Living Trust Property Record Utah Form

What is the Living Trust Property Record Utah

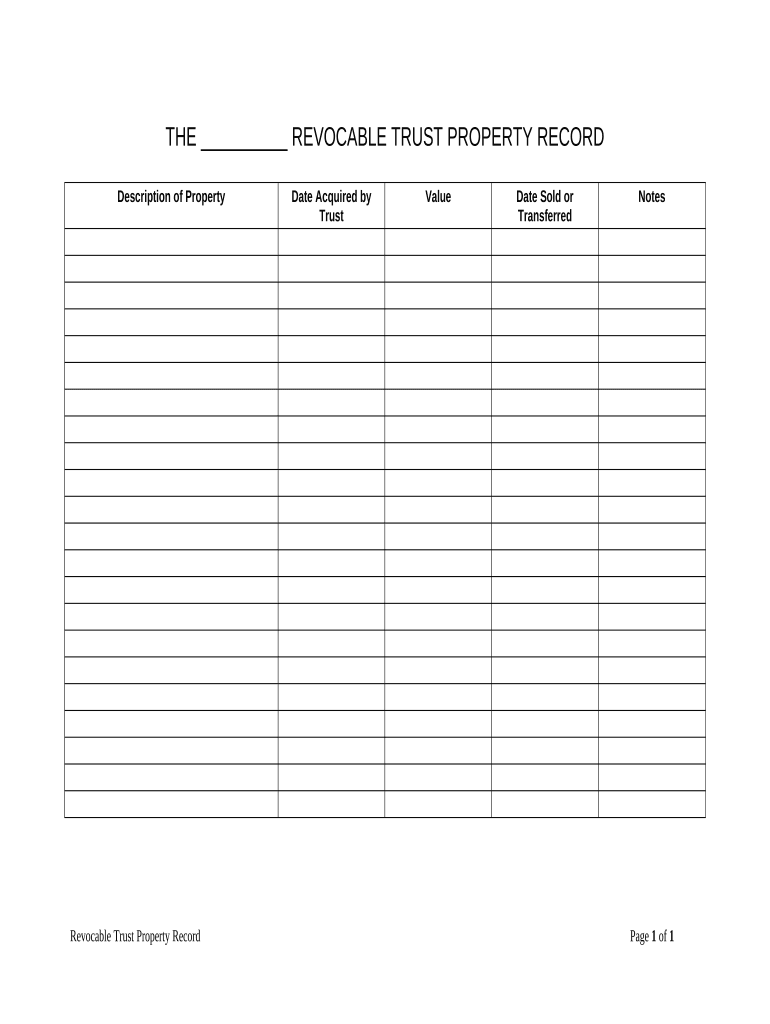

The Living Trust Property Record in Utah is a legal document that outlines the assets held within a living trust. This record serves to clarify the ownership and management of property during the grantor's lifetime and after their passing. It is essential for ensuring that the assets are distributed according to the grantor's wishes, avoiding probate, and providing a clear directive for the management of the trust. This document typically includes details such as the names of the trust beneficiaries, a description of the assets, and the terms of the trust.

How to use the Living Trust Property Record Utah

Using the Living Trust Property Record in Utah involves several key steps. First, gather all necessary information about the assets you wish to include in the trust. This may consist of real estate, bank accounts, investments, and personal property. Next, complete the Living Trust Property Record form accurately, ensuring that all details are correct and comprehensive. Once the form is filled out, it should be signed in accordance with Utah state laws, which may require notarization. Finally, keep the completed document in a safe place and inform beneficiaries about its location and contents.

Steps to complete the Living Trust Property Record Utah

Completing the Living Trust Property Record in Utah involves a systematic approach:

- Gather all relevant information about your assets.

- Obtain the Living Trust Property Record form from a reliable source.

- Fill in the form with accurate details, including asset descriptions and beneficiary information.

- Review the completed form for any errors or omissions.

- Sign the form in the presence of a notary public, if required.

- Store the signed document securely and inform relevant parties.

Legal use of the Living Trust Property Record Utah

The Living Trust Property Record is legally binding in Utah when executed properly. It provides a clear framework for asset management and distribution, which can prevent disputes among heirs. To ensure its legal standing, the document must comply with state laws, including proper signing and notarization. Additionally, it is advisable to keep the record updated as assets change or new beneficiaries are added to the trust.

State-specific rules for the Living Trust Property Record Utah

Utah has specific regulations governing the creation and use of living trusts. These include requirements for the documentation of assets, the necessary signatures, and the potential need for notarization. It is important to familiarize yourself with these rules to ensure compliance. Furthermore, Utah law allows for the revocation or amendment of living trusts, which should be documented to maintain clarity and legality.

Who Issues the Form

The Living Trust Property Record in Utah is typically not issued by a specific governmental agency. Instead, individuals can obtain the form from legal professionals, online legal resources, or estate planning services. It is advisable to consult with an attorney specializing in estate planning to ensure that the form meets all legal requirements and adequately reflects the individual's intentions.

Quick guide on how to complete living trust property record utah

Complete Living Trust Property Record Utah effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle Living Trust Property Record Utah on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-centric process today.

How to modify and electronically sign Living Trust Property Record Utah with ease

- Find Living Trust Property Record Utah and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all the details and then click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Banish the worry of lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your selected device. Alter and electronically sign Living Trust Property Record Utah and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Utah?

A Living Trust Property Record in Utah is a legal document that outlines the assets held in a living trust and specifies how those assets are to be managed and distributed. This record ensures that your property is properly handled upon your passing, helping your beneficiaries avoid probate. Understanding this document is crucial for effective estate planning.

-

How can airSlate SignNow assist with my Living Trust Property Record in Utah?

airSlate SignNow provides a seamless platform to create, send, and eSign your Living Trust Property Record in Utah. Our user-friendly interface makes it easy to manage your trust documents, ensuring they are secure and compliant with state requirements. With our solution, you can streamline the process of documenting your living trust.

-

What are the pricing options for using airSlate SignNow for Living Trust Property Record in Utah?

airSlate SignNow offers flexible pricing plans to accommodate various needs when managing your Living Trust Property Record in Utah. Our plans are cost-effective, allowing you to choose one that fits your budget and requirements. You can even take advantage of a free trial to explore our features before making a commitment.

-

Is airSlate SignNow compliant with Utah state laws for Living Trust Property Records?

Yes, airSlate SignNow is designed to be compliant with Utah state laws regarding Living Trust Property Records. Our platform is updated regularly to ensure all documents meet legal standards, giving you peace of mind when managing important estate planning documents. Always consult with a legal professional for specific advice related to your situation.

-

What features does airSlate SignNow offer for managing Living Trust Property Records in Utah?

Our platform offers a range of features for effectively managing Living Trust Property Records in Utah, including cloud storage, secure eSignature capability, and customizable templates. These tools help ensure your documents are organized and easily accessible. Additionally, airSlate SignNow enables you to track document progress and sign status, facilitating a smooth experience.

-

Can I integrate airSlate SignNow with other tools for managing my Living Trust Property Record in Utah?

Yes, airSlate SignNow offers integrations with many productivity and document management tools. This allows you to easily synchronize your Living Trust Property Record in Utah with other applications you may already be using. Our integrations enhance workflow efficiency and help you manage your estate planning documents more effectively.

-

How does electronic signing work for my Living Trust Property Record in Utah?

Electronic signing with airSlate SignNow is simple and secure for your Living Trust Property Record in Utah. Once your document is prepared, you can send it to designated signers, who can eSign it from any device. This eliminates the need for physical paperwork and allows for a faster, more convenient way to finalize important documents.

Get more for Living Trust Property Record Utah

Find out other Living Trust Property Record Utah

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip