Closing Agreement Form

What is the Closing Agreement

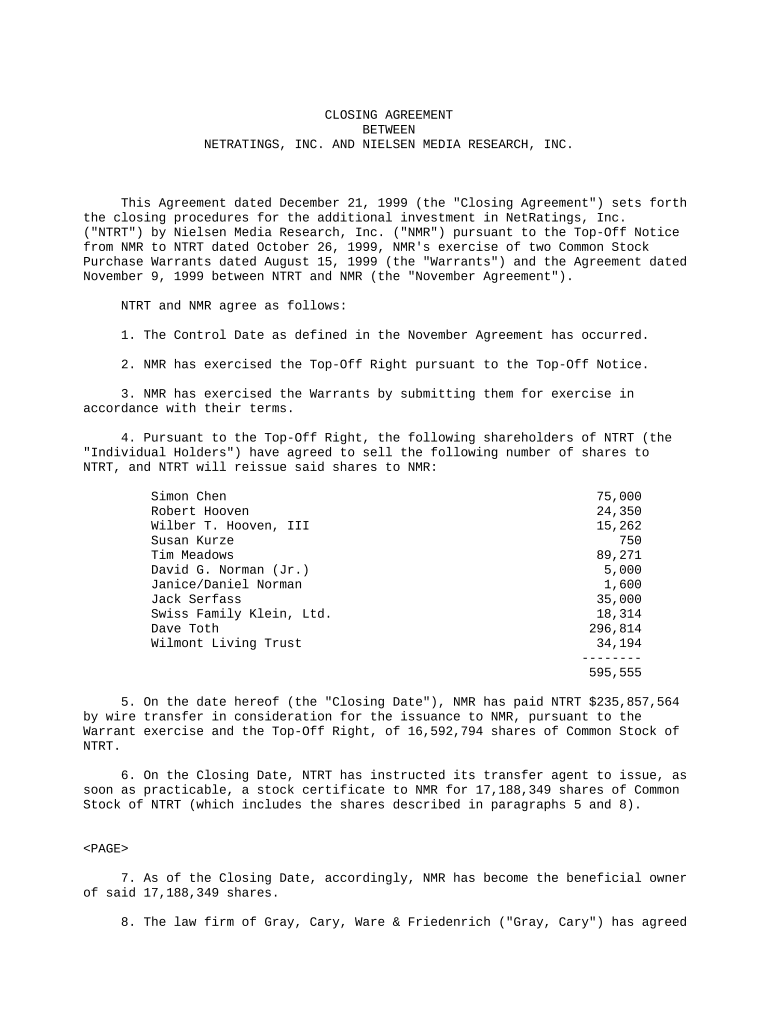

The Closing Agreement is a formal document that outlines the terms and conditions agreed upon by parties involved in a transaction or settlement. It serves as a binding contract, ensuring that all parties understand their obligations and rights. Typically used in legal and financial contexts, this agreement can help prevent disputes by clearly defining the responsibilities of each party. The Closing Agreement is essential for finalizing negotiations and can be particularly important in real estate transactions, tax matters, and business dealings.

How to use the Closing Agreement

Using a Closing Agreement involves several key steps to ensure that it is executed correctly. First, all parties must review the terms outlined in the document to confirm their understanding and agreement. Next, each party should provide their signature, which can be done electronically for convenience. It is important to keep a copy of the signed agreement for future reference. In some cases, the agreement may need to be submitted to relevant authorities or regulatory bodies, depending on the nature of the transaction.

Steps to complete the Closing Agreement

Completing a Closing Agreement requires careful attention to detail. Here are the essential steps:

- Gather necessary information: Collect all relevant documents and details needed to fill out the agreement.

- Fill out the agreement: Accurately complete all sections of the Closing Agreement, ensuring all information is correct.

- Review and confirm: Have all parties review the document to ensure accuracy and mutual understanding.

- Sign the agreement: Obtain signatures from all parties, which can be done electronically for efficiency.

- Distribute copies: Provide copies of the signed agreement to all parties involved for their records.

Legal use of the Closing Agreement

The legal use of a Closing Agreement is critical to ensure its enforceability. For the agreement to be legally binding, it must meet specific requirements, such as being signed by all parties involved and containing clear terms. Additionally, the agreement should comply with relevant laws and regulations, which may vary by state or jurisdiction. Understanding these legal frameworks is essential for all parties to protect their interests and ensure that the agreement is upheld in a court of law if necessary.

Key elements of the Closing Agreement

A well-structured Closing Agreement includes several key elements that contribute to its effectiveness:

- Identification of parties: Clearly state the names and roles of all parties involved.

- Terms and conditions: Outline the specific obligations and responsibilities of each party.

- Effective date: Specify when the agreement becomes effective.

- Signatures: Include spaces for all parties to sign, indicating their acceptance of the terms.

- Governing law: Indicate which state’s laws will govern the agreement.

Required Documents

When preparing a Closing Agreement, certain documents may be required to support the information provided. These can include:

- Identification documents for all parties involved.

- Previous agreements or contracts related to the transaction.

- Financial statements or records, if applicable.

- Any additional documentation required by specific regulations or laws.

Quick guide on how to complete closing agreement 497336784

Effortlessly Prepare Closing Agreement on Any Device

Online document administration has gained traction among enterprises and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents since you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Handle Closing Agreement on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Closing Agreement effortlessly

- Find Closing Agreement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Closing Agreement and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Closing Agreement and how does it work with airSlate SignNow?

A Closing Agreement is a legal document that outlines the terms of an agreement when concluding a transaction or settlement. With airSlate SignNow, you can easily create, send, and eSign Closing Agreements, streamlining your workflow and ensuring that all parties are in agreement before finalizing any deal.

-

What features does airSlate SignNow offer for managing Closing Agreements?

airSlate SignNow provides a comprehensive suite of features for managing Closing Agreements, including customizable templates, secure eSigning, and real-time tracking. These features help ensure that your agreements are executed quickly and efficiently, minimizing the risk of errors or delays.

-

How can airSlate SignNow help reduce costs when handling Closing Agreements?

By using airSlate SignNow, businesses can signNowly reduce costs associated with traditional document handling. The platform eliminates the need for printing, faxing, and shipping physical documents, allowing for a more cost-effective solution when preparing and executing Closing Agreements.

-

Is airSlate SignNow compliant with legal standards for Closing Agreements?

Yes, airSlate SignNow is compliant with all necessary legal standards for eSignature laws, including the ESIGN Act and UETA. This compliance ensures that your Closing Agreements are legally binding and recognized in all jurisdictions, providing peace of mind for your business transactions.

-

Can I integrate airSlate SignNow with other software for handling Closing Agreements?

Absolutely! airSlate SignNow offers seamless integrations with various software systems such as Salesforce, Google Drive, and more. These integrations allow you to manage your Closing Agreements alongside your existing tools, making the process even more efficient.

-

What benefits does airSlate SignNow offer for remote teams regarding Closing Agreements?

For remote teams, airSlate SignNow provides the flexibility to send and eSign Closing Agreements from anywhere, at any time. This convenience ensures that all stakeholders can participate in the agreement process without geographic limitations, enhancing overall productivity.

-

Is there a trial period available for airSlate SignNow to test the Closing Agreement features?

Yes, airSlate SignNow offers a trial period for new users to explore all its features, including those specific to Closing Agreements. During the trial, you can evaluate the platform's usability and effectiveness in managing your business agreements without any financial commitment.

Get more for Closing Agreement

- Thank you for choosing jefferson surgical clinic for your form

- New patient packet allergy and asthma specialists psc form

- Molly rutherfords office is located at 1234 franklin road s form

- Printable blue cross and blue shield precertification forms

- Healthfirst outpatient authorization form

- Adoption application this form is to help you find the best

- Washington practitioner bapplicationb wpa form molina healthcare

- Chpw authorization form

Find out other Closing Agreement

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT