Schedule D Form

What is the Schedule D Form

The Schedule D Form is a crucial document used in the United States tax system. It is primarily utilized for reporting capital gains and losses from the sale of assets, including stocks, bonds, and real estate. Taxpayers must complete this form to calculate their overall capital gains tax liability. The information provided on Schedule D helps the Internal Revenue Service (IRS) understand the taxpayer's financial activities during the tax year.

How to Obtain the Schedule D Form

Taxpayers can easily obtain the Schedule D Form through various methods. The most common way is by visiting the official IRS website, where the form is available for download in a printable format. Additionally, taxpayers may find the form in tax preparation software, which often includes the latest version of Schedule D as part of their services. Local libraries and post offices may also have physical copies available for those who prefer a hard copy.

Steps to Complete the Schedule D Form

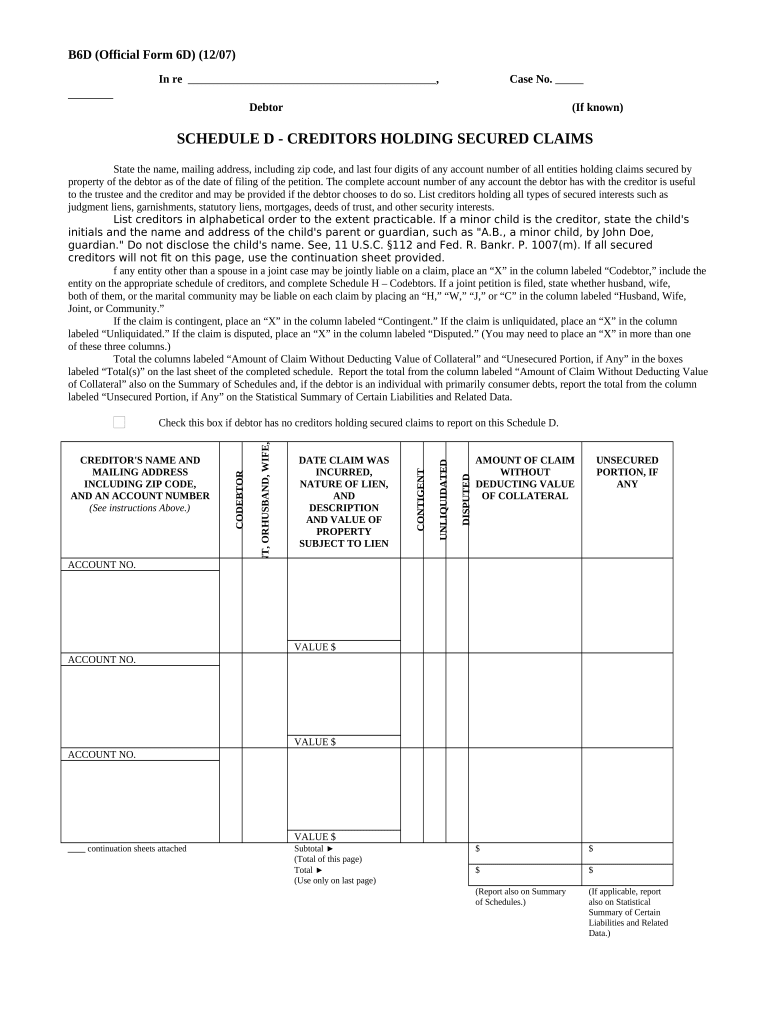

Completing the Schedule D Form involves several key steps. First, taxpayers need to gather all relevant documentation, including records of asset purchases and sales. Next, they should calculate their total capital gains and losses by entering the necessary information into the appropriate sections of the form. It is essential to accurately report each transaction, including dates, amounts, and any adjustments. Finally, taxpayers must review their entries for accuracy before submitting the form with their tax return.

Legal Use of the Schedule D Form

The Schedule D Form serves a legal purpose in the tax filing process. It is essential for ensuring compliance with IRS regulations regarding capital gains taxation. Accurate completion and submission of this form are necessary to avoid potential penalties and legal issues. Taxpayers should be aware that the information reported on Schedule D can be subject to audits, making it crucial to maintain thorough records and documentation related to all reported transactions.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form align with the overall tax return deadlines in the United States. Typically, individual taxpayers must submit their tax returns, including Schedule D, by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to deadlines and to plan accordingly to avoid late filing penalties.

Examples of Using the Schedule D Form

There are various scenarios in which the Schedule D Form is utilized. For instance, an individual who sells stock for a profit must report this transaction on Schedule D to calculate the capital gains tax owed. Conversely, if a taxpayer sells an asset at a loss, they can report this on the form to offset other capital gains. Understanding these examples helps taxpayers recognize the importance of accurately reporting their financial activities on Schedule D.

Quick guide on how to complete schedule d form

Complete Schedule D Form effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It serves as an ideal sustainable alternative to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Schedule D Form on any platform using airSlate SignNow apps for Android or iOS and simplify your document-related processes today.

How to modify and eSign Schedule D Form with ease

- Obtain Schedule D Form and click on Get Form to begin.

- Utilize the tools we supply to complete your form.

- Emphasize relevant sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form – via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Schedule D Form while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Schedule D form printable and why do I need it?

A Schedule D form printable is a tax form used to report capital gains and losses on your federal tax return. It is essential for individuals engaging in stock sales or investment transactions, as it helps to accurately calculate the tax owed. By utilizing a schedule D form printable, you can simplify your tax preparation process and ensure compliance with tax regulations.

-

Where can I find a Schedule D form printable?

You can easily access a schedule D form printable on the IRS website or through online tax services. Many online platforms, including airSlate SignNow, offer downloadable and fillable versions. This makes it convenient for you to obtain the form whenever you need it for tax season.

-

Are there any costs associated with obtaining a Schedule D form printable?

Obtaining a schedule D form printable is typically free, especially if you access it through government resources or reputable tax websites. However, if you use tax preparation software or services that offer assistance with filling out the form, there may be a fee involved. Always check to ensure you're getting a reliable and cost-effective solution.

-

How do I fill out a Schedule D form printable?

To fill out a schedule D form printable, you need to gather documentation of your investment activities, including purchase and sale records. The form requires details such as the asset sold, the purchase and sale prices, and the length of ownership. Step-by-step instructions are usually provided with the form to guide you through the completion process.

-

Can I eSign my Schedule D form printable using airSlate SignNow?

Yes, you can eSign your schedule D form printable using airSlate SignNow. Our platform allows you to upload your completed document, add signature fields, and securely send it for electronic signatures. This feature streamlines the process and saves you time, ensuring your form is signed and submitted promptly.

-

What are the benefits of using airSlate SignNow for tax documents like Schedule D?

Using airSlate SignNow for tax documents, such as schedule D form printable, provides several benefits including ease of use, cost-effectiveness, and time-saving features. You can quickly prepare, sign, and send your document without the hassles of printing and mailing. Additionally, our platform ensures your documents are securely stored and easily accessible.

-

Is airSlate SignNow compatible with other accounting software?

Yes, airSlate SignNow offers integrations with various accounting and tax software, making it easy to use with your existing tools. This compatibility allows you to seamlessly manage your financial documentation, including your schedule D form printable, directly within your preferred software environment. This integration enhances overall efficiency in your tax preparation workflow.

Get more for Schedule D Form

Find out other Schedule D Form

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online