Living Trust for Husband and Wife with One Child Virginia Form

What is the Living Trust for Husband and Wife with One Child in Virginia

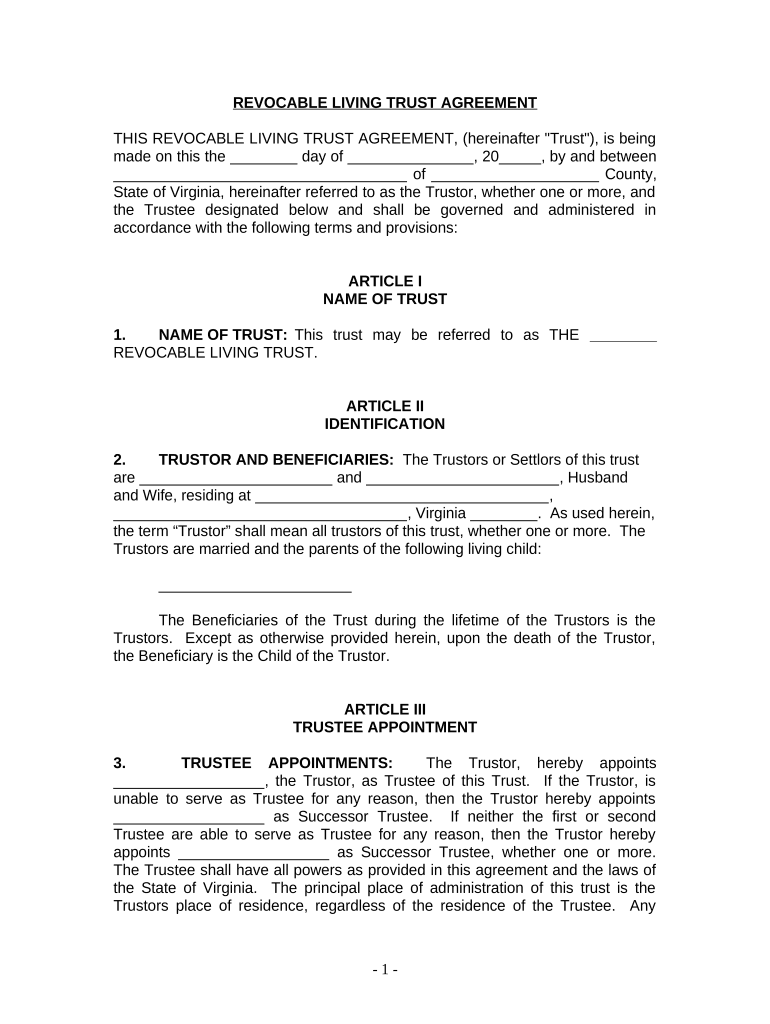

A living trust for husband and wife with one child in Virginia is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust can help avoid the lengthy probate process, ensuring a smoother transition of assets to the surviving spouse and child. The trust remains revocable, meaning the couple can alter its terms or dissolve it entirely while they are alive. This flexibility is beneficial for adapting to changing family circumstances or financial situations.

Key Elements of the Living Trust for Husband and Wife with One Child in Virginia

Several key elements define a living trust for husband and wife with one child in Virginia:

- Grantors: The couple creating the trust, who will also be the initial trustees managing the assets.

- Beneficiaries: Typically, the surviving spouse and child are the primary beneficiaries, receiving the trust's assets upon the death of the grantors.

- Trust Assets: The trust can hold various assets, including real estate, bank accounts, investments, and personal property.

- Successor Trustees: Individuals or institutions designated to manage the trust if the original trustees become unable to do so.

- Distribution Terms: Clear instructions on how and when the assets will be distributed to the beneficiaries, which can include immediate distribution or staggered payments over time.

Steps to Complete the Living Trust for Husband and Wife with One Child in Virginia

Completing a living trust involves several important steps:

- Consultation: Meet with an estate planning attorney to discuss your goals and understand the implications of creating a trust.

- Drafting the Trust Document: The attorney will prepare the trust document, outlining the terms and conditions of the trust.

- Funding the Trust: Transfer ownership of assets into the trust, which may involve changing titles or designations on bank accounts and property deeds.

- Signing the Document: Both spouses must sign the trust document in the presence of a notary public to ensure its legal validity.

- Periodic Review: Regularly review and update the trust as needed to reflect changes in family circumstances or financial situations.

Legal Use of the Living Trust for Husband and Wife with One Child in Virginia

The legal use of a living trust in Virginia is governed by state laws that outline how trusts can be created, managed, and enforced. A properly executed living trust is recognized as a valid legal document, allowing the grantors to retain control over their assets while designating how those assets will be distributed upon their death. It is essential to ensure that the trust complies with Virginia's legal requirements, including proper notarization and witnessing, to avoid potential disputes or challenges in the future.

State-Specific Rules for the Living Trust for Husband and Wife with One Child in Virginia

Virginia has specific rules regarding the creation and management of living trusts. These include:

- Revocability: Living trusts in Virginia are revocable, allowing the grantors to modify or revoke the trust at any time during their lifetime.

- Notarization: The trust document must be signed in the presence of a notary public to be legally binding.

- Asset Transfer: Properly transferring assets into the trust is crucial for its effectiveness, which may require legal assistance to ensure compliance with state laws.

- Tax Considerations: While living trusts typically do not affect income taxes, it is important to consult a tax professional regarding any potential implications for estate taxes.

Quick guide on how to complete living trust for husband and wife with one child virginia

Effortlessly Prepare Living Trust For Husband And Wife With One Child Virginia on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Living Trust For Husband And Wife With One Child Virginia on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign Living Trust For Husband And Wife With One Child Virginia with Ease

- Find Living Trust For Husband And Wife With One Child Virginia and select Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Decide how you'd like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Living Trust For Husband And Wife With One Child Virginia and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust For Husband And Wife With One Child in Virginia?

A Living Trust For Husband And Wife With One Child in Virginia is a legal document that allows couples to manage their assets during their lifetime and ensure a smooth transfer to their child after death. This type of trust can help avoid probate and provide clarity on asset distribution.

-

What are the benefits of creating a Living Trust For Husband And Wife With One Child in Virginia?

Creating a Living Trust For Husband And Wife With One Child in Virginia offers numerous benefits, including avoiding probate, reducing estate taxes, and ensuring your child's financial security. A Living Trust also allows for flexibility in managing assets and can provide peace of mind for parents.

-

How much does a Living Trust For Husband And Wife With One Child in Virginia cost?

The cost of establishing a Living Trust For Husband And Wife With One Child in Virginia can vary based on complexity and legal assistance. Typically, fees range from a few hundred to several thousand dollars, depending on the services you choose to include.

-

Can I modify my Living Trust For Husband And Wife With One Child in Virginia?

Yes, one of the key features of a Living Trust For Husband And Wife With One Child in Virginia is its flexibility. You can modify the terms, add or remove assets, or even revoke the trust altogether as circumstances change over time.

-

Is a Living Trust For Husband And Wife With One Child in Virginia necessary if I have a will?

While having a will is important, a Living Trust For Husband And Wife With One Child in Virginia is often more advantageous as it helps to avoid probate and can directly manage asset distribution. Using both documents together can provide comprehensive estate planning.

-

How does a Living Trust For Husband And Wife With One Child in Virginia impact taxes?

A Living Trust For Husband And Wife With One Child in Virginia generally does not affect your income taxes during your lifetime. However, it's important to consider the long-term tax implications for your estate, as the trust may help reduce estate taxes on your assets.

-

What types of assets can be included in a Living Trust For Husband And Wife With One Child in Virginia?

You can include various types of assets in a Living Trust For Husband And Wife With One Child in Virginia, such as real estate, bank accounts, investments, and personal property. Ensuring all relevant assets are included is crucial for effective management and distribution.

Get more for Living Trust For Husband And Wife With One Child Virginia

- Dear colleagues dear friends please find enclosed the first draft of form

- Please find your copy of the courts order denying form

- Enclosed herewith please find a copy of a letter which i received from form

- Sample formal letter asking for permission

- The applications filed by form

- Sample cover letter networks northwest form

- The owner of form

- Franchise disclosure document cheba hut form

Find out other Living Trust For Husband And Wife With One Child Virginia

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney