Grantor Trust Form

What is the Grantor Trust Form

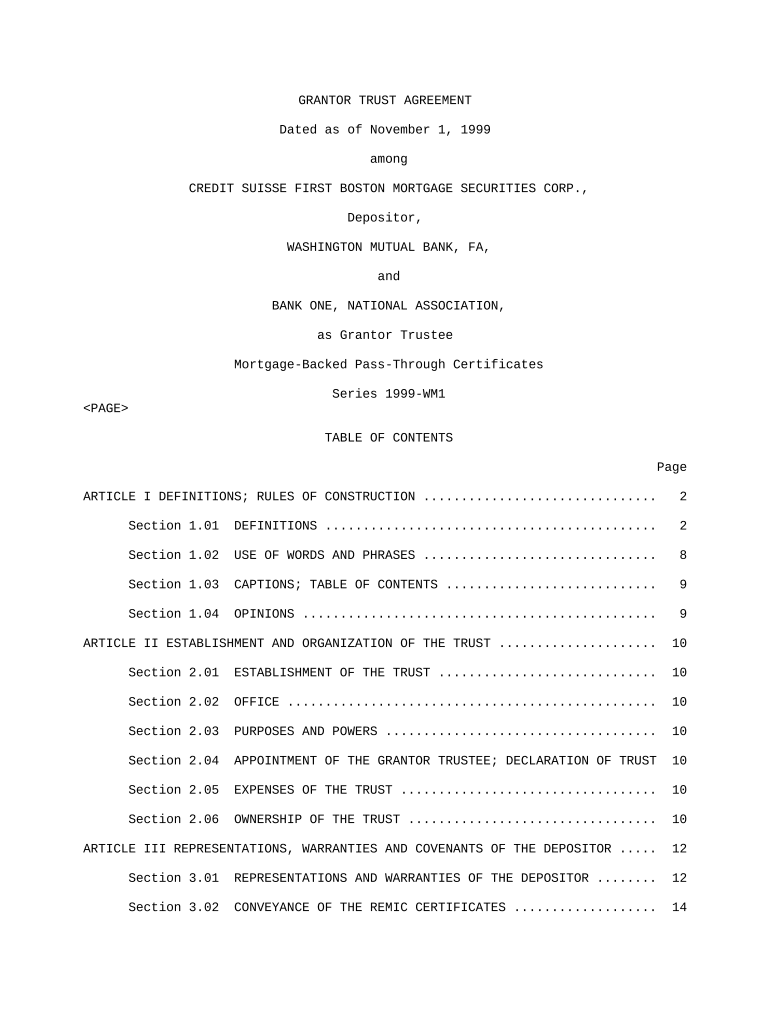

The grantor trust form is a legal document that establishes a trust in which the grantor retains certain powers over the trust assets. This form is essential for individuals looking to manage their assets while potentially benefiting from tax advantages. Trusts can be revocable or irrevocable, and the grantor trust arrangement allows the grantor to maintain control during their lifetime, making it a popular choice for estate planning. The grantor trust agreement outlines the terms of the trust, including the distribution of assets and the responsibilities of the trustee.

How to Use the Grantor Trust Form

Using the grantor trust form involves several steps to ensure that it meets legal requirements and effectively serves its intended purpose. First, individuals must gather necessary information about the assets to be placed in the trust, including property, investments, and any other relevant items. Next, the grantor must fill out the form accurately, detailing the terms of the trust, including beneficiaries and distribution instructions. Once completed, the form should be signed in accordance with state laws, often requiring witnesses or notarization to enhance its validity.

Steps to Complete the Grantor Trust Form

Completing the grantor trust form requires attention to detail. Here are the key steps:

- Identify the assets to be included in the trust.

- Provide personal information, including the grantor's name and address.

- Specify the beneficiaries who will receive the trust assets.

- Outline the terms of the trust, including any specific instructions for asset management.

- Sign the document, ensuring compliance with state requirements for witnessing or notarization.

Legal Use of the Grantor Trust Form

The legal use of the grantor trust form is governed by state laws, which may vary significantly. It is crucial for the grantor to understand the legal implications of the trust arrangement. The form must comply with the Uniform Trust Code and any relevant state-specific regulations to ensure that it is enforceable. Additionally, the grantor should be aware of tax implications, as income generated by the trust may be taxable to the grantor under certain conditions.

Key Elements of the Grantor Trust Form

Several key elements must be included in the grantor trust form to ensure its effectiveness:

- Grantor Information: Full name and contact details of the grantor.

- Trustee Information: Name and contact details of the trustee responsible for managing the trust.

- Beneficiaries: Names and relationships of individuals or entities who will benefit from the trust.

- Asset Description: Detailed list of assets included in the trust.

- Terms of Distribution: Clear instructions on how and when assets will be distributed to beneficiaries.

Examples of Using the Grantor Trust Form

There are various scenarios in which the grantor trust form can be utilized effectively. For instance, individuals may use it to pass on family property to heirs while avoiding probate. It can also be beneficial for those looking to minimize estate taxes by transferring assets into a trust. Additionally, the form can be employed in charitable giving, allowing the grantor to support a cause while retaining some control over the assets during their lifetime.

Quick guide on how to complete grantor trust form

Easily Create Grantor Trust Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to produce, edit, and electronically sign your documents swiftly without delays. Handle Grantor Trust Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Edit and Electronically Sign Grantor Trust Form Effortlessly

- Locate Grantor Trust Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to confirm your changes.

- Select your preferred method for sending your form: via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Grantor Trust Form to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a grantor trust form?

A grantor trust form is a legal document that establishes a trust where the grantor retains control over the assets. This form helps in facilitating estate planning and asset protection, ensuring that the grantor can manage the trust's income and expenses.

-

How can airSlate SignNow assist with signing grantor trust forms?

airSlate SignNow makes it simple to eSign grantor trust forms securely and efficiently. With our intuitive platform, users can send documents for signature, track their status, and ensure that all legal requirements are met while maintaining compliance.

-

What features does airSlate SignNow offer for grantor trust forms?

Our platform provides various features, including customizable templates for grantor trust forms, automated workflows, and secure storage. These features enhance the signing experience and streamline document management for users.

-

Are there any integration options available for grantor trust forms?

Yes, airSlate SignNow integrates seamlessly with numerous applications to enhance your workflow. You can easily connect tools like Google Drive, Salesforce, and Dropbox to manage your grantor trust forms efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different needs, from individuals to larger organizations. Each plan includes features that are ideal for managing grantor trust forms without requiring a hefty financial commitment.

-

Can I customize my grantor trust form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize grantor trust forms to meet their specific requirements. You can edit text fields, add signers, and include your branding to create personalized legal documents.

-

Is it secure to use airSlate SignNow for grantor trust forms?

Yes, airSlate SignNow takes security seriously, employing advanced encryption and security protocols to protect your grantor trust forms. Our platform ensures that your sensitive information is kept safe and confidential throughout the signing process.

Get more for Grantor Trust Form

- Request for verification new mexico department of workforce form

- Preliminary notice of disciplinary action 31 a state of new jersey newjersey form

- Fl 0852 1218indd form

- X dpf31cpmd nj form

- Within 31 days of your hire date and south carolina form

- Wkc 12 employers first report of injury or disease this form is for the employer to report every work related injury to its

- Nyc nycers forms fill online printable fillable blank

- Wc 77 application for hearing department of labor and industrial form

Find out other Grantor Trust Form

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple