Deed Gift Property Form

What is the deed gift property?

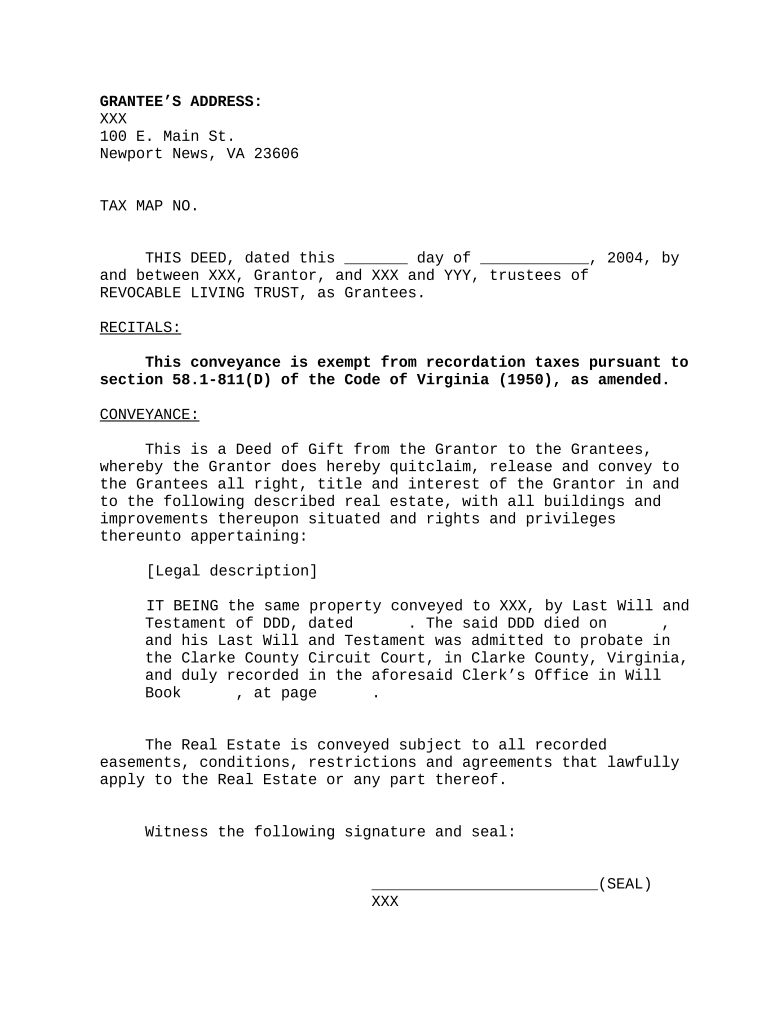

The deed gift property refers to a legal document that transfers ownership of real estate from one individual to another without any exchange of money. This type of deed is often used to give property as a gift to family members or friends. The deed outlines the details of the property being transferred, including its legal description, and must be signed by the grantor, the person giving the property. In the United States, such transfers are subject to state laws, which can vary significantly.

Steps to complete the deed gift property

Completing a deed gift property involves several important steps to ensure that the transfer is legally valid. First, gather all necessary information about the property, including its legal description and current ownership details. Next, draft the deed, ensuring it includes the names of both the grantor and grantee, along with a clear statement of the gift. After the deed is prepared, it must be signed by the grantor in the presence of a notary public. Finally, the completed deed should be recorded with the appropriate county office to make the transfer official.

Legal use of the deed gift property

The legal use of a deed gift property is governed by state laws, which dictate how property can be transferred. It is essential to comply with these regulations to ensure that the deed is enforceable. This includes adhering to specific requirements for signatures, notarization, and recording. Additionally, understanding any tax implications associated with gifting property is crucial, as the IRS may impose gift taxes depending on the property's value. Consulting with a legal professional can provide clarity on these matters.

Required documents

To complete a deed gift property, certain documents are necessary. These typically include the deed itself, which outlines the transfer, and any additional forms required by the state or local jurisdiction for recording purposes. Identification for both the grantor and grantee may also be needed, as well as proof of ownership of the property being gifted. In some cases, a property appraisal may be required to assess its value for tax purposes.

State-specific rules for the deed gift property

Each state in the U.S. has its own rules and regulations regarding the deed gift property. These laws can affect how the deed is drafted, signed, and recorded. Some states may require specific language to be included in the deed or have unique requirements for notarization. It is important to research the laws applicable in the state where the property is located to ensure compliance and avoid potential legal issues.

Examples of using the deed gift property

Common scenarios for using a deed gift property include transferring a family home to a child or gifting a vacation property to a sibling. In these cases, the grantor may wish to avoid probate or ensure that the property remains within the family. Additionally, individuals may use a deed gift to minimize estate taxes or to provide financial assistance to loved ones without the need for a sale. Each situation may have different legal and tax implications, so it is advisable to consult with a legal expert.

Quick guide on how to complete deed gift property

Prepare Deed Gift Property effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can acquire the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without delays. Manage Deed Gift Property on any platform using airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

How to modify and eSign Deed Gift Property seamlessly

- Find Deed Gift Property and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choosing. Modify and eSign Deed Gift Property and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed gift property and how does it work?

A deed gift property involves transferring ownership of real estate as a gift, typically to family or friends. This process requires a specially drafted deed that outlines the transfer, ensuring the gift is legally recognized. Using airSlate SignNow simplifies this process by allowing you to electronically sign the deed gift property document securely and efficiently.

-

What are the benefits of using airSlate SignNow for a deed gift property?

Using airSlate SignNow for a deed gift property offers numerous benefits, including fast electronic signing and secure document storage. The platform streamlines the entire gifting process, reducing paperwork and ensuring compliance with legal requirements. Moreover, you can track the signing status in real-time, making it easier to manage your transactions.

-

How much does it cost to use airSlate SignNow for deed gift property transactions?

airSlate SignNow offers flexible pricing plans that cater to different needs, even when dealing with deed gift property transactions. Each plan includes features such as unlimited document signing and secure storage, ensuring you get the best value. To find the best pricing option for your situation, you can visit our website and explore our plans.

-

Can I integrate airSlate SignNow with other tools for managing deed gift property?

Yes, airSlate SignNow can be easily integrated with various tools and applications, enhancing your workflow for deed gift property transactions. You can connect it with CRM systems, cloud storage solutions, and productivity apps, enabling seamless document management. These integrations allow you to customize your processes and improve efficiency.

-

What features does airSlate SignNow offer for deed gift property documentation?

airSlate SignNow offers a range of features tailored for deed gift property documentation, including customizable templates, secure electronic signatures, and audit trails. These features help ensure that all transactions are legally binding and well-documented. Additionally, you can easily collaborate with others during the signing process.

-

Is it legally binding to eSign a deed gift property with airSlate SignNow?

Yes, eSigning a deed gift property with airSlate SignNow is legally binding, as long as it complies with local laws and regulations. The platform ensures that all signatures are secure and verifiable, providing confidence in your transactions. Always consult with a legal professional to ensure compliance with specific state laws.

-

How does airSlate SignNow ensure the security of my deed gift property documents?

airSlate SignNow prioritizes document security by using encryption and secure server practices to protect your deed gift property documents. This ensures that your sensitive information remains confidential and safe from unauthorized access. Regular audits and compliance checks also enhance the overall security of the platform.

Get more for Deed Gift Property

- Dear colleagues dear friends please find enclosed the first draft of form

- Please find your copy of the courts order denying form

- Enclosed herewith please find a copy of a letter which i received from form

- Sample formal letter asking for permission

- The applications filed by form

- Sample cover letter networks northwest form

- The owner of form

- Franchise disclosure document cheba hut form

Find out other Deed Gift Property

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast