Chapter 13 Form

What is the Chapter 13?

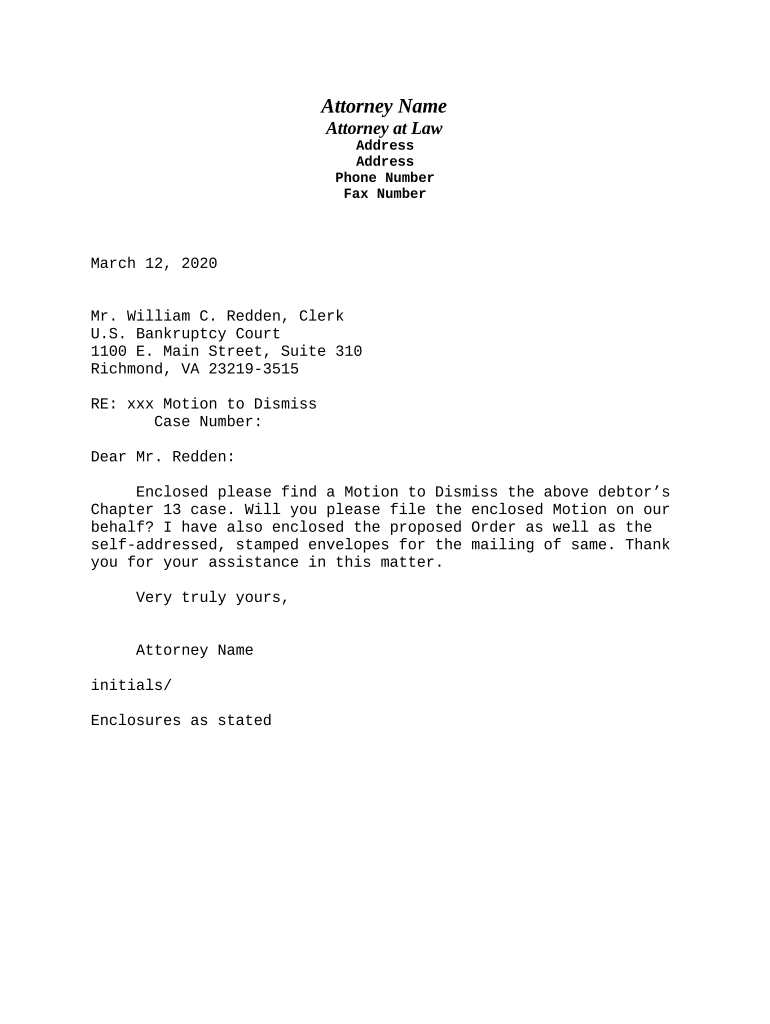

The Chapter 13 motion dismiss is a legal process that allows individuals to reorganize their debts under the bankruptcy code. This option is particularly beneficial for those who have a regular income and wish to retain their assets while repaying their debts over a specified period, typically three to five years. The Chapter 13 motion dismiss can be filed to request the court to dismiss a previous bankruptcy case, often due to failure to comply with the repayment plan or other legal requirements.

Steps to Complete the Chapter 13

Completing a Chapter 13 motion dismiss involves several key steps:

- Gather necessary financial documents, including income statements, tax returns, and a list of debts.

- Complete the Chapter 13 petition, which outlines your financial situation and proposed repayment plan.

- File the petition with the bankruptcy court, ensuring all required fees are paid.

- Attend the creditors' meeting, where creditors can ask questions about your financial situation.

- Make regular payments as outlined in the repayment plan to avoid dismissal of the case.

Legal Use of the Chapter 13

The Chapter 13 motion dismiss is legally binding once filed with the court. It allows individuals to restructure their debts while providing protections against creditors. This legal framework ensures that debtors can keep their property, such as their home or vehicle, while making manageable payments over time. Compliance with the terms of the Chapter 13 plan is crucial to avoid dismissal and achieve a successful discharge of debts.

Required Documents

To file a Chapter 13 motion dismiss, certain documents are essential:

- Proof of income, such as pay stubs or tax returns.

- A list of all debts, including secured and unsecured obligations.

- A detailed budget outlining monthly expenses.

- Any prior bankruptcy filings, if applicable.

Eligibility Criteria

Eligibility for filing a Chapter 13 motion dismiss requires meeting specific criteria set by the bankruptcy code. Individuals must have a regular income and unsecured debts that do not exceed a certain limit. Additionally, they should not have filed for bankruptcy in the past few years. Meeting these criteria is essential for the court to accept the Chapter 13 petition and allow for debt reorganization.

Filing Deadlines / Important Dates

Filing deadlines are critical in the Chapter 13 process. Individuals must file their Chapter 13 motion dismiss within specific time frames to avoid complications. Key dates include:

- The deadline for filing the bankruptcy petition and required documents.

- The date of the creditors' meeting, typically scheduled within a few weeks of filing.

- Regular payment deadlines as outlined in the repayment plan.

Quick guide on how to complete chapter 13

Complete Chapter 13 effortlessly on any device

Managing documents online has gained increased popularity among companies and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Chapter 13 on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-focused operation today.

How to modify and eSign Chapter 13 without breaking a sweat

- Obtain Chapter 13 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your revisions.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Chapter 13 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a chapter 13 form?

A chapter 13 form is a legal document that individuals use to file for bankruptcy under Chapter 13 of the U.S. Bankruptcy Code. This form allows individuals to propose a repayment plan to make installments to creditors over a period of time. Using airSlate SignNow to complete your chapter 13 form can streamline the signing process, ensuring your documents are prepared and submitted efficiently.

-

How can airSlate SignNow help with chapter 13 forms?

AirSlate SignNow offers a user-friendly platform to fill out and eSign your chapter 13 forms seamlessly. Its features include customizable templates that cater specifically to bankruptcy filings, making documentation simple and accessible. This ensures that you can focus on your repayment plan rather than worrying about paperwork.

-

Is there a cost associated with using airSlate SignNow for chapter 13 forms?

Yes, there is a cost associated with using airSlate SignNow, but it is a cost-effective solution for managing your chapter 13 forms. The subscription plans are designed to fit varying budgets while providing powerful features such as unlimited eSigning and document storage. Choose the plan that best suits your needs for handling your financial documentation.

-

What features does airSlate SignNow offer for chapter 13 forms?

AirSlate SignNow provides numerous features specifically for managing chapter 13 forms, including electronic signatures, document tracking, and the ability to share documents securely. Additionally, it supports integrations with other applications to help streamline your financial processes. With these features, preparing and submitting your chapter 13 forms becomes hassle-free.

-

How secure is my information when using airSlate SignNow for chapter 13 forms?

When using airSlate SignNow for chapter 13 forms, your information is protected with top-notch security measures. The platform employs encryption and complies with industry standards to ensure that your personal and financial data remains confidential. You can trust that your chapter 13 forms are handled securely throughout the signing process.

-

Can I customize my chapter 13 form using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize your chapter 13 form to meet your specific needs. You can add fields for signatures, dates, or additional information as required, making your form uniquely yours. This level of customization ensures that your chapter 13 documentation aligns with your financial goals.

-

What integrations does airSlate SignNow offer for chapter 13 forms?

AirSlate SignNow integrates with various applications that can enhance your experience when managing chapter 13 forms. These include tools for document storage, customer relationship management, and productivity applications. By integrating airSlate SignNow with your existing tools, you can create a more cohesive workflow for handling financial documentation.

Get more for Chapter 13

- Arizona medical living wills attorneysue sandays estate plan form

- Formsgsa gsagov

- Dear parent andor caregiver alliance for childrens rights form

- Forms guardianshipfamlawselfhelp california courts state of

- Entity must be represented in the bankruptcy case by an attorney form

- If an individual including an individual person a married couple or a sole proprietorship is form

- Control number ca name 2 form

- California legal forms california legal documents uslegalforms

Find out other Chapter 13

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT