Revolving Loan Agreement Template Form

Understanding the Revolving Loan Agreement Template

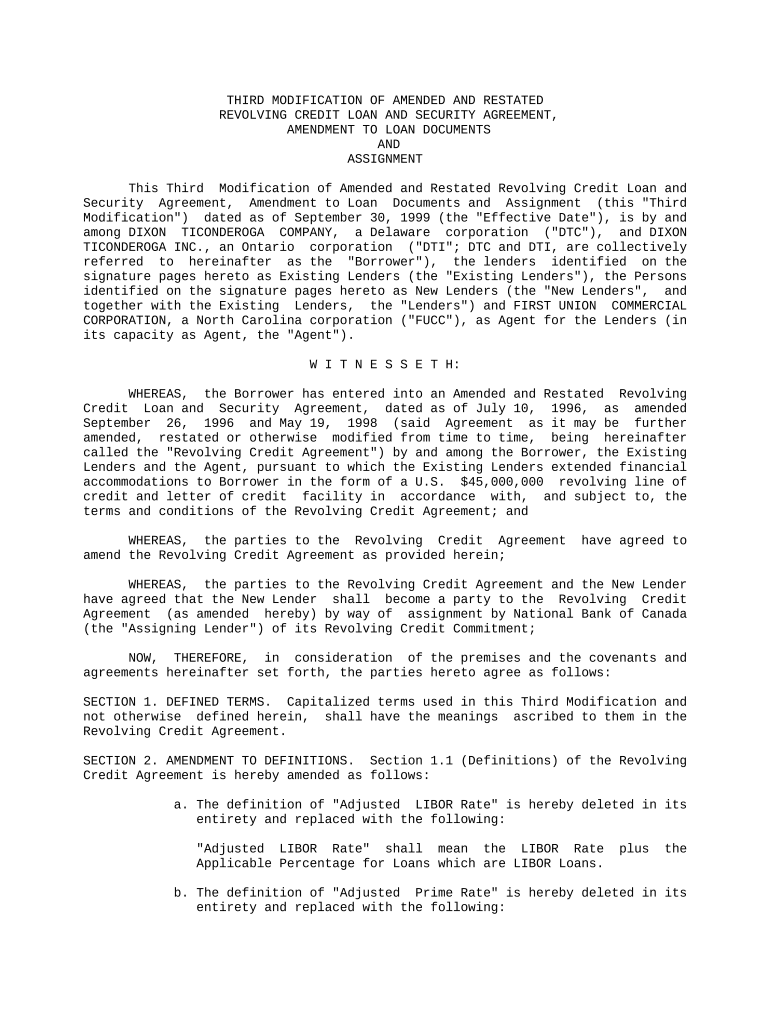

A revolving loan agreement template is a structured document that outlines the terms and conditions under which a lender provides funds to a borrower. This type of agreement allows the borrower to access a specified amount of credit repeatedly, as long as they meet the repayment obligations. It is essential for businesses and individuals looking to manage cash flow effectively. The template typically includes key elements such as the credit limit, interest rates, repayment terms, and any fees associated with the loan.

Steps to Complete the Revolving Loan Agreement Template

Completing a revolving loan agreement template requires careful attention to detail. Here are the steps to ensure accuracy:

- Review the Template: Familiarize yourself with all sections of the template, including definitions and terms.

- Fill in Borrower Information: Provide accurate details about the borrower, including name, address, and contact information.

- Specify Loan Terms: Clearly outline the credit limit, interest rates, and repayment schedule.

- Include Security Provisions: If applicable, detail any collateral that secures the loan.

- Sign and Date: Ensure that both parties sign and date the agreement to validate it legally.

Legal Use of the Revolving Loan Agreement Template

The legal validity of a revolving loan agreement template hinges on compliance with relevant laws and regulations. In the United States, both federal and state laws govern lending practices, including the Truth in Lending Act (TILA), which mandates clear disclosure of loan terms. Additionally, the agreement must be signed by both parties to be considered enforceable in a court of law. Using a reliable electronic signature solution can help ensure that the agreement meets legal standards.

Key Elements of the Revolving Loan Agreement Template

When drafting a revolving loan agreement template, it is crucial to include several key elements to protect both the lender and the borrower. These elements typically include:

- Credit Limit: The maximum amount the borrower can access.

- Interest Rate: The cost of borrowing, usually expressed as an annual percentage rate (APR).

- Repayment Terms: Details on how and when payments are to be made.

- Fees: Any additional costs associated with the loan, such as late fees or annual fees.

- Default Conditions: Circumstances under which the lender can declare the loan in default.

How to Obtain the Revolving Loan Agreement Template

Obtaining a revolving loan agreement template can be done through various means. Many financial institutions provide standardized templates for their clients. Additionally, templates are available online through legal document services and financial websites. It is advisable to ensure that the template complies with state-specific regulations and is tailored to meet the needs of the borrower and lender.

Examples of Using the Revolving Loan Agreement Template

Revolving loan agreements are commonly used in various scenarios, including:

- Business Lines of Credit: Companies often use revolving agreements to manage operational expenses.

- Personal Credit Lines: Individuals may utilize these agreements for personal expenses or emergencies.

- Inventory Financing: Retailers can access funds to purchase inventory and repay as sales occur.

Quick guide on how to complete revolving loan agreement template

Effortlessly prepare Revolving Loan Agreement Template on any device

Managing documents online has gained traction among both enterprises and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the right template and store it securely online. airSlate SignNow equips you with all the necessary features to create, edit, and eSign your documents quickly and without delays. Handle Revolving Loan Agreement Template on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Revolving Loan Agreement Template with ease

- Find Revolving Loan Agreement Template and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections or conceal sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, text (SMS), or invitation link, or download it directly to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow satisfies your document management requirements in just a few clicks from your preferred device. Edit and eSign Revolving Loan Agreement Template while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revolving agreement and how does it work with airSlate SignNow?

A revolving agreement is a flexible contract arrangement that allows parties to repeatedly borrow and repay funds. With airSlate SignNow, you can easily draft, send, and eSign these agreements to streamline the process, ensuring that both parties maintain clear terms and efficient communication.

-

What are the key features of airSlate SignNow for managing revolving agreements?

airSlate SignNow offers a range of features for managing revolving agreements, including document templates, electronic signatures, and real-time tracking. These tools help simplify the drafting and signing processes, making it easier to manage ongoing agreements without the hassle of paper documents.

-

How does airSlate SignNow ensure security for my revolving agreements?

Security is a top priority at airSlate SignNow. Our platform employs bank-level encryption and secure access controls to protect your revolving agreements and sensitive data, ensuring that only authorized parties can view or modify the documents you create and send.

-

What pricing plans are available for airSlate SignNow to handle revolving agreements?

airSlate SignNow offers various pricing plans, tailored to suit different business needs and budgets. Each plan provides comprehensive features for managing revolving agreements, allowing you to choose the level of service that fits your requirements and ensure cost-effective document management.

-

Can I integrate airSlate SignNow with other software to manage revolving agreements?

Yes, airSlate SignNow supports integration with numerous third-party applications, enhancing your ability to manage revolving agreements seamlessly. Whether you use CRM tools, productivity software, or financial platforms, our integrations help you streamline workflows and improve efficiency.

-

What benefits can I expect from using airSlate SignNow for revolving agreements?

By using airSlate SignNow for your revolving agreements, you can expect faster turnaround times, reduced paper usage, and improved collaboration between parties. Our platform simplifies the entire process, allowing for quick eSigning and easy tracking of document status.

-

Is airSlate SignNow easy to use for creating revolving agreements?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to create, send, and eSign revolving agreements. With an intuitive interface and step-by-step guidance, you can navigate the platform confidently, even without prior experience.

Get more for Revolving Loan Agreement Template

Find out other Revolving Loan Agreement Template

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself