Specialty Services Contact Self Employed Form

What is the Specialty Services Contact Self Employed

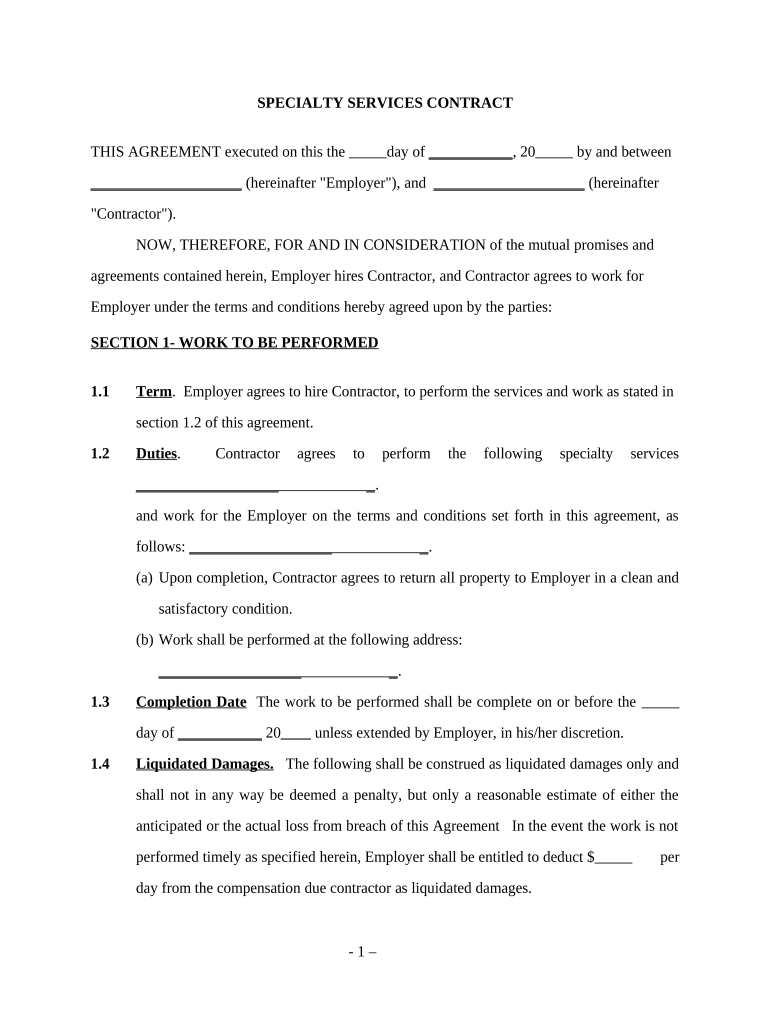

The Specialty Services Contact Self Employed form is a crucial document for individuals who operate as independent contractors or freelancers. This form outlines the specific services provided, the terms of engagement, and the responsibilities of both the self-employed individual and the client. It serves as a formal agreement that clarifies expectations, payment terms, and any other relevant details pertaining to the work arrangement. Understanding this form is essential for ensuring a clear and professional relationship between parties involved.

How to use the Specialty Services Contact Self Employed

Using the Specialty Services Contact Self Employed form effectively involves several steps. First, gather all necessary information, including personal details, service descriptions, and payment terms. Next, fill out the form accurately, ensuring that all sections are completed. Once filled, both parties should review the document to confirm that all terms are agreeable. After mutual consent, the form can be signed electronically, ensuring a legally binding agreement. Utilizing a reliable eSignature platform can streamline this process and enhance security.

Steps to complete the Specialty Services Contact Self Employed

Completing the Specialty Services Contact Self Employed form involves a systematic approach:

- Gather necessary information, including your name, contact details, and service specifics.

- Clearly outline the services you will provide, including timelines and deliverables.

- Specify payment terms, including rates, payment methods, and due dates.

- Review the form for accuracy and completeness.

- Both parties should sign the document electronically to finalize the agreement.

Legal use of the Specialty Services Contact Self Employed

The legal use of the Specialty Services Contact Self Employed form hinges on compliance with relevant laws governing contracts and eSignatures. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that both parties consent to use electronic means for signing. This form must clearly articulate the terms of the agreement to ensure enforceability in a legal context. It is advisable to retain a copy of the signed document for record-keeping and potential future reference.

Key elements of the Specialty Services Contact Self Employed

Several key elements are essential to include in the Specialty Services Contact Self Employed form:

- Contact Information: Names, addresses, and contact details of both parties.

- Description of Services: A detailed account of the services to be provided.

- Payment Terms: Rates, payment schedules, and accepted payment methods.

- Timeline: Start and end dates for the services.

- Signatures: Digital signatures from both parties to validate the agreement.

Examples of using the Specialty Services Contact Self Employed

Examples of situations where the Specialty Services Contact Self Employed form is utilized include:

- A freelance graphic designer entering into an agreement with a business for logo design.

- A consultant providing strategic advice to a startup, outlining the scope and payment terms.

- A writer contracted to produce content for a website, detailing deadlines and compensation.

Quick guide on how to complete specialty services contact self employed

Complete Specialty Services Contact Self Employed effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly without any hold-ups. Manage Specialty Services Contact Self Employed on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Specialty Services Contact Self Employed without any hassle

- Locate Specialty Services Contact Self Employed and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Specialty Services Contact Self Employed to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the pricing options for Specialty Services Contact Self Employed?

airSlate SignNow offers flexible pricing options tailored for Specialty Services Contact Self Employed. You can choose from monthly or yearly subscriptions, with discounts available for annual plans. This ensures that you find a plan that not only fits your budget but also meets your business needs.

-

What features are included in the Specialty Services Contact Self Employed package?

The Specialty Services Contact Self Employed package includes essential features such as document templates, eSigning, and real-time collaboration. Additionally, you can easily customize workflows and track document status for enhanced productivity. These features are designed to streamline your document management process.

-

How can airSlate SignNow benefit my Specialty Services Contact Self Employed business?

airSlate SignNow can signNowly benefit your Specialty Services Contact Self Employed business by simplifying the signing process and saving you time. With its user-friendly interface, you can quickly send, sign, and manage documents on the go. This efficiency leads to faster transactions and happier clients.

-

Is there a mobile app for Specialty Services Contact Self Employed users?

Yes, airSlate SignNow offers a mobile app specifically designed for Specialty Services Contact Self Employed users. The app allows you to send and eSign documents right from your smartphone, ensuring that you stay productive while on the go. You can manage your documents anytime, anywhere.

-

What integrations are available for Specialty Services Contact Self Employed?

airSlate SignNow integrates seamlessly with a variety of popular applications, making it a great choice for Specialty Services Contact Self Employed. You can connect with tools such as Google Drive, Dropbox, and Salesforce to enhance your workflow. These integrations allow for streamlined processes and better data management.

-

How secure is my data with airSlate SignNow for Specialty Services Contact Self Employed?

Data security is a priority for airSlate SignNow, especially for Specialty Services Contact Self Employed. The platform utilizes military-grade encryption to protect your documents and ensure safe eSigning. Additionally, compliance with regulations such as GDPR helps keep your sensitive information secure.

-

Can I customize templates for my Specialty Services Contact Self Employed needs?

Absolutely! airSlate SignNow allows you to customize templates to meet your specific needs as a Specialty Services Contact Self Employed. You can create documents that reflect your business branding and incorporate necessary fields for signatures, dates, and more, enhancing your professional image.

Get more for Specialty Services Contact Self Employed

- Marijuana business llc questionnaire form

- Employee electric vehicle charging application state of form

- Oregon deq waste tire carrier permit renewal application deq state or form

- Oregon business change in status form

- Facility and on street permit application city of salem cityofsalem form

- Employee electric vehicle charging application print oregon form

- Foreign limited liability company oregon secretary of state form

- Individual history form oregongov

Find out other Specialty Services Contact Self Employed

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe