Limited Partnership Form

What is the limited partnership?

A limited partnership is a business structure that consists of at least one general partner and one limited partner. The general partner manages the business and is personally liable for its debts, while the limited partner contributes capital and shares profits but has limited liability, meaning they are only responsible for the debts of the partnership to the extent of their investment. This structure is often used in real estate, investment funds, and other ventures where investors prefer limited involvement in management.

Key elements of the limited partnership

Several key elements define a limited partnership:

- General Partner: Responsible for the day-to-day operations and has unlimited liability.

- Limited Partner: Provides capital and shares in profits but does not participate in management, limiting their liability.

- Partnership Agreement: A legal document that outlines the rights and responsibilities of each partner, profit-sharing arrangements, and other operational guidelines.

- Registration: Limited partnerships must be registered with the state to obtain legal recognition.

Steps to complete the limited partnership

Completing a limited partnership involves several steps:

- Choose a Business Name: Select a unique name that complies with state regulations.

- Draft a Partnership Agreement: Create a detailed agreement outlining the roles, responsibilities, and profit-sharing between partners.

- File Registration Documents: Submit the necessary forms to the appropriate state agency, typically the Secretary of State.

- Obtain Necessary Licenses: Check for any local or state licenses required to operate legally.

Legal use of the limited partnership

The limited partnership structure is legally recognized in the United States, provided it complies with state laws. It is essential to adhere to the terms outlined in the partnership agreement and maintain proper records to ensure the limited partnership operates within legal boundaries. This includes filing annual reports and tax returns as required by state regulations.

Required documents

To establish a limited partnership, several documents are typically required:

- Partnership Agreement: Details the relationship between partners.

- Certificate of Limited Partnership: Official registration document filed with the state.

- Tax Identification Number (TIN): Required for tax purposes.

- Operating Licenses: Depending on the business type and location.

State-specific rules for the limited partnership

Each state has its own regulations governing limited partnerships. These rules can affect the formation process, required documentation, and ongoing compliance obligations. It is crucial to consult state-specific guidelines to ensure adherence to local laws and regulations. This may include variations in filing fees, renewal requirements, and specific disclosures that must be made in the partnership agreement.

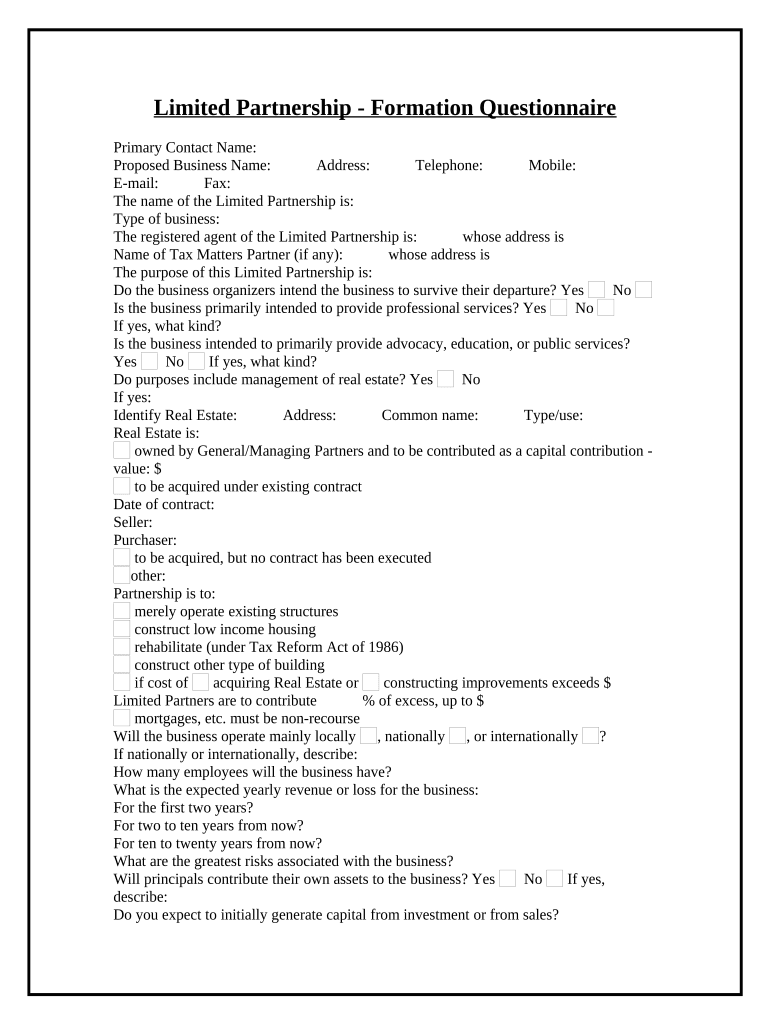

Quick guide on how to complete limited partnership 497426835

Complete Limited Partnership effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without unnecessary waits. Manage Limited Partnership on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The simplest method to edit and eSign Limited Partnership with ease

- Locate Limited Partnership and click on Get Form to initiate the process.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools provided by airSlate SignNow specifically for this function.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form: via email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Limited Partnership and maintain exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a limited partnership and how can airSlate SignNow help?

A limited partnership is a business structure that involves at least one general partner and one limited partner. airSlate SignNow facilitates the management of limited partnership agreements by providing an easy-to-use platform for eSigning and sending documents efficiently, ensuring that all partners can access and sign important documents from anywhere.

-

Is airSlate SignNow cost-effective for managing limited partnership agreements?

Yes, airSlate SignNow offers a cost-effective solution for businesses managing limited partnership agreements. With various pricing plans tailored to different needs, it allows businesses to streamline their document processes without breaking the bank, making it a smart choice for partnership management.

-

What features does airSlate SignNow offer specifically for limited partnerships?

airSlate SignNow provides features that are beneficial for limited partnerships, including custom templates for partnership agreements, automated reminders for signatures, and a secure document storage system. These features simplify the management of legal documents and enhance collaboration between partners.

-

Can I integrate airSlate SignNow with other tools for my limited partnership?

Absolutely, airSlate SignNow offers robust integrations with popular tools like Salesforce, Google Drive, and Microsoft Office. This allows businesses managing limited partnerships to seamlessly connect their workflows and manage documents efficiently across different platforms.

-

How does airSlate SignNow ensure the security of my limited partnership documents?

AirSlate SignNow prioritizes the security of your limited partnership documents with features like end-to-end encryption, two-factor authentication, and compliance with major regulations such as GDPR and HIPAA. This ensures that sensitive information related to your limited partnership remains protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for a limited partnership?

Using airSlate SignNow for a limited partnership brings multiple benefits, including faster turnaround times for document signing, enhanced accessibility for all partners, and reduced paper waste. These advantages contribute to increased efficiency and better collaboration among partners.

-

Is it easy to manage limited partnership documents with airSlate SignNow?

Yes, airSlate SignNow is designed to be user-friendly, making it easy to manage limited partnership documents. Its intuitive interface allows users to create, send, and track documents effortlessly, ensuring that managing a limited partnership is straightforward.

Get more for Limited Partnership

- 2018 pierpont community technical college independent verification worksheet form

- 2018 pierpont community technical college dependent verification worksheet form

- 2019 ccac work study application form

- Pcmac time clock change request form

- Psychotropic medications judicial reference guidepsychotropic medications judicial reference guide0600 51410 psychotropic form

- Gc 335a attachment to form gc 335 capacity declarationconservatorship only for proposed conservatee with a major neurocognitive

- Get the iowa medicaid enterprise iowa department of form

- How can i unlock jiofi for using other sim cards form

Find out other Limited Partnership

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement