Debt Validation Letter Form

What is the debt validation letter?

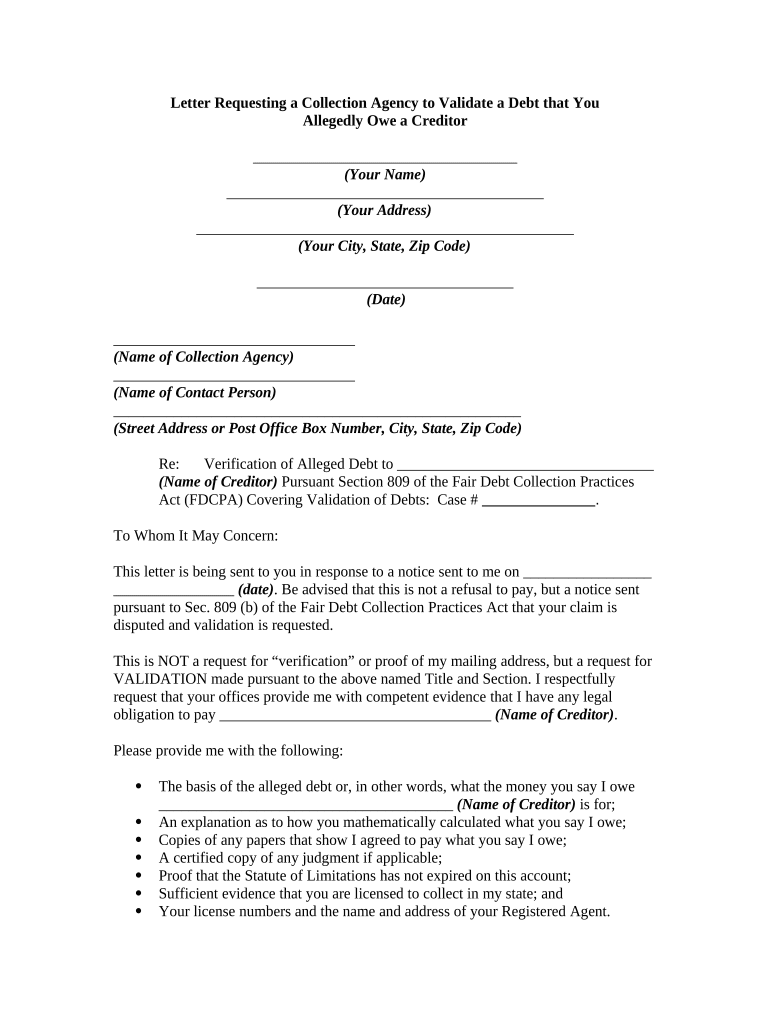

A debt validation letter is a written request sent to a collection agency to verify the legitimacy of a debt. This letter serves as a formal way for consumers to ensure that the debt being pursued is valid and that the agency has the right to collect it. Under the Fair Debt Collection Practices Act (FDCPA), consumers have the right to request validation of the debt within thirty days of being contacted by a collection agency. This letter typically includes essential details such as the amount owed, the name of the creditor, and any relevant account numbers.

Key elements of the debt validation letter

When drafting a debt validation letter, it is important to include specific elements to ensure its effectiveness. Key components include:

- Your contact information: Include your full name, address, and phone number.

- The collection agency's details: Provide the name and address of the agency you are addressing.

- Account information: Mention any account numbers associated with the debt.

- Request for validation: Clearly state that you are requesting verification of the debt.

- Deadline for response: Indicate a reasonable timeframe for the agency to respond to your request.

How to use the debt validation letter

Using a debt validation letter effectively involves several steps. First, ensure you send the letter within the thirty-day window after the initial contact from the collection agency. Next, send the letter via certified mail with a return receipt requested. This provides proof that the agency received your request. After sending the letter, wait for the agency to respond with the requested validation. If they fail to provide adequate proof, they must cease collection efforts on the debt.

Steps to complete the debt validation letter

Completing a debt validation letter requires careful attention to detail. Follow these steps:

- Gather all relevant information about the debt, including any previous correspondence with the collection agency.

- Draft the letter using clear and concise language, ensuring all key elements are included.

- Review the letter for accuracy and completeness.

- Send the letter via certified mail to maintain a record of your communication.

- Keep a copy of the letter for your records.

Legal use of the debt validation letter

The legal use of a debt validation letter is supported by the Fair Debt Collection Practices Act. This law grants consumers the right to dispute debts and request validation. If a collection agency does not respond or fails to provide sufficient proof of the debt, they may be in violation of federal law. This can provide grounds for consumers to take further action, including filing complaints with regulatory agencies or seeking legal counsel.

Examples of using the debt validation letter

There are various scenarios in which a consumer might use a debt validation letter. For instance, if you receive a call from a collection agency regarding a debt you do not recognize, sending a validation letter can help clarify the situation. Another example includes receiving a letter about a debt that you believe has already been paid. In both cases, the validation letter serves as a protective measure to ensure your rights are upheld.

Quick guide on how to complete debt validation letter 497336199

Complete Debt Validation Letter effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers a superb environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents rapidly without delays. Manage Debt Validation Letter on any device with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to adjust and eSign Debt Validation Letter without stress

- Find Debt Validation Letter and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from your preferred device. Modify and eSign Debt Validation Letter and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is collection agency debt and how can airSlate SignNow help manage it?

Collection agency debt refers to money that is owed but has been handed over to a collection agency. airSlate SignNow provides an efficient platform for businesses to handle documents related to collection agency debt, such as contracts and payment agreements, ensuring streamlined communication and compliance.

-

How does airSlate SignNow simplify the process of managing collection agency debt?

With airSlate SignNow, businesses can easily send, eSign, and manage documents related to collection agency debt digitally. This eliminates the need for printing and mailing, thus speeding up the collection process and reducing administrative costs associated with debt management.

-

What pricing plans does airSlate SignNow offer for managing collection agency debt?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage collection agency debt efficiently. Each plan offers tiered features, ensuring you only pay for what you need while accessing vital tools for eSigning and document management.

-

Can I integrate airSlate SignNow with my existing debt collection software?

Yes, airSlate SignNow seamlessly integrates with various debt collection software and CRM systems, allowing businesses to manage collection agency debt effectively within their existing workflows. This integration helps enhance productivity and ensures all deals and documents are accessible in one place.

-

What features does airSlate SignNow offer that are specifically useful for collection agency debt?

airSlate SignNow offers features like customizable templates, automated reminders, and secure eSigning, all of which are essential for efficiently managing collection agency debt. These tools help facilitate timely agreements and ensure that all documents meet legal compliance.

-

How secure is airSlate SignNow for handling sensitive collection agency debt documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive collection agency debt documents. The platform features robust encryption, secure cloud storage, and compliance with legal regulations, ensuring your data is protected at all times.

-

What benefits can businesses expect from using airSlate SignNow for their collection agency debt needs?

By using airSlate SignNow, businesses can expect improved efficiency, reduced turnaround times for documents, and enhanced clarity in communication regarding collection agency debt. This not only accelerates the collection process but also helps maintain positive relationships with clients.

Get more for Debt Validation Letter

- Adp client account agreement form

- 2018 2019 escc federal direct loan certification form

- Environmental questionnaire and disclosure timberland bank form

- Financial assistance application form atlanticare atlanticare

- Federal direct loan certification form escc

- Cdsc form

- Ncsl forms

- Business card order suny new paltz form

Find out other Debt Validation Letter

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF