Deed Gift Husband Wife Form

What is the deed gift husband wife?

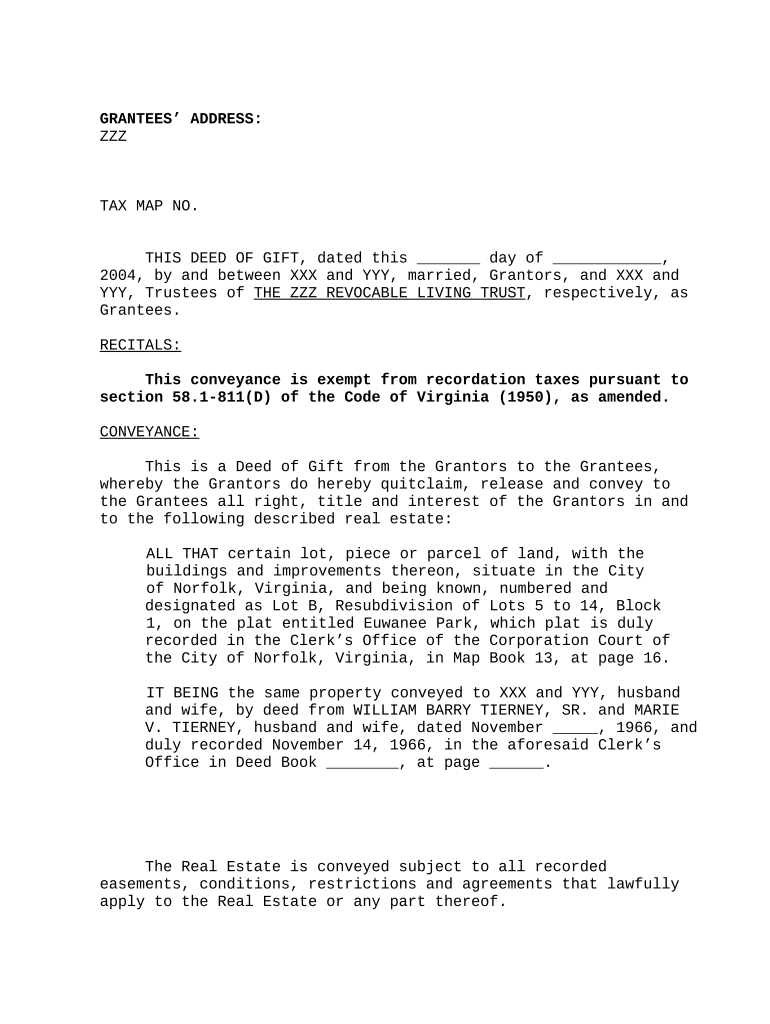

A deed gift husband wife is a legal document that transfers ownership of property from one spouse to another without any exchange of money. This type of deed is often used to simplify property ownership between married couples. It is important to ensure that the deed complies with state regulations, particularly in Virginia, where specific requirements must be met for the transfer to be valid. The deed typically includes details such as the names of both spouses, a description of the property, and the intent to gift the property.

Steps to complete the deed gift husband wife

Completing a deed gift husband wife involves several key steps:

- Gather necessary information, including property details and both spouses' names.

- Obtain a blank deed form that complies with Virginia state laws.

- Fill out the form accurately, ensuring all required information is included.

- Sign the deed in the presence of a notary public to validate the transfer.

- File the completed deed with the local county clerk's office to officially record the transfer.

Legal use of the deed gift husband wife

The legal use of a deed gift husband wife is to facilitate the transfer of property between spouses without the need for a sale. This type of deed is recognized under Virginia law, provided that it meets specific legal requirements. It is essential to ensure that the deed is executed properly, including notarization and recording, to prevent any future disputes regarding ownership. Additionally, the deed should clearly state that it is a gift to avoid any implications of a sale or exchange.

Key elements of the deed gift husband wife

When preparing a deed gift husband wife, several key elements must be included to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of both the transferring spouse (grantor) and the receiving spouse (grantee).

- Property Description: A detailed description of the property being transferred, including its legal description.

- Statement of Gift: A clear declaration that the property is being gifted without any monetary exchange.

- Signatures: Signatures of both spouses, along with a notary public's acknowledgment.

State-specific rules for the deed gift husband wife

In Virginia, specific rules govern the use of a deed gift husband wife. These rules include requirements for notarization, the necessity of recording the deed with the local government, and compliance with state property laws. It is advisable to consult with a legal professional to ensure that all state-specific regulations are followed, as failure to comply can result in the deed being deemed invalid. Understanding these rules helps protect both parties and ensures a smooth transfer process.

Examples of using the deed gift husband wife

There are various scenarios in which a deed gift husband wife may be utilized:

- A couple wishes to transfer ownership of their family home to one spouse for estate planning purposes.

- One spouse wants to gift their interest in a jointly owned property to the other spouse to simplify ownership.

- In the event of a divorce, a deed gift may be used to transfer property rights as part of a settlement agreement.

Quick guide on how to complete deed gift husband wife

Effortlessly Prepare Deed Gift Husband Wife on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Manage Deed Gift Husband Wife on any device using airSlate SignNow's Android or iOS applications and enhance your document-based workflows today.

Edit and eSign Deed Gift Husband Wife with Ease

- Obtain Deed Gift Husband Wife and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of delivering your document, whether by email, SMS, invite link, or download it to your computer.

Eliminate the stress of lost or mislaid documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Deed Gift Husband Wife and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Virginia deed trust?

A Virginia deed trust is a legal document that outlines the arrangement between a grantor, trustee, and beneficiaries regarding the management of property in Virginia. This trust allows for more efficient estate planning and can provide benefits such as avoiding probate. Understanding the specifics of a Virginia deed trust is crucial for effective asset management.

-

How does airSlate SignNow facilitate the creation of a Virginia deed trust?

AirSlate SignNow provides an intuitive platform that simplifies the process of drafting and executing a Virginia deed trust. Users can customize templates to meet their specific needs, ensuring that all necessary legal requirements are met. The platform’s eSignature feature also streamlines the signing process, making it quick and hassle-free.

-

What are the benefits of using airSlate SignNow for Virginia deed trust documentation?

Using airSlate SignNow for Virginia deed trust documentation offers several advantages, including time-saving capabilities and ease of use. The platform ensures all legal forms are compliant and securely stored, which protects sensitive information. Additionally, electronic signatures enable quick approvals, speeding up the entire process.

-

Is there a cost associated with creating a Virginia deed trust using airSlate SignNow?

Yes, there are pricing options available for using airSlate SignNow to create a Virginia deed trust, which depend on the features you choose. The subscription plans cater to different business needs, ensuring you only pay for what you require. Overall, it remains a cost-effective solution for electronic document management.

-

Can I integrate airSlate SignNow with other tools for managing Virginia deed trusts?

Absolutely! airSlate SignNow offers integrations with various applications like Google Drive, Dropbox, and CRMs, enhancing your overall management of Virginia deed trusts. This connectivity ensures that your documentation workflow is seamless and efficient, allowing you to access everything you need in one place.

-

How secure is my information when using airSlate SignNow for a Virginia deed trust?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like a Virginia deed trust. The platform employs advanced encryption protocols to shield your data, ensuring that only authorized individuals can access it. Regular security audits further enhance the reliability of the service.

-

What types of documents can I prepare besides a Virginia deed trust with airSlate SignNow?

In addition to creating a Virginia deed trust, airSlate SignNow enables you to prepare various legal and business documents such as contracts, agreements, and forms. The platform is versatile, allowing you to streamline multiple document processes in one place. This flexibility is invaluable for businesses looking to optimize their operations.

Get more for Deed Gift Husband Wife

Find out other Deed Gift Husband Wife

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure