Self Employed Contract Form

What is the self employed contract?

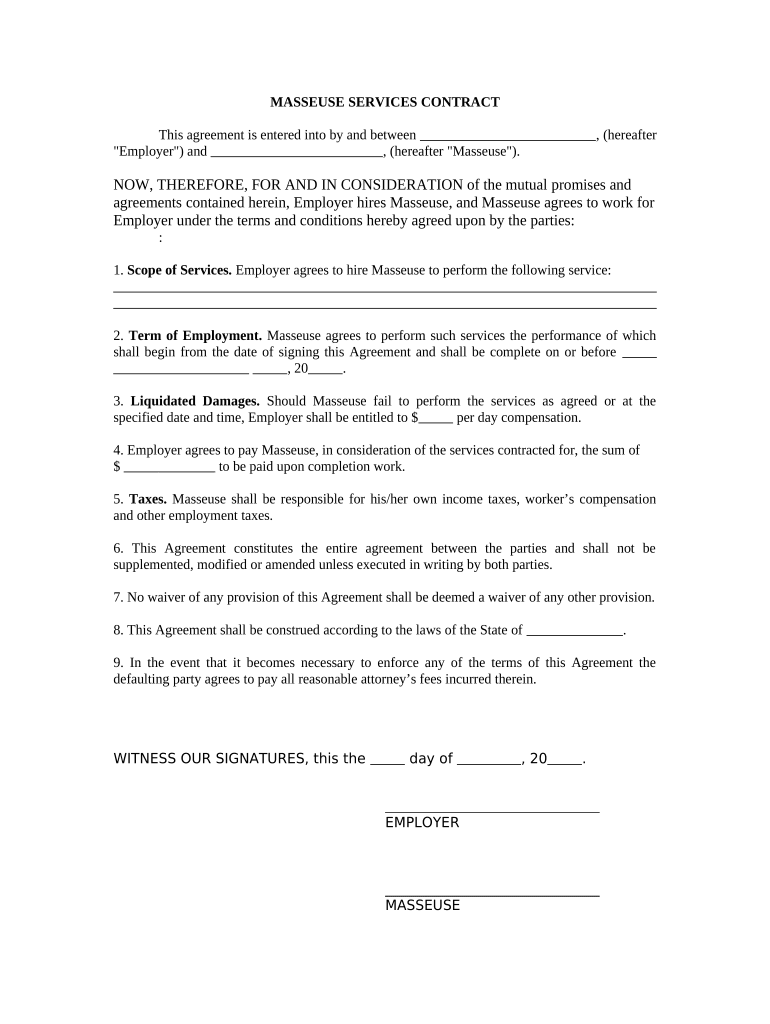

A self employed contract is a formal agreement between a self-employed individual and a client or business. This document outlines the terms of the working relationship, including the scope of work, payment terms, deadlines, and other essential details. It serves to protect both parties by clearly defining expectations and responsibilities. Having a well-structured self employed contract can help prevent misunderstandings and disputes, ensuring a smoother working relationship.

Key elements of the self employed contract

When creating a self employed contract, several key elements should be included to ensure clarity and legality:

- Parties involved: Clearly state the names and addresses of both the self-employed individual and the client.

- Scope of work: Define the specific services to be provided, including any deliverables and deadlines.

- Payment terms: Outline how and when payments will be made, including rates, invoicing procedures, and any additional expenses.

- Duration of the contract: Specify the start date and end date of the agreement, or state if it is ongoing.

- Termination clause: Include conditions under which either party can terminate the contract.

- Confidentiality agreement: If applicable, outline any confidentiality requirements to protect sensitive information.

- Governing law: Indicate which state’s laws will govern the contract in case of disputes.

Steps to complete the self employed contract

Completing a self employed contract involves several important steps to ensure it is effective and legally binding:

- Draft the contract: Use a self employed contract template to create a draft, ensuring all key elements are included.

- Review the terms: Both parties should carefully review the terms to ensure mutual understanding and agreement.

- Make necessary revisions: Discuss any changes or adjustments needed before finalizing the document.

- Sign the contract: Both parties should sign the contract, either physically or electronically, to make it legally binding.

- Distribute copies: Provide each party with a signed copy of the contract for their records.

Legal use of the self employed contract

To ensure the self employed contract is legally valid, it must adhere to specific legal requirements. In the United States, electronic signatures are recognized as valid under the ESIGN Act and UETA, provided that both parties consent to use electronic means. It is essential to use a reliable eSignature solution that complies with these laws, ensuring that the contract holds up in legal contexts. Additionally, both parties should retain copies of the signed contract for future reference.

How to obtain the self employed contract

Obtaining a self employed contract can be straightforward. Many online resources offer customizable templates that can be tailored to fit specific needs. When selecting a template, consider the following:

- Ensure the template covers all necessary elements relevant to the specific type of work.

- Look for templates that include clauses for confidentiality, termination, and payment terms.

- Verify that the template complies with local laws and regulations.

Once a suitable template is chosen, it can be filled out and customized to reflect the agreement between the parties involved.

Examples of using the self employed contract

Self employed contracts can be utilized in various scenarios, including:

- A freelance graphic designer working with a client on a branding project.

- A consultant providing advisory services to a business.

- A writer engaged to produce content for a website or publication.

- A contractor hired for home renovation projects.

In each case, a self employed contract helps to clarify the expectations and responsibilities of both the self-employed individual and the client, reducing the risk of disputes and enhancing professional relationships.

Quick guide on how to complete self employed contract

Complete Self Employed Contract effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly solution to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Self Employed Contract on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Self Employed Contract seamlessly

- Locate Self Employed Contract and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Self Employed Contract while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a self employed contract template?

A self employed contract template is a pre-formatted document designed to establish the terms and conditions between a freelancer or contractor and a client. This template helps clarify roles, responsibilities, payment terms, and deliverables. Using a self employed contract template ensures both parties are on the same page, reducing the risk of misunderstandings.

-

How can airSlate SignNow help with self employed contract templates?

airSlate SignNow provides a user-friendly platform for creating, customizing, and signing self employed contract templates. Our tools enable users to easily fill in necessary details and obtain electronic signatures securely. This streamlines the contracting process, allowing self-employed individuals to focus on their work rather than paperwork.

-

Are there any costs associated with using self employed contract templates on SignNow?

airSlate SignNow offers various pricing plans that include access to self employed contract templates. While there are free options available, premium plans provide additional features like advanced editing, integrations, and enhanced security. Evaluate our pricing options to find the best fit for your business needs.

-

Can I customize a self employed contract template on airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize self employed contract templates to meet your specific requirements. You can modify text, add clauses, and insert your branding elements. This flexibility ensures that your contract reflects your unique business practices and agreements.

-

What features does airSlate SignNow offer for self employed contract templates?

airSlate SignNow offers essential features for self employed contract templates, including eSigning, document sharing, and real-time collaboration. Our platform also provides templates for various professions, secure storage, and audit trails. These features enhance the efficiency of managing contracts for self-employed individuals.

-

Is airSlate SignNow compatible with other software tools?

Yes, airSlate SignNow integrates with various software tools commonly used by self-employed professionals, such as CRM systems and accounting software. This integration allows for streamlined workflows and better management of contracts. You can easily connect your existing tools to enhance your productivity.

-

How secure is my self employed contract template in airSlate SignNow?

Security is a top priority for airSlate SignNow. Our platform ensures that your self employed contract templates are protected with encryption and secure access controls. Additionally, we provide audit trails to track any changes, giving you peace of mind that your documents are safe and compliant with industry standards.

Get more for Self Employed Contract

- Disclosure of investment activities in iran form new jersey

- Form cms 1 mn ampquotrequest for conciliation conferenceampquot new york

- Property tax payment agreement request 2020 2021 fill form

- Nj division of taxation employer payroll tax form

- Real property income and expense rpie nyc businesswhat you need to know about the real property income and real property income form

- Pub 172 annual w 2 1099 r 1099 misc 1099 nec and form

- Wwwloopnetcom65 court street brooklyn ny65 court street brooklyn ny 11201 restaurant for lease form

- Form st 100 att new york state and local quarterly sales and use tax credit worksheet revised 921

Find out other Self Employed Contract

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now