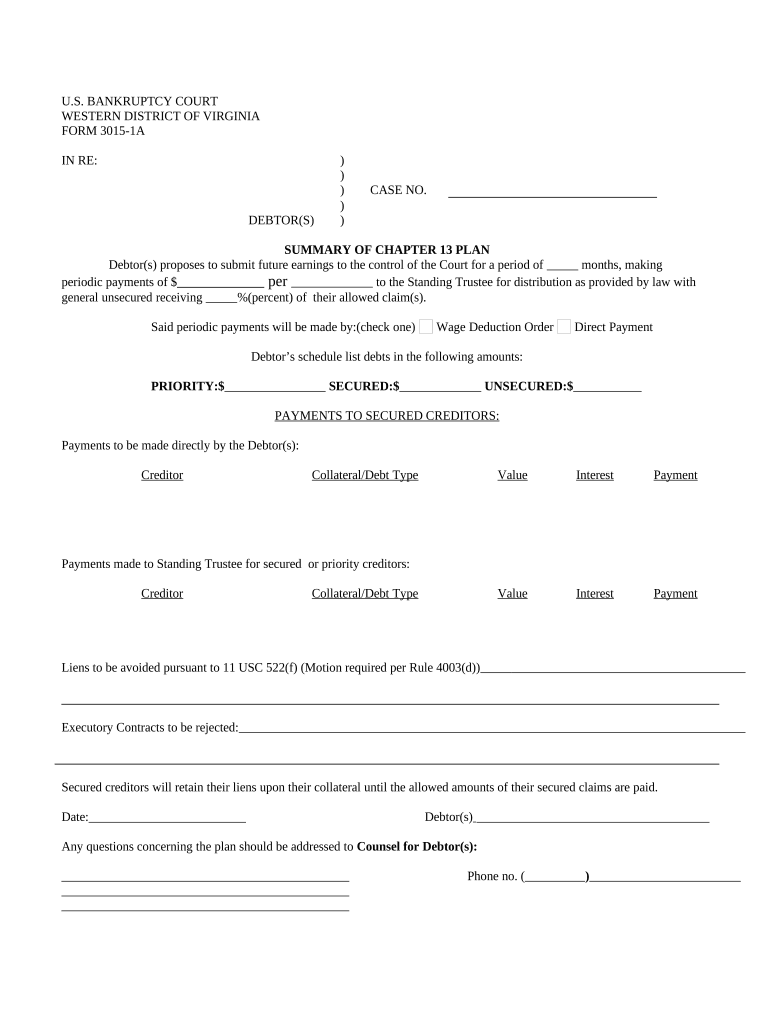

Chapter 13 Plan Form

What is the Chapter 13 Plan

The Chapter 13 Plan is a legal framework that allows individuals to reorganize their debts and create a manageable repayment plan over a period of three to five years. This plan is designed for individuals with a regular income who want to keep their assets while repaying their debts. It is often used by those who are facing financial difficulties but wish to avoid bankruptcy liquidation. Under this plan, debtors propose a repayment schedule to creditors, which must be approved by the court.

Key elements of the Chapter 13 Plan

Several key elements define the Chapter 13 Plan, making it unique compared to other bankruptcy options. These elements include:

- Repayment Period: The plan typically lasts three to five years, depending on the debtor's income and the amount of debt.

- Debt Limits: There are specific limits on the amount of unsecured and secured debt that can be included in the plan.

- Priority Debts: Certain debts, like child support and taxes, must be paid in full during the plan.

- Discharge of Remaining Debt: At the end of the repayment period, any remaining eligible unsecured debts may be discharged.

Steps to complete the Chapter 13 Plan

Completing the Chapter 13 Plan involves several important steps:

- Gather Financial Information: Collect details about income, expenses, debts, and assets.

- Consult with a Bankruptcy Attorney: Professional guidance is crucial to navigate the complexities of the plan.

- Prepare the Plan: Draft a repayment plan that outlines how debts will be repaid over the specified period.

- File the Plan with the Court: Submit the plan along with required documents to the bankruptcy court.

- Attend the Confirmation Hearing: Present the plan to the court for approval, addressing any objections from creditors.

Legal use of the Chapter 13 Plan

The legal use of the Chapter 13 Plan is governed by federal bankruptcy laws. To be valid, the plan must meet specific legal requirements, including:

- Good Faith: The debtor must propose the plan in good faith, demonstrating a genuine intention to repay debts.

- Feasibility: The proposed payments must be realistic based on the debtor's income and expenses.

- Compliance with Bankruptcy Code: The plan must adhere to the provisions set forth in the Bankruptcy Code, ensuring all creditors are treated fairly.

Eligibility Criteria

To qualify for a Chapter 13 Plan, individuals must meet certain eligibility criteria, including:

- Regular Income: Debtors must have a stable source of income to support the repayment plan.

- Debt Limits: The total amount of unsecured and secured debts must fall within the limits established by the Bankruptcy Code.

- Residency Requirements: Debtors must reside in the United States or have a domicile, residence, or place of business in the country for at least 180 days before filing.

Filing Deadlines / Important Dates

Filing deadlines and important dates are crucial for the successful execution of the Chapter 13 Plan. Key dates include:

- Filing Date: The date when the Chapter 13 petition is filed with the bankruptcy court.

- Confirmation Hearing Date: A scheduled court date where the proposed plan is reviewed and approved.

- Payment Schedule: Dates when payments must be made to the bankruptcy trustee as outlined in the plan.

Quick guide on how to complete chapter 13 plan 497428244

Effortlessly complete Chapter 13 Plan on any device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Chapter 13 Plan on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The simplest way to edit and electronically sign Chapter 13 Plan effortlessly

- Obtain Chapter 13 Plan and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to store your modifications.

- Choose your method of delivering the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Chapter 13 Plan to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a chapter 13 plan?

A chapter 13 plan is a legal framework that allows individuals to reorganize their debts and create a repayment plan manageable over three to five years. This plan is designed to help maintain assets while satisfying creditors. It’s crucial for anyone considering bankruptcy to understand how a chapter 13 plan works.

-

How much does setting up a chapter 13 plan cost?

The cost for setting up a chapter 13 plan can vary widely depending on various factors, including legal fees and court costs. Typically, the fees can be included in your plan payments. It's advisable to consult with a bankruptcy attorney to get a clear estimate tailored to your situation.

-

What are the benefits of a chapter 13 plan?

The benefits of a chapter 13 plan include the ability to keep your assets, stop foreclosure proceedings, and reduce overall debt payments. Additionally, a chapter 13 plan offers a structured way to repay debts while adhering to a budget. This plan provides signNow relief for those overwhelmed with financial obligations.

-

How does the chapter 13 plan process work?

The chapter 13 plan process begins with filing a bankruptcy petition and proposing a repayment plan to the court that outlines how debts will be paid over time. Once approved by the court, you'll make regular payments to a trustee, who then distributes the funds to creditors. Adhering to this structured approach is crucial for successful debt repayment.

-

Can I modify my chapter 13 plan if my financial situation changes?

Yes, you can modify your chapter 13 plan if your financial situation changes signNowly. This flexibility allows you to adjust your payment amounts or terms to better fit your current income and expenses. A modification must be submitted to and approved by the bankruptcy court.

-

What documents do I need to file for a chapter 13 plan?

To file for a chapter 13 plan, you will need several documents, including a list of your debts, a budget outlining your income and expenses, and tax returns for the past few years. These documents are essential to demonstrate your financial situation to the court. It's advisable to work with a qualified attorney to ensure you have everything necessary for a successful filing.

-

How does a chapter 13 plan affect my credit score?

Filing for a chapter 13 plan will impact your credit score, as it signifies serious financial distress. However, over time, successfully completing the plan and making consistent payments can help rebuild your credit. The chapter 13 plan typically remains on your credit report for seven years, but your credit potential can improve as debts are paid off.

Get more for Chapter 13 Plan

- Taxrigovabout uscontact usri division of taxation state of rhode island division of form

- Fillable kansas department of revenue power of attorney form

- Ce 5 petition for abatement collectability for businesses rev 8 19 form

- Exemption certificate forms ohio department of taxationexemptions ampamp exclusions vehicles vessels californiaexemption

- Kansas department of revenue 465818 statement for sales tax form

- Kansas liquor license ownership abc 890 abc 890 kansas liquor license ownership form

- Wwwrevenuepagovformsandpublicationsmotor carrier road taxifta forms

- Kansas department of revenue home page form

Find out other Chapter 13 Plan

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free