and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive data with the tools designed by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and eSign Notice Of Adverse Action Non Employment Due To Credit Report and guarantee seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice Of Adverse Action Non Employment Due To Credit Report?

A Notice Of Adverse Action Non Employment Due To Credit Report is a formal notification sent to individuals when a negative decision is made based on their credit report, particularly in instances like lending or rental applications. This notice helps ensure compliance with the Fair Credit Reporting Act (FCRA) and strengthens transparency in the decision-making process.

-

How can airSlate SignNow help with sending Notices Of Adverse Action?

airSlate SignNow simplifies the process of creating and sending Notices Of Adverse Action Non Employment Due To Credit Report by providing an intuitive platform for eSigning and document management. With customizable templates and easy workflows, businesses can efficiently deliver these important notifications while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for Notices Of Adverse Action?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our solutions for sending Notices Of Adverse Action Non Employment Due To Credit Reports are cost-effective, ensuring that organizations can manage their document processes without overspending.

-

What features does airSlate SignNow include for document management?

airSlate SignNow includes features such as electronic signatures, customizable templates, document tracking, and integration capabilities with other business tools. These features streamline the creation and delivery of Notices Of Adverse Action Non Employment Due To Credit Report, making compliance and record-keeping much easier.

-

Can airSlate SignNow integrate with my existing software for handling credit reports?

Yes, airSlate SignNow offers seamless integration with various software applications, which can enhance the way you handle credit reports and related processes. By integrating with your systems, you can efficiently manage and send Notices Of Adverse Action Non Employment Due To Credit Report without disrupting your current workflows.

-

What benefits can companies expect from using airSlate SignNow for legal documents?

Companies can expect increased efficiency, compliance, and security when using airSlate SignNow for legal documents, including Notices Of Adverse Action Non Employment Due To Credit Report. The platform reduces the time spent on administrative tasks while ensuring that documents are properly managed and securely stored.

-

How does airSlate SignNow ensure compliance with legal standards for Notices Of Adverse Action?

airSlate SignNow is designed to help businesses comply with legal standards, particularly regarding the sending of Notices Of Adverse Action Non Employment Due To Credit Report. Our platform provides templates and resources that align with FCRA guidelines, making it easier for businesses to fulfill their legal obligations.

Get more for Notice Of Adverse Action Non Employment Due To Credit Report

- 2020 irs publication 5412 sp form

- 2015 nv sex offender verificationchange 2015 01 08 form

- 2020 ct jd hm 10 form

- 2005 ga stalking permanent protective order pursuant to criminal conviction form

- 2018 md rw1313 form

- 2017 or laws chapter 294 form

- 2016 tx cr 65 form

- Kindergarten transition checklist form

Find out other Notice Of Adverse Action Non Employment Due To Credit Report

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document