Insurance Agreement Form

What is the Insurance Agreement

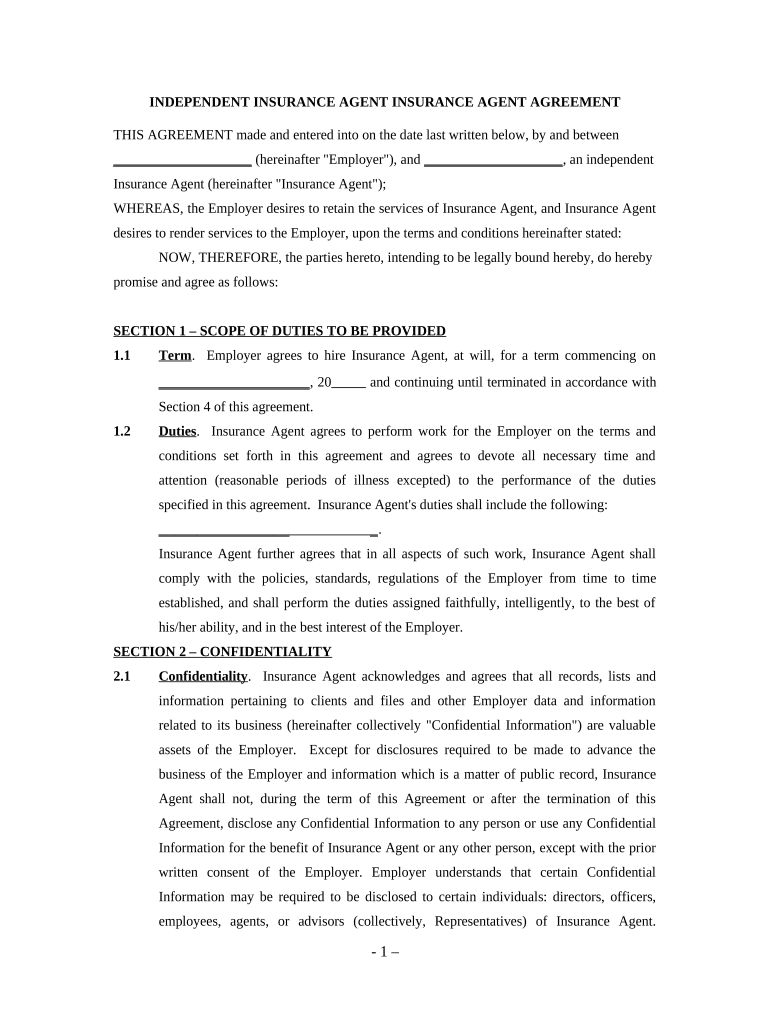

An insurance agreement is a legally binding document between an insurance provider and a policyholder. It outlines the terms and conditions under which the insurer agrees to provide coverage in exchange for premium payments. This agreement specifies the types of coverage, limits, exclusions, and the responsibilities of both parties. Understanding the details of an insurance agreement is crucial for policyholders to ensure they receive the protection they expect.

Key Elements of the Insurance Agreement

The insurance agreement typically includes several key elements that define the relationship between the insurer and the policyholder. These elements often consist of:

- Coverage Details: Specifies what risks are covered and the extent of that coverage.

- Premium Amount: The cost of the insurance policy, which the policyholder must pay to maintain coverage.

- Deductibles: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

- Exclusions: Specific situations or conditions that are not covered by the policy.

- Claims Process: The procedure for filing a claim and the documentation required.

Steps to Complete the Insurance Agreement

Completing an insurance agreement involves several important steps to ensure accuracy and compliance. Here are the typical steps:

- Review the Agreement: Carefully read the entire document to understand the terms and conditions.

- Fill Out Personal Information: Provide accurate personal and contact information as required.

- Select Coverage Options: Choose the coverage types and limits that best meet your needs.

- Sign the Agreement: Provide your signature, either electronically or physically, to validate the agreement.

- Submit the Agreement: Send the completed agreement to the insurance provider through the designated method.

Legal Use of the Insurance Agreement

For an insurance agreement to be legally binding, it must meet specific legal requirements. These include mutual consent, a lawful object, and consideration (the exchange of value). Additionally, both parties must have the legal capacity to enter into the agreement. Electronic signatures, when compliant with laws such as the ESIGN Act and UETA, are also considered valid, allowing for efficient processing of the insurance agreement.

How to Use the Insurance Agreement

Utilizing an insurance agreement effectively involves understanding its purpose and the obligations it entails. Policyholders should:

- Keep a copy of the signed agreement for their records.

- Review the agreement periodically to ensure it still meets their needs.

- Contact the insurance provider for any questions or clarifications regarding the terms.

- File claims according to the outlined process in the agreement.

Examples of Using the Insurance Agreement

Insurance agreements can be applied in various scenarios, including:

- Homeowners Insurance: Protects against damage to the home and personal property.

- Auto Insurance: Covers damages related to vehicle accidents and liability.

- Health Insurance: Provides coverage for medical expenses and treatments.

- Life Insurance: Offers financial support to beneficiaries upon the policyholder's death.

Quick guide on how to complete insurance agreement 497337104

Accomplish Insurance Agreement effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Insurance Agreement on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Insurance Agreement with ease

- Locate Insurance Agreement and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal weight as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow efficiently addresses your needs in document management with just a few clicks from any device you prefer. Alter and eSign Insurance Agreement to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an insurance agreement and how can airSlate SignNow help with it?

An insurance agreement is a legal document between an insurer and the insured, outlining the terms of coverage. With airSlate SignNow, you can easily create, send, and eSign insurance agreements in a secure and efficient manner. Our platform simplifies the process, allowing you to focus on your core business.

-

What are the pricing options for creating insurance agreements with airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to the needs of different businesses. Whether you're a solo entrepreneur or part of a large organization, our solutions for managing insurance agreements are cost-effective. Visit our pricing page to find a plan that suits your budget and requirements.

-

Can airSlate SignNow integrate with my existing CRM for insurance agreements?

Yes, airSlate SignNow seamlessly integrates with various CRM systems to streamline the management of insurance agreements. This means you can send, receive, and eSign documents directly within your CRM, enhancing your workflow. Check our integrations section for more details on compatibility.

-

What features should I look for when using airSlate SignNow for insurance agreements?

When using airSlate SignNow for insurance agreements, look for features like customizable templates, real-time tracking, and secure storage. These functionalities ensure that your documents are efficiently managed and compliant with industry standards. Our user-friendly interface simplifies the entire process.

-

How secure is airSlate SignNow for handling insurance agreements?

airSlate SignNow prioritizes the security of your insurance agreements with advanced encryption and authentication measures. Our platform is designed to protect sensitive data and ensure compliance with regulations. You can eSign with confidence knowing your documents are secure.

-

What benefits does airSlate SignNow provide for insurance agreements?

Using airSlate SignNow for insurance agreements offers numerous benefits, including faster turnaround times and improved organization of documents. The easy eSigning process reduces delays and enhances client satisfaction. Additionally, our system keeps all your agreements in one place for easy access.

-

Is it easy to collaborate on insurance agreements using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple parties to collaborate on insurance agreements effortlessly. You can invite stakeholders to review and eSign documents within the platform, ensuring everyone stays on the same page throughout the process. This collaboration feature streamlines communication and speeds up final approvals.

Get more for Insurance Agreement

- Connecticut practice book connecticut judicial branch form

- Motion for first order of notice foreclosure action form

- Public assistance connecticut judicial branch ctgov form

- Illinois secretary of state employeeattorney information

- Fl 141 declaration regarding service of california form

- Foc 23 form

- Rule 3007 1 objections to claimsnorthern district of form

- Wwwpdffillercom559705782 how to fillup email2020 form wi be 101 fill online printable fillable blank

Find out other Insurance Agreement

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy