Utah Trust Form

What is the Utah Trust

The Utah Trust is a legal arrangement that allows individuals to manage their assets while providing benefits to designated beneficiaries. This type of trust is commonly used for estate planning, asset protection, and tax efficiency. It enables the trustor, or creator of the trust, to dictate how their assets will be distributed after their passing, ensuring that their wishes are honored. Trusts can be revocable or irrevocable, with revocable trusts allowing the trustor to make changes during their lifetime, while irrevocable trusts generally cannot be altered once established.

How to Use the Utah Trust

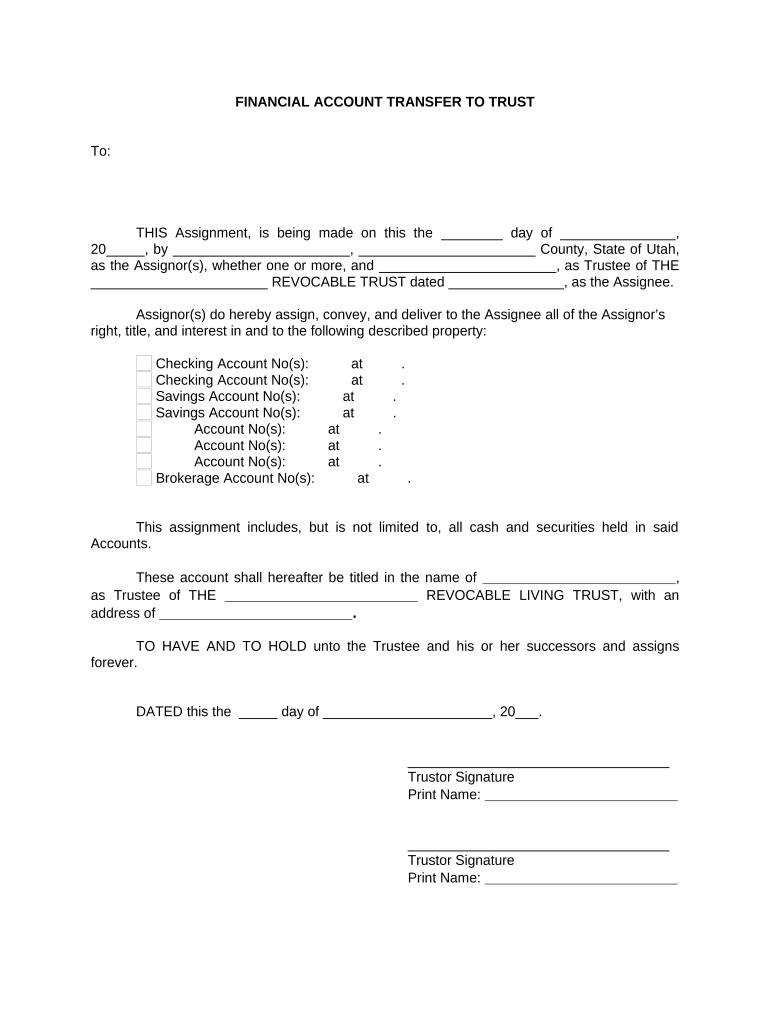

Using the Utah Trust involves several steps, including drafting the trust document, transferring assets into the trust, and appointing a trustee to manage the trust. The trust document outlines the terms of the trust, including the beneficiaries and how assets should be distributed. Once the document is finalized, the trustor must transfer ownership of their assets to the trust, which may include real estate, bank accounts, or investments. Appointing a reliable trustee is crucial, as this individual will be responsible for managing the trust according to its terms.

Steps to Complete the Utah Trust

Completing the Utah Trust requires careful attention to detail. The following steps outline the process:

- Draft the trust document: Clearly outline the terms, including beneficiaries and trustee responsibilities.

- Transfer assets: Change the title of assets to reflect the trust's ownership.

- Sign the document: Ensure that the trust document is signed in accordance with Utah state laws, which may require notarization.

- Maintain records: Keep detailed records of all transactions and communications related to the trust.

Legal Use of the Utah Trust

The legal use of the Utah Trust is governed by state law, which outlines the requirements for creating and maintaining a trust. Trusts can be used for various purposes, including avoiding probate, minimizing estate taxes, and protecting assets from creditors. It is essential to comply with Utah laws to ensure that the trust remains valid and enforceable. Legal counsel is often recommended to navigate the complexities of trust law and to ensure that all legal requirements are met.

Key Elements of the Utah Trust

Several key elements define the Utah Trust, including:

- Trustor: The individual who creates the trust.

- Trustee: The person or institution responsible for managing the trust's assets.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Trust document: The legal document that outlines the terms and conditions of the trust.

Eligibility Criteria

To establish a Utah Trust, the trustor must meet specific eligibility criteria, including being of legal age and having the mental capacity to create a trust. There are no residency requirements for the trustor, but the trust must be governed by Utah law. Additionally, the trustor should have clear intentions regarding the distribution of their assets and must comply with any applicable state regulations when drafting the trust document.

Quick guide on how to complete utah trust 497427648

Finish Utah Trust effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Utah Trust on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based workflow today.

How to edit and eSign Utah Trust with ease

- Find Utah Trust and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Utah Trust to guarantee excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Utah trust and how can it benefit my business?

A Utah trust is a legal arrangement that allows individuals to manage their assets while enjoying tax benefits and protections. By utilizing a Utah trust, businesses can secure their assets against creditors, reduce taxes, and ensure smooth succession planning. Leveraging airSlate SignNow can simplify the eSigning process for trust documents.

-

How much does it cost to set up a Utah trust?

The cost of setting up a Utah trust varies depending on the complexity of the trust and the legal services needed. Typically, fees can range from a few hundred to several thousand dollars. With airSlate SignNow, you can save money and time by easily managing trust documents digitally.

-

Can airSlate SignNow integrate with my existing financial software for managing a Utah trust?

Yes, airSlate SignNow offers seamless integrations with various financial software, enhancing your ability to manage a Utah trust effectively. This connectivity allows you to streamline document management and ensure that all trust-related paperwork is organized and easily accessible. Integrating these tools can save you time and reduce errors.

-

What types of documents are involved in creating a Utah trust?

Creating a Utah trust typically involves drafting a trust agreement, a certificate of trust, and possibly a power of attorney. These documents outline the terms and conditions of the trust and dictate how assets should be managed. Using airSlate SignNow simplifies the signing process, making document completion quick and efficient.

-

Are there tax benefits to using a Utah trust?

Yes, a Utah trust can offer several tax advantages, including reduced estate taxes and potential income tax benefits. By sheltering assets within a trust, individuals can manage their tax liability more effectively. airSlate SignNow helps facilitate the signing of necessary tax documents to maximize these benefits.

-

How does airSlate SignNow enhance the process of managing a Utah trust?

airSlate SignNow enhances the management of a Utah trust by providing an easy-to-use platform for eSigning and sending crucial documents securely. With features like document templates, automated workflows, and mobile access, you can manage your trust effectively from anywhere. This efficiency helps streamline operations and improves overall trust management.

-

Is it necessary to hire a lawyer to set up a Utah trust?

While it isn't strictly necessary to hire a lawyer to set up a Utah trust, it is highly recommended to ensure that all legal requirements are met and that your documents are correctly drafted. A professional can help navigate complex legalities and prevent costly mistakes. Utilizing airSlate SignNow can complement this process by simplifying digital document handling.

Get more for Utah Trust

Find out other Utah Trust

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking