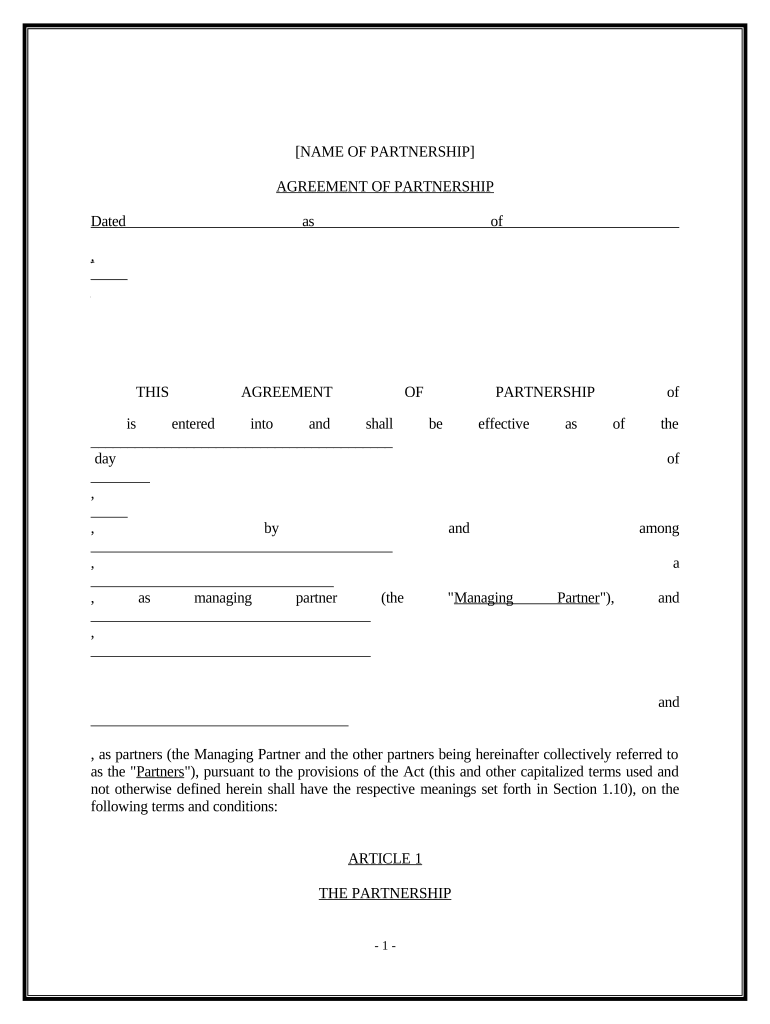

Estate Partnership Form

What is the estate partnership?

An estate partnership is a legal arrangement where two or more individuals collaborate to manage and distribute assets after one partner's death. This partnership can encompass various types of assets, including real estate, investments, and personal property. The primary purpose of establishing an estate partnership is to ensure a smooth transition of assets while minimizing potential disputes among heirs. Each partner typically has defined rights and responsibilities, which may include decision-making authority and financial contributions. Understanding the structure of an estate partnership is essential for effective estate planning.

Steps to complete the estate partnership

Completing an estate partnership involves several important steps to ensure that all legal requirements are met. Here are the key steps:

- Define the partnership terms: Clearly outline the roles, responsibilities, and contributions of each partner.

- Draft a partnership agreement: Create a formal document that details the terms of the partnership, including asset management and distribution upon the death of a partner.

- Obtain necessary legal advice: Consult with an attorney specializing in estate planning to ensure compliance with state laws.

- Sign the agreement: All partners must sign the partnership agreement, often in the presence of a notary public for added legal validity.

- File any required documents: Depending on state regulations, you may need to file the partnership agreement with local authorities.

Legal use of the estate partnership

The legal use of an estate partnership is crucial for ensuring that the partnership operates within the framework of the law. This includes adherence to state-specific regulations regarding estate planning and asset distribution. Legal recognition of the estate partnership allows for the efficient transfer of assets without the need for probate, which can be time-consuming and costly. Additionally, a properly executed estate partnership can provide tax benefits, such as avoiding estate taxes on assets transferred to surviving partners. It is essential to keep the partnership agreement updated to reflect any changes in laws or personal circumstances.

Key elements of the estate partnership

Several key elements define an estate partnership, making it distinct from other forms of partnerships. These elements include:

- Partnership Agreement: A formal document that outlines the terms, roles, and responsibilities of each partner.

- Asset Management: Clear guidelines on how assets will be managed during the partnership and how they will be distributed after a partner's death.

- Decision-Making Process: Established procedures for making decisions related to the partnership's assets and operations.

- Duration: Specification of whether the partnership is intended to be temporary or ongoing.

Examples of using the estate partnership

Estate partnerships can be beneficial in various scenarios. For instance:

- A couple may establish an estate partnership to manage their shared assets, ensuring that both partners have equal say in decisions regarding their property.

- Two siblings might create an estate partnership to manage their inherited family business, allowing for joint decision-making and profit-sharing.

- A group of friends may form an estate partnership to co-own a vacation property, outlining how expenses and profits will be shared.

Eligibility criteria

To establish an estate partnership, certain eligibility criteria must be met. Generally, the partners must:

- Be of legal age, typically eighteen years or older, to enter into a binding agreement.

- Have the legal capacity to manage assets, meaning they are not under guardianship or facing legal restrictions.

- Agree on the terms of the partnership and sign the partnership agreement voluntarily.

Quick guide on how to complete estate partnership

Complete Estate Partnership effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It presents a superb eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the resources you need to generate, modify, and eSign your documents quickly without interruptions. Manage Estate Partnership on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Estate Partnership with ease

- Retrieve Estate Partnership and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign Estate Partnership and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an estate partnership and how can airSlate SignNow assist with it?

An estate partnership refers to a collaborative arrangement between individuals aiming to manage and distribute an estate efficiently. airSlate SignNow offers a user-friendly platform that simplifies the document signing process involved in estate partnerships, ensuring all parties can execute necessary agreements swiftly and securely.

-

How does airSlate SignNow ensure the security of estate partnership documents?

Security is paramount when handling estate partnership documents. airSlate SignNow employs advanced encryption protocols and strict access controls to safeguard sensitive information, allowing users to sign and share documents with confidence.

-

What features does airSlate SignNow offer specifically for estate partnerships?

airSlate SignNow provides features like customizable templates, automated reminders, and easy collaboration tools that enhance the efficiency of document management in estate partnerships. These features help streamline the process and reduce the time spent on administrative tasks.

-

Is there a cost associated with using airSlate SignNow for estate partnerships?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. These plans are designed to provide cost-effective solutions for managing estate partnerships, ensuring you receive value for your investment while gaining access to essential features.

-

Can airSlate SignNow integrate with other tools used in estate partnerships?

Absolutely, airSlate SignNow seamlessly integrates with popular tools and applications commonly used in estate partnership management. This ensures that you can streamline workflows and enhance productivity by connecting your existing systems with our eSigning platform.

-

What are the benefits of using airSlate SignNow for estate partnership documentation?

By using airSlate SignNow for estate partnership documentation, you benefit from increased efficiency, improved accuracy, and enhanced collaboration. The platform expedites the signing process, allowing all parties involved in the estate partnership to focus more on strategic decisions rather than paperwork.

-

How easy is it to get started with airSlate SignNow for estate partnerships?

Getting started with airSlate SignNow for estate partnerships is incredibly straightforward. You can sign up for an account, choose a suitable pricing plan, and start uploading your documents in minutes, making it an ideal solution for busy professionals.

Get more for Estate Partnership

- Hospice referral form template

- Cal south pro odp cal south form

- Application for food facility permit stanislaus county form

- 601 university drive jck 240 finaid txstate form

- The essential estate planning questionnairequiz provides form

- Participant information form untamed path adventures

- Patient death reporting form

- Fall 20 application california state university sacramento form

Find out other Estate Partnership

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free