Personnel File Requirements Form

What is the Personnel File Requirements

The personnel file requirements encompass the essential documents and information that employers must maintain for each employee. These files typically include personal identification, employment history, performance evaluations, disciplinary records, and any other relevant documentation that reflects the employee's work history and status within the organization. Compliance with these requirements is crucial for legal and operational purposes, ensuring that employers can effectively manage their workforce while adhering to state and federal regulations.

Key Elements of the Personnel File Requirements

Understanding the key elements of personnel file requirements is vital for both employers and employees. The following components are commonly included:

- Personal Information: This includes the employee's name, address, social security number, and contact details.

- Employment Records: Documentation related to hiring, promotions, transfers, and terminations.

- Performance Evaluations: Regular assessments of the employee's work performance and achievements.

- Disciplinary Actions: Records of any disciplinary measures taken against the employee.

- Training and Certifications: Documentation of any training programs or certifications completed by the employee.

Steps to Complete the Personnel File Requirements

Completing the personnel file requirements involves several systematic steps to ensure compliance and accuracy. Here are the recommended steps:

- Gather necessary personal information from the employee.

- Compile employment records, including offer letters and contracts.

- Document performance evaluations and any feedback provided.

- Record any disciplinary actions taken, ensuring to include dates and details.

- Include copies of training certificates and other relevant documents.

Legal Use of the Personnel File Requirements

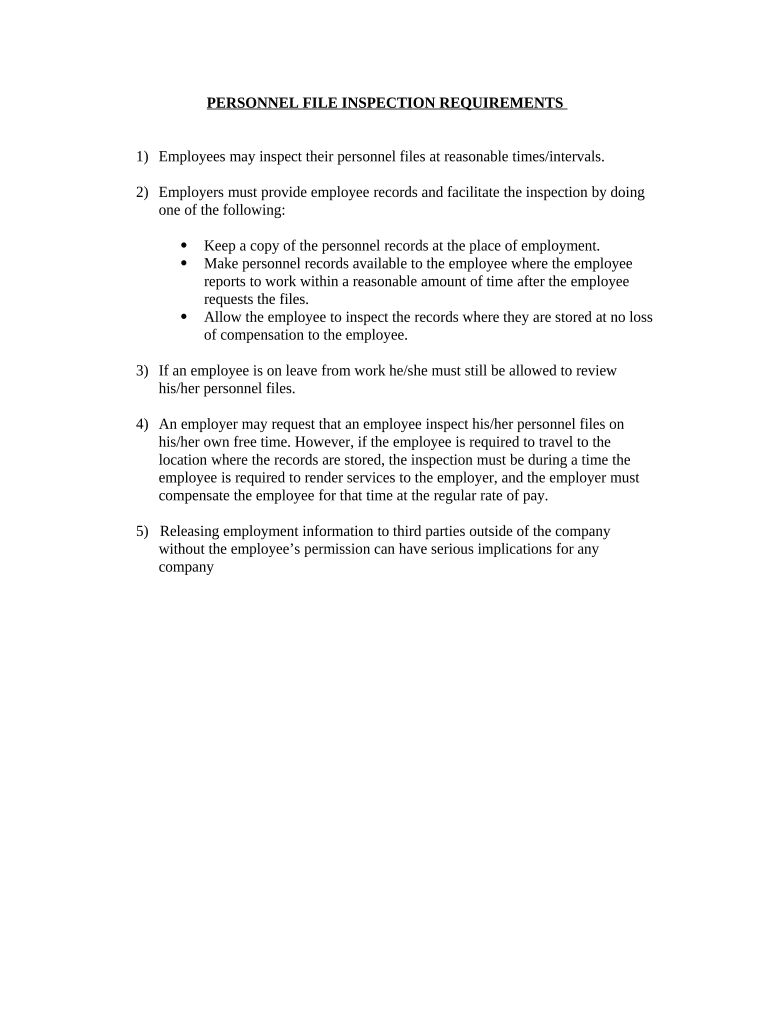

The legal use of personnel file requirements is governed by various federal and state laws. Employers must ensure that these files are maintained securely and that access is restricted to authorized personnel only. Furthermore, employees have the right to inspect their personnel files under certain conditions, which varies by state. Adhering to these legal guidelines helps protect both the employer and employee, ensuring that sensitive information is handled appropriately.

Who Issues the Form

Personnel file requirements are typically managed internally by the human resources department of an organization. However, specific forms related to employment documentation may be issued by various governmental agencies, depending on the context. For instance, the Equal Employment Opportunity Commission (EEOC) and the Department of Labor (DOL) provide guidelines that influence what must be included in personnel files. Employers should stay informed about these regulations to ensure compliance.

Required Documents

To meet personnel file requirements, certain documents are essential. These may include:

- Employment application and resume

- W-4 form for tax withholding

- I-9 form for employment eligibility verification

- Performance reviews and feedback

- Records of training and development

State-Specific Rules for the Personnel File Requirements

Each state in the U.S. may have specific rules governing personnel file requirements. Employers should familiarize themselves with local laws to ensure compliance. For example, some states require that employees be allowed to review their personnel files upon request, while others may have specific retention periods for certain documents. Understanding these nuances is essential for effective personnel management.

Quick guide on how to complete personnel file requirements

Effortlessly Prepare Personnel File Requirements on Any Gadget

Digital document management has become increasingly favored by organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hold-ups. Manage Personnel File Requirements on any gadget using airSlate SignNow Android or iOS applications and streamline any document-centric procedure today.

The Easiest Way to Alter and Electronically Sign Personnel File Requirements Without Stress

- Locate Personnel File Requirements and click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark essential sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to retain your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Personnel File Requirements to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the personnel file requirements for electronic signatures?

Personnel file requirements for electronic signatures include ensuring the security and authenticity of the signed documents. You should verify that the eSigning platform, like airSlate SignNow, complies with industry standards and regulations. Additionally, maintaining a clear audit trail is crucial to meet personnel file requirements.

-

How does airSlate SignNow meet personnel file requirements?

airSlate SignNow meets personnel file requirements by providing a secure platform that ensures compliance with eSignature laws. It features robust authentication methods and maintains detailed logs of all transactions. This transparency and security help businesses to meet their personnel file requirements effortlessly.

-

Are there any costs associated with meeting personnel file requirements using airSlate SignNow?

airSlate SignNow offers various pricing plans, ensuring that businesses can find an option that fits their budget while meeting personnel file requirements. The cost-effectiveness of the solution allows organizations to manage their files without compromising on compliance or security. You can choose a plan that includes features tailored for your specific personnel file requirements.

-

What features does airSlate SignNow offer to comply with personnel file requirements?

To comply with personnel file requirements, airSlate SignNow offers features like customizable workflows, secure storage, and detailed reporting tools. These features help users manage documentation efficiently while ensuring all electronic signatures are legally binding. It streamlines the process, thus enhancing compliance with personnel file requirements.

-

Can I integrate airSlate SignNow with other HR systems to manage personnel file requirements?

Yes, airSlate SignNow integrates seamlessly with various HR systems to help manage personnel file requirements efficiently. This integration allows for automatic updates and storage of signed documents directly into your HR platform. As a result, you can simplify your document management processes while adhering to personnel file requirements.

-

How does airSlate SignNow enhance the security of personnel file requirements?

airSlate SignNow enhances the security of personnel file requirements through strong encryption methods and secure data centers. The platform employs advanced technology to protect sensitive information during and after the signing process. Additionally, users can utilize authentication features to further safeguard their personnel files.

-

What are the benefits of using airSlate SignNow for personnel file requirements?

The benefits of using airSlate SignNow for personnel file requirements include improved efficiency, reduced paper usage, and enhanced compliance. By streamlining the signing process, businesses can save time and resources while ensuring all documents meet legal standards. This can lead to a more organized and efficient management of personnel files.

Get more for Personnel File Requirements

Find out other Personnel File Requirements

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation