Va Llc Form

What is the Virginia LLC?

A Virginia LLC, or Limited Liability Company, is a popular business structure that combines the flexibility of a partnership with the liability protection of a corporation. This entity type protects its owners, known as members, from personal liability for business debts and obligations. In Virginia, forming an LLC requires compliance with specific state regulations, including filing articles of organization with the Virginia State Corporation Commission (SCC). The Virginia LLC provides a straightforward way to manage a business while safeguarding personal assets.

Steps to Complete the Virginia LLC

Completing the process to establish a Virginia LLC involves several key steps:

- Choose a Name: Select a unique name that complies with Virginia naming requirements, including the inclusion of "Limited Liability Company" or abbreviations like "LLC."

- Designate a Registered Agent: Appoint a registered agent who will receive legal documents on behalf of the LLC. This agent must be a resident of Virginia or a business entity authorized to conduct business in the state.

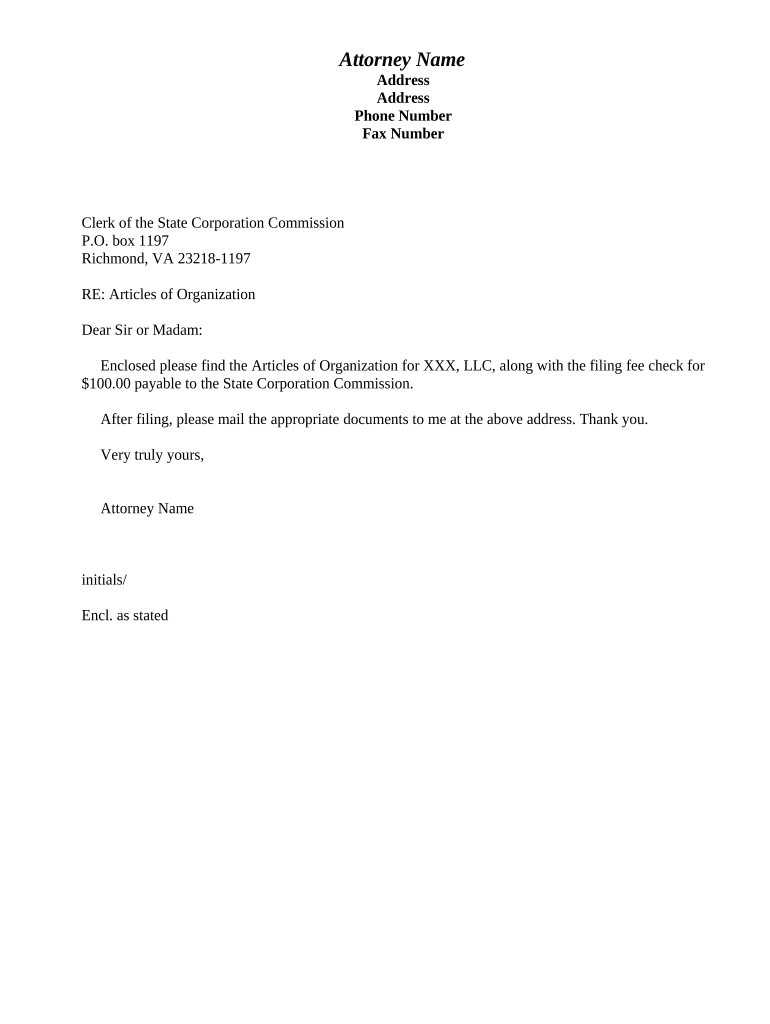

- File Articles of Organization: Submit the articles of organization to the Virginia SCC, either online or by mail. This document outlines essential details about the LLC, including its name, registered agent, and management structure.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes and hiring employees.

- Create an Operating Agreement: Although not mandatory in Virginia, it is advisable to draft an operating agreement that outlines the management structure and operational procedures of the LLC.

Legal Use of the Virginia LLC

The legal use of a Virginia LLC encompasses various business activities while ensuring compliance with state laws. This structure allows members to operate a business, enter contracts, and conduct transactions under the LLC's name. Additionally, the limited liability protection means that personal assets are generally shielded from business liabilities, provided that the LLC is maintained as a separate entity. Members must adhere to state regulations, including annual reporting and tax obligations, to maintain the legal protections afforded by the LLC structure.

Required Documents

To establish a Virginia LLC, certain documents are necessary:

- Articles of Organization: This primary document must be filed with the Virginia SCC to officially create the LLC.

- Operating Agreement: While not required, this internal document is important for outlining the management and operational guidelines of the LLC.

- Employer Identification Number (EIN): Obtained from the IRS, this number is essential for tax purposes and hiring employees.

Filing Deadlines / Important Dates

When forming a Virginia LLC, it is important to be aware of key deadlines:

- Articles of Organization Submission: There is no specific deadline for filing the articles, but it should be done before conducting business.

- Annual Reports: Virginia LLCs must file an annual report by the last day of the month in which the LLC was formed to maintain good standing.

Eligibility Criteria

To form a Virginia LLC, the following eligibility criteria must be met:

- At least one member is required, who can be an individual or a business entity.

- The chosen name must be unique and comply with Virginia naming conventions.

- The registered agent must have a physical address in Virginia and be available during business hours.

Quick guide on how to complete va llc 497428335

Effortlessly Prepare Va Llc on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Va Llc across any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Va Llc Effortlessly

- Obtain Va Llc and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form—via email, SMS, an invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Va Llc and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Virginia LLC and how can it benefit my business?

A Virginia LLC, or Limited Liability Company, provides personal liability protection for business owners while allowing flexible taxation options. By forming a Virginia LLC, you can separate your personal assets from your business liabilities, which is vital for reducing risk in legal scenarios. Additionally, a Virginia LLC can enhance your business's credibility with customers and partners.

-

How do I form a Virginia LLC?

To form a Virginia LLC, you need to choose a unique name that complies with state regulations, file Articles of Organization with the Virginia State Corporation Commission, and obtain any necessary licenses or permits. It's a straightforward process, often done online, and once approved, your Virginia LLC will be officially recognized. Consulting an expert can ensure that all requirements are met effectively.

-

What are the costs associated with creating a Virginia LLC?

The primary cost of establishing a Virginia LLC includes the filing fee for the Articles of Organization, which is approximately $100. Additional costs may arise from obtaining an EIN, any necessary business licenses, and legal assistance if you choose to hire a professional. Overall, starting a Virginia LLC can be a cost-effective solution for many entrepreneurs.

-

What features does airSlate SignNow offer for Virginia LLC formations?

AirSlate SignNow provides a user-friendly platform for managing documents and eSigning, which is essential for streamlining the formation of your Virginia LLC. The service includes templates for essential forms, secure eSigning, and collaboration features. This makes it easier to handle contracts and filings required for setting up a Virginia LLC efficiently.

-

What are the tax benefits of choosing a Virginia LLC?

A Virginia LLC offers signNow tax benefits, including pass-through taxation, where income passes directly to your personal tax return, avoiding double taxation at the corporate level. Additionally, LLCs in Virginia can deduct certain business expenses, ultimately reducing your taxable income. This flexibility makes a Virginia LLC an attractive choice for many business owners.

-

Can I manage my Virginia LLC's documents electronically with airSlate SignNow?

Yes, airSlate SignNow allows you to manage all your Virginia LLC's documents electronically. You can eSign contracts, agreements, and essential forms securely and efficiently from any device. This not only saves time but also enhances the organization of your Virginia LLC's documentation.

-

How does airSlate SignNow integrate with other platforms for my Virginia LLC?

AirSlate SignNow seamlessly integrates with various productivity tools and platforms, enhancing your Virginia LLC’s operational efficiency. Whether it’s connecting with CRM systems, cloud storage, or project management tools, these integrations simplify workflows and enhance collaboration for your LLC. This flexibility allows you to tailor your business operations according to your specific needs.

Get more for Va Llc

- Sec filingfox investor relationsfox fox corporation form

- Farmland leasing checklist adapted by robert tigner tim lemmons form

- Revocation of power of attorney the judicial branch of arizona in form

- Model form orrtfrftfrlng agreement nm oil conservation

- Pugh clauseunderstanding the horizontal ampamp vertical pugh clause form

- Access control easement form

- Asbestos removal clause form

- Right of first refusal a complete tenant guidelease ref form

Find out other Va Llc

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast