Download the New Client Form Kembel Tax Services 2013-2026

Key elements of the tax client information sheet template

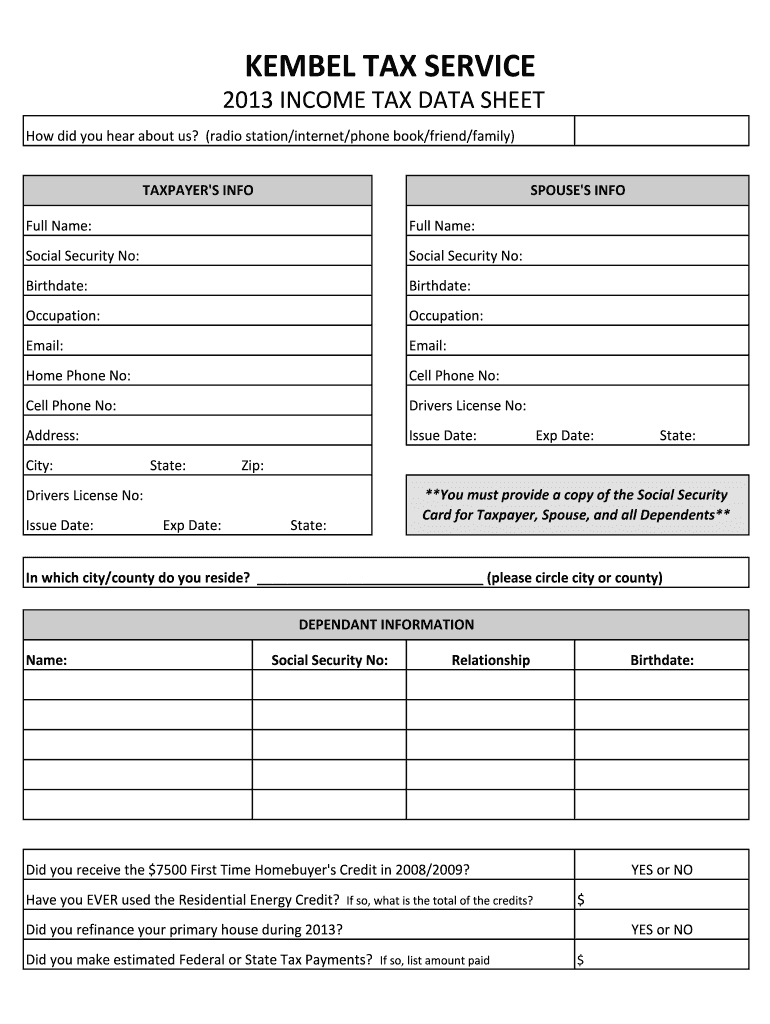

The tax client information sheet template serves as a crucial document for tax preparers and clients alike. This template typically includes essential details such as:

- Client identification: Full name, Social Security number, and contact information.

- Income details: Sources of income, including wages, self-employment earnings, and investment income.

- Deductions and credits: Information on potential deductions, such as mortgage interest, medical expenses, and education credits.

- Filing status: Options like single, married filing jointly, married filing separately, or head of household.

- Banking information: Details for direct deposit of refunds, including bank name, account number, and routing number.

Incorporating these elements ensures that tax preparers have the necessary information to file accurate returns on behalf of their clients.

Steps to complete the tax client information sheet template

Completing the tax client information sheet template involves a series of methodical steps to ensure accuracy and comprehensiveness. Here’s how to proceed:

- Begin by entering the client's full name and Social Security number in the designated fields.

- Collect income information, detailing all sources of income, and input this data accurately.

- Identify applicable deductions and credits, ensuring that the client provides supporting documentation if needed.

- Determine the client’s filing status based on their personal circumstances.

- Include banking details for direct deposit, ensuring that the information is correct to avoid delays.

- Review the completed sheet for accuracy and completeness before finalizing.

Following these steps helps maintain a clear and organized approach to gathering essential tax information.

IRS Guidelines

Understanding IRS guidelines is vital when using the tax client information sheet template. The IRS provides specific instructions regarding:

- Required information: The IRS mandates certain information must be included on tax forms to ensure compliance.

- Filing requirements: Different income levels and filing statuses may have unique requirements that must be adhered to.

- Record keeping: The IRS recommends maintaining copies of all tax documents for at least three years.

Familiarity with these guidelines ensures that the information collected is compliant with federal regulations.

Required Documents

To complete the tax client information sheet template effectively, several documents may be necessary. These documents typically include:

- W-2 forms: For employees, detailing wages and taxes withheld.

- 1099 forms: For independent contractors and other income sources.

- Receipts: For deductible expenses, such as medical bills or charitable donations.

- Prior year tax returns: Useful for reference and ensuring consistency in reporting.

Gathering these documents beforehand can streamline the completion process and enhance accuracy.

Form Submission Methods

Once the tax client information sheet template is completed, it can be submitted through various methods, including:

- Online submission: Many tax preparers offer secure online portals for clients to submit their information electronically.

- Mail: Clients may choose to print the form and send it via postal service to their tax preparer.

- In-person delivery: Arranging a meeting with the tax preparer allows clients to submit the information directly.

Choosing the right submission method can depend on client preferences and the urgency of the tax filing process.

Penalties for Non-Compliance

It is important for clients to understand the potential penalties for non-compliance when filing taxes. These penalties can include:

- Late filing penalties: Fees incurred for not submitting tax returns by the deadline.

- Failure to pay penalties: Charges for not paying owed taxes on time.

- Accuracy-related penalties: Fines for underreporting income or claiming improper deductions.

Being aware of these penalties encourages timely and accurate filing, reducing the risk of financial repercussions.

Quick guide on how to complete download the new client form kembel tax services

The optimal method to locate and endorse Download The New Client Form Kembel Tax Services

On the scale of your entire organization, ineffective workflows concerning document authorization can occupy signNow working hours. Endorsing documents such as Download The New Client Form Kembel Tax Services is a customary aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle greatly impacts the overall efficiency of the company. With airSlate SignNow, endorsing your Download The New Client Form Kembel Tax Services is as straightforward and quick as possible. You will discover on this platform the most recent version of nearly any form. Even better, you can endorse it instantly without needing to install any external applications on your computer or produce hard copies.

Steps to acquire and endorse your Download The New Client Form Kembel Tax Services

- Browse our library by category or employ the search field to locate the form you require.

- View the form preview by clicking on Learn more to confirm it is the correct one.

- Click Get form to start editing immediately.

- Fill out your form and input any necessary information using the toolbar.

- When complete, click the Sign tool to endorse your Download The New Client Form Kembel Tax Services.

- Choose the signature method that works best for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to handle your paperwork efficiently. You can search for, complete, modify, and even send your Download The New Client Form Kembel Tax Services in a single tab without any complications. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

Create this form in 5 minutes!

How to create an eSignature for the download the new client form kembel tax services

How to generate an electronic signature for the Download The New Client Form Kembel Tax Services in the online mode

How to create an eSignature for the Download The New Client Form Kembel Tax Services in Google Chrome

How to create an electronic signature for signing the Download The New Client Form Kembel Tax Services in Gmail

How to generate an eSignature for the Download The New Client Form Kembel Tax Services right from your smart phone

How to make an electronic signature for the Download The New Client Form Kembel Tax Services on iOS

How to make an eSignature for the Download The New Client Form Kembel Tax Services on Android

People also ask

-

What is a tax client information sheet template?

A tax client information sheet template is a standardized document used by tax professionals to gather essential details from their clients. This template helps streamline the collection of critical information needed for accurate tax preparation, ensuring no important details are overlooked.

-

How can airSlate SignNow help with tax client information sheet templates?

airSlate SignNow offers an easy-to-use platform for creating and managing your tax client information sheet template. You can customize your template, send it for e-signature, and store all documents securely in the cloud, making tax season more efficient and organized.

-

Is there a cost associated with using the tax client information sheet template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs and sizes. These plans include access to customizable templates like the tax client information sheet template, enabling you to choose a plan that fits your budget while maximizing efficiency.

-

What features are included with the tax client information sheet template?

The tax client information sheet template includes features such as customizable fields, easy drag-and-drop interface, and secure e-signature options. These features help ensure that tax professionals can efficiently gather and manage client information without hassle.

-

Can I integrate the tax client information sheet template with other software?

Absolutely! airSlate SignNow allows seamless integration with numerous third-party applications, including accounting software. This capability ensures that the information gathered from your tax client information sheet template flows directly into your preferred tools for greater efficiency.

-

What are the benefits of using a tax client information sheet template?

Using a tax client information sheet template enhances efficiency and reduces errors by providing a clear structure for gathering client information. It also saves time during tax season, allowing tax professionals to focus on more critical tasks while easily accessing client data at their fingertips.

-

How secure is the data collected using the tax client information sheet template?

Data security is a priority at airSlate SignNow. The platform employs robust encryption and secure storage protocols to ensure that information collected through your tax client information sheet template is safe and compliant with data protection regulations.

Get more for Download The New Client Form Kembel Tax Services

- Missouri attorney form

- Revised uniform anatomical gift act donation missouri

- Employment hiring process package missouri form

- Anatomical gift act donation by a person under 18 years old missouri form

- Revocation of anatomical gift donation missouri form

- Employment or job termination package missouri form

- Newly widowed individuals package missouri form

- Employment interview package missouri form

Find out other Download The New Client Form Kembel Tax Services

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement