Form it 214, Claim for Real Property Tax Credit

What is the Form IT 214, Claim For Real Property Tax Credit

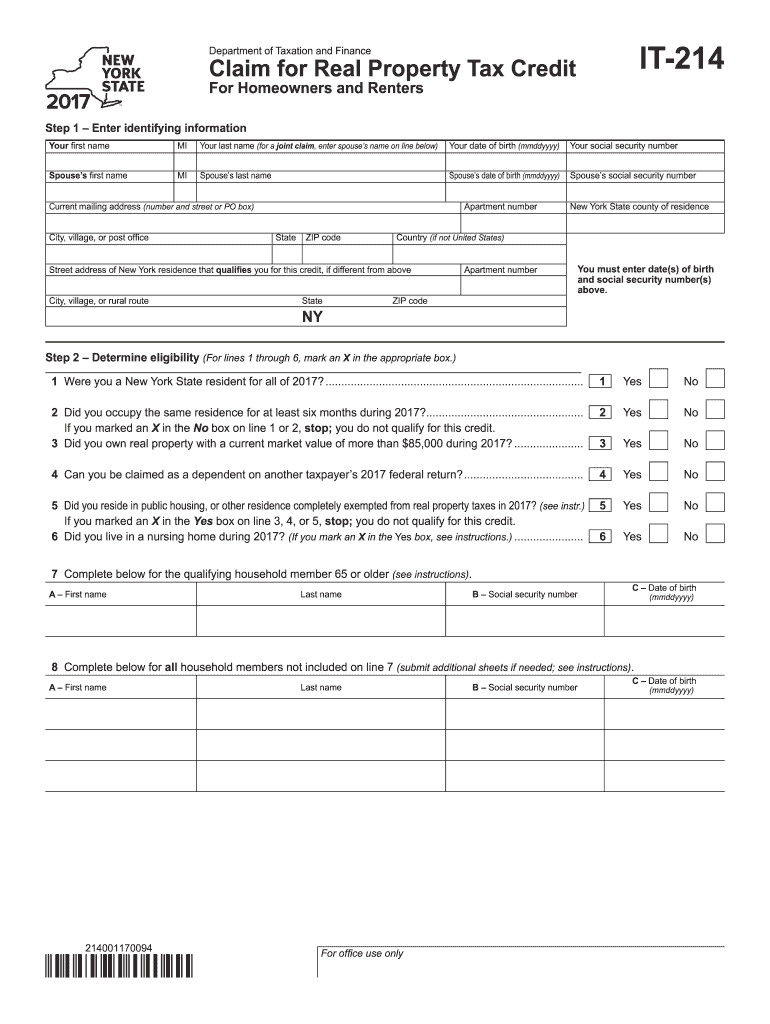

The Form IT 214 is a tax document used in New York State to claim a Real Property Tax Credit. This form is primarily designed for tenants and homeowners who meet specific eligibility criteria, including income limits and residency requirements. The tax credit is available to individuals and families with a gross household income of less than $200,000 per year and, in some cases, a household gross pay of $18,000 or less. Depending on the age of the tenants, the credit amount can vary, providing financial relief to those who qualify.

Steps to complete the Form IT 214, Claim For Real Property Tax Credit

Completing the Form IT 214 involves several key steps to ensure accuracy and compliance. First, gather all necessary identifying information, including names and addresses. Next, determine your eligibility by answering questions related to your residency status, property ownership, and any dependents claimed on another taxpayer's federal return. After confirming eligibility, calculate your household gross pay by summing all income sources, including social security benefits and pensions. Finally, calculate your total property charges, such as rent paid, to determine the amount of credit you may claim.

Eligibility Criteria

To qualify for the Form IT 214, applicants must meet specific criteria. You must be a resident of New York for at least six months during the tax year. Additionally, you should have owned property with a market value exceeding $85,000 or have been a tenant in a rental property. Income thresholds apply, with a gross household income of less than $200,000 being a primary requirement. If you are a tenant under the age of 65, your credit may be limited to $75, while tenants aged 65 and older may qualify for a credit of up to $375.

How to obtain the Form IT 214, Claim For Real Property Tax Credit

The Form IT 214 can be obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be printed and filled out by hand. Additionally, the form may be accessible at local tax offices or libraries. Ensure you have the most current version of the form to avoid any issues during submission.

Required Documents

When completing the Form IT 214, certain documents are necessary to support your claim. You will need proof of residency, such as a driver's license or utility bills, and documentation of income, including pay stubs or tax returns. If applicable, gather records of any property ownership or rental agreements. Having these documents ready will facilitate a smoother application process and help ensure accuracy in your submission.

Form Submission Methods

The completed Form IT 214 can be submitted in several ways. You can file it online through the New York State Department of Taxation and Finance e-filing system, which offers a convenient method for tax submission. Alternatively, you may choose to mail the form to the appropriate tax office or submit it in person at a local tax office. Be sure to check the specific submission guidelines to ensure compliance with state requirements.

Quick guide on how to complete form it 214 claim for real property tax credit

Complete Form IT 214, Claim For Real Property Tax Credit effortlessly on any device

Online document management has gained traction among enterprises and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed papers, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without lag. Manage Form IT 214, Claim For Real Property Tax Credit on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form IT 214, Claim For Real Property Tax Credit without any hassle

- Find Form IT 214, Claim For Real Property Tax Credit and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form IT 214, Claim For Real Property Tax Credit and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

If you played one of those $10,000 a spin slot machines in Vegas would that mean that anytime it won anything even one credit I would still have to fill out a tax form?

Yes, although they can set the machine to accumulated credit mode, and a staffer will sit by recording each jackpot on a form, then quickly resetting the machine so it’s ready to go again. You get a single W2G at the end of the session.It’s close to impossible to play extremely high-limit machines at any decent speed by feeding it currency and stopping for traditional hand-pays.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the form it 214 claim for real property tax credit

How to create an eSignature for your Form It 214 Claim For Real Property Tax Credit in the online mode

How to make an electronic signature for your Form It 214 Claim For Real Property Tax Credit in Chrome

How to generate an electronic signature for putting it on the Form It 214 Claim For Real Property Tax Credit in Gmail

How to make an electronic signature for the Form It 214 Claim For Real Property Tax Credit from your smartphone

How to create an electronic signature for the Form It 214 Claim For Real Property Tax Credit on iOS devices

How to create an electronic signature for the Form It 214 Claim For Real Property Tax Credit on Android devices

People also ask

-

What is Form IT 214, Claim For Real Property Tax Credit?

Form IT 214, Claim For Real Property Tax Credit, is a specific form used by property owners in New York to claim a credit on their real property taxes. This form helps taxpayers receive financial relief by providing a tax credit based on their property taxes paid. Completing this form accurately is essential to ensure you receive the benefits you qualify for.

-

How can airSlate SignNow help with Form IT 214, Claim For Real Property Tax Credit?

airSlate SignNow streamlines the process of completing and submitting Form IT 214, Claim For Real Property Tax Credit. Our platform allows you to easily fill out the form online and eSign it, ensuring your submission is both quick and secure. Additionally, you can track the status of your form to confirm that it has been processed.

-

Is there a cost to use airSlate SignNow for Form IT 214, Claim For Real Property Tax Credit?

airSlate SignNow offers a cost-effective solution for managing your documents, including Form IT 214, Claim For Real Property Tax Credit. While we provide a free trial, our subscription plans are designed to fit various budgets, ensuring you only pay for the features you need. Check our pricing page for more details.

-

What features does airSlate SignNow provide for managing Form IT 214, Claim For Real Property Tax Credit?

With airSlate SignNow, you benefit from features like easy document creation, eSigning, and real-time collaboration when working on Form IT 214, Claim For Real Property Tax Credit. Our platform also allows you to store your documents securely, integrate with other applications, and access templates to simplify the process.

-

Can I integrate airSlate SignNow with other applications for Form IT 214, Claim For Real Property Tax Credit?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for Form IT 214, Claim For Real Property Tax Credit. Whether you use CRMs, cloud storage, or productivity tools, our platform can connect with them to streamline your document management process. This integration helps you access all your tools in one place.

-

What are the benefits of using airSlate SignNow for Form IT 214, Claim For Real Property Tax Credit?

Using airSlate SignNow for Form IT 214, Claim For Real Property Tax Credit offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our easy-to-use interface allows you to complete forms quickly, while eSigning ensures that your documents are legally binding. Additionally, our platform saves you time and reduces the risk of errors.

-

Is it safe to eSign Form IT 214, Claim For Real Property Tax Credit with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to ensure that your eSigning of Form IT 214, Claim For Real Property Tax Credit is safe and secure. We use encryption and secure storage solutions to protect your personal information and documents, giving you peace of mind while signing.

Get more for Form IT 214, Claim For Real Property Tax Credit

Find out other Form IT 214, Claim For Real Property Tax Credit

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now