Certified Bill of Sale for a Vehicle Brevard County Tax Collector Form

Key elements of the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector

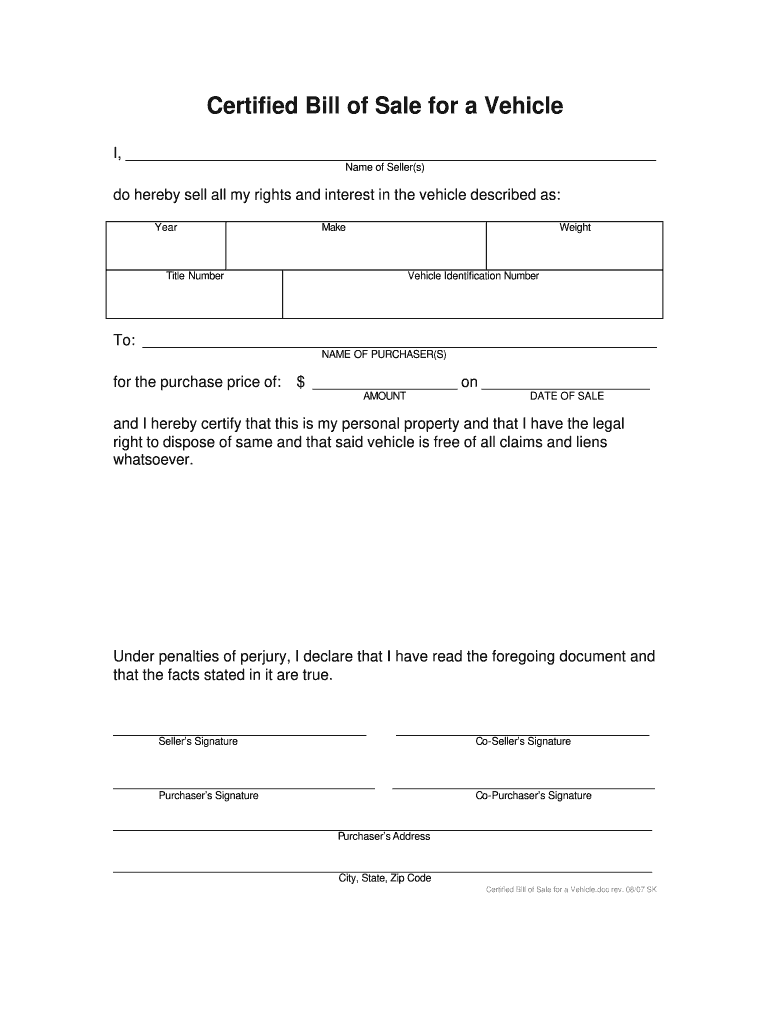

The Certified Bill of Sale for a vehicle in Brevard County is a crucial document that outlines the transfer of ownership from the seller to the buyer. This document must include specific elements to be legally valid. Essential components include:

- Buyer and Seller Information: Full names, addresses, and contact details of both parties.

- Vehicle Details: Make, model, year, Vehicle Identification Number (VIN), and odometer reading at the time of sale.

- Sale Price: The agreed-upon amount for the vehicle.

- Date of Sale: The exact date when the transaction occurs.

- Signatures: Both parties must sign the document to validate the transfer.

Including these elements ensures that the bill of sale meets legal standards and protects both the buyer and seller in the transaction.

Steps to complete the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector

Completing the Certified Bill of Sale for a vehicle involves several straightforward steps. Following these steps can help ensure that the document is filled out correctly:

- Gather Information: Collect all necessary details about the vehicle and both parties involved in the sale.

- Download the Form: Obtain the Certified Bill of Sale form from the Brevard County Tax Collector's website or other official sources.

- Fill Out the Form: Carefully enter all required information, including vehicle details, sale price, and the date of sale.

- Sign the Document: Both the seller and buyer should sign the form to confirm the transaction.

- Submit the Form: Depending on local regulations, submit the completed bill of sale to the appropriate authority, such as the Brevard County Tax Collector.

Following these steps helps ensure a smooth transaction and compliance with local laws.

Legal use of the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector

The Certified Bill of Sale serves as a legal document that protects the rights of both the buyer and seller. It provides proof of ownership transfer and can be used in various legal contexts, such as:

- Vehicle Registration: Required for registering the vehicle in the new owner's name.

- Tax Purposes: May be needed for tax assessments or when filing taxes related to vehicle ownership.

- Dispute Resolution: Can serve as evidence in case of disputes regarding the sale terms or ownership.

Understanding the legal implications of this document is essential for both parties to ensure their rights are protected.

How to use the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector

Using the Certified Bill of Sale effectively involves understanding its purpose and how to present it during the vehicle transaction. The bill of sale should be used as follows:

- As a Transaction Record: Keep a copy for personal records to document the sale.

- For Registration: Present the bill of sale to the Department of Motor Vehicles (DMV) when registering the vehicle under the new owner's name.

- In Case of Future Sales: Retain the document for future reference, especially if the vehicle is sold again.

This document is not only a record of the transaction but also a vital part of the vehicle's history.

How to obtain the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector

Obtaining the Certified Bill of Sale for a vehicle in Brevard County is a straightforward process. Here’s how to get one:

- Visit the Tax Collector's Office: Go to the Brevard County Tax Collector's office in person to request the form.

- Online Access: Check the official Brevard County Tax Collector's website for downloadable forms.

- Request by Mail: If necessary, you can request the form via mail by contacting the office directly.

Ensuring you have the correct form is essential for a legally binding transaction.

Quick guide on how to complete certified bill of sale for a vehicle brevard county tax collector

Complete Certified Bill Of Sale For A Vehicle Brevard County Tax Collector effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Certified Bill Of Sale For A Vehicle Brevard County Tax Collector on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and electronically sign Certified Bill Of Sale For A Vehicle Brevard County Tax Collector without hassle

- Find Certified Bill Of Sale For A Vehicle Brevard County Tax Collector and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Certified Bill Of Sale For A Vehicle Brevard County Tax Collector and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Why are checks made out to the personal name of the county collector for property tax in Missouri? Isn’t that a recipe for fraud or commingling personal and government funds?

You make your check out to

, Collector of Taxes. For example, if you are paying personal property or real property taxes in Carthage, MO, you make the check out to “Steven H Holt, Jasper County Collector of Taxes.”As long as you have your canceled check, you're good to go. In the unlikely event that the tax collector absconds with the funds (it has happened) he or she is the one who gets a reservation at the Greybar Hotel. -

How did the USA IRS find out about the sale of Boris Johnson's London house and send him a large tax bill for it?

Easy as pie.Step 1) Determine if Mr. Johnson fits the Classification of Taxpayers for U.S. Tax Purposes: A simple internet search of Boris Johnson will tell you he was born in the US and as a result of Jus soli is a US citizen and therefore a US person for tax purposes;Step 2) Find out that Mr. Johnson sold his London home: Reading the UK newspapers or doing a property record search;Step 3) Look to see if Mr. Johnson paid his US capital gains tax (after exemption) on the sale of his London home: If he has not filing at all, then throw the book at him. If filing but failing to note foreign capital gain at all caused by sale of London home (NOTE: To the US, a London home is a foreign asset), then throw the book at him. If filing improperly (such as noting sale of but not paying applicable US capital gains tax on the sale of a foreign residence), then advise him of applicable tax. For those who wonder why tax authorities would know to look at Mr. Johnson, they need to step into the shoes of your average IRS (or other tax collection agency) field agent. Most of them live pretty mundane lives of quiet desperation, dealing with small-time collections of unknown persons. They (and their bosses) dream of "bagging the unicorn" and that is why there is now a focus on celebrity tax obligations. Social media and the internet know make the searching easy on this prized target group.With this perspective, you can now understand why several of the world's top footballers (Messi, Neymar), fashion icons (Dolce and Gabbana, Karl Lagerfeld), and assorted other "names" (Princess of Spain) are finding themselves hauled in front of tax courts.For those who are wondering why Mr. Johnson finally decided to pay the US tax bill and renounce US citizenship after so publicly stating he would never do so, I direct you to one of my blog postings A Lion in Winter becomes a Lamb in Spring

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

I'm about to register a vehicle I bought out of state but I don't have a bill of sale if I write a higher number for taxes will that enable me to get a higher valuation if I use the car as collateral for an asset backed loan?

Nice try, but no, and it would be dumb. You’ll end up paying more in registration taxes.It also doesn’t matter what value you list on the registration documents, no lender is going to lend on that number, they have access to Kelley Blue Book and Edmonds, just like you do.

Create this form in 5 minutes!

How to create an eSignature for the certified bill of sale for a vehicle brevard county tax collector

How to make an electronic signature for your Certified Bill Of Sale For A Vehicle Brevard County Tax Collector in the online mode

How to generate an eSignature for the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector in Google Chrome

How to create an electronic signature for putting it on the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector in Gmail

How to generate an electronic signature for the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector from your mobile device

How to make an eSignature for the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector on iOS

How to create an eSignature for the Certified Bill Of Sale For A Vehicle Brevard County Tax Collector on Android OS

People also ask

-

What is a vehicle bill of sale download?

A vehicle bill of sale download is a document that legally transfers ownership of a vehicle from the seller to the buyer. With airSlate SignNow, you can easily download a customizable template for your vehicle bill of sale to streamline the transaction process and ensure all necessary details are captured.

-

How can I download a vehicle bill of sale using airSlate SignNow?

To download a vehicle bill of sale with airSlate SignNow, simply select the template you need, fill in the required information, and click on the download button. Our user-friendly platform ensures that you can obtain your vehicle bill of sale download in just a few clicks.

-

Is there a cost associated with downloading a vehicle bill of sale?

Yes, airSlate SignNow offers various pricing plans, including a free trial. Depending on your selected plan, there may be a minimal fee to access premium features, including the vehicle bill of sale download, but our service remains cost-effective compared to traditional options.

-

What features are included in the vehicle bill of sale download?

The vehicle bill of sale download from airSlate SignNow includes customizable fields, electronic signature options, and the ability to add necessary terms and conditions. You can also track the document's status and receive notifications once it's signed, all to enhance your experience.

-

Can I integrate airSlate SignNow with other applications for a seamless workflow?

Absolutely! airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and others. This means you can create and download your vehicle bill of sale while maintaining a smooth and connected workflow throughout your business operations.

-

What benefits does airSlate SignNow provide for creating a vehicle bill of sale?

Using airSlate SignNow to create a vehicle bill of sale offers numerous benefits, such as saving time with fast document creation, reducing paperwork, and ensuring legal compliance. The easy-to-use platform simplifies the process, making it accessible for both individuals and businesses.

-

How secure is my data when I download a vehicle bill of sale?

Data security is our top priority at airSlate SignNow. When you download a vehicle bill of sale, your information is encrypted and stored securely to prevent unauthorized access. We comply with industry-standard security protocols to ensure your documents are safe.

Get more for Certified Bill Of Sale For A Vehicle Brevard County Tax Collector

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497313865 form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent 497313866 form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable mississippi form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497313868 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497313869 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement mississippi form

- Letter notice change form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants mississippi form

Find out other Certified Bill Of Sale For A Vehicle Brevard County Tax Collector

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word