Deed Widower Form

What is the Deed Widower

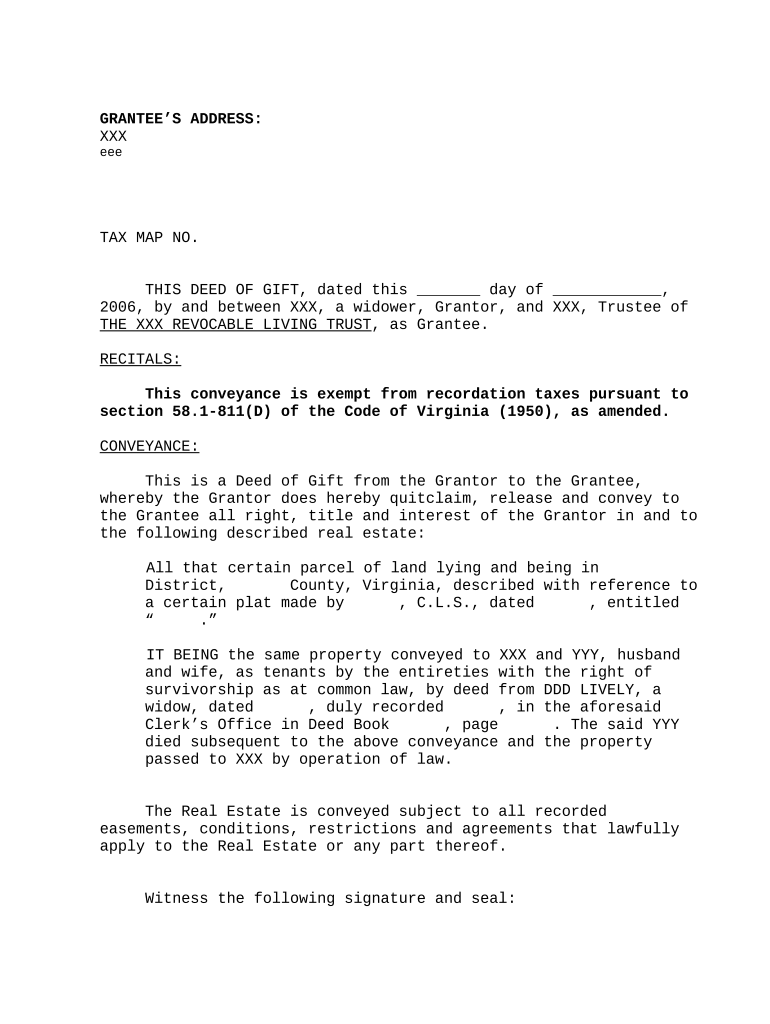

The deed widower is a legal document that allows a widower to transfer property ownership after the death of a spouse. This form is crucial for ensuring that the deceased spouse's assets are properly managed and distributed according to their wishes. It serves as a formal declaration that the widower has the right to handle the property without the need for probate, streamlining the process of transferring ownership.

How to use the Deed Widower

Using the deed widower involves several key steps. First, the widower must gather all necessary information regarding the property, including its legal description and any existing liens. Next, the form must be accurately filled out, ensuring that all details are correct and complete. After completing the form, it should be signed in the presence of a notary public to ensure its validity. Finally, the executed deed must be filed with the appropriate county office to officially record the transfer of ownership.

Steps to complete the Deed Widower

Completing the deed widower requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including the death certificate and property deed.

- Fill out the deed widower form with accurate property details and personal information.

- Sign the form in front of a notary public.

- Submit the signed deed to the local county clerk or recorder's office for recording.

Legal use of the Deed Widower

The legal use of the deed widower is to facilitate the transfer of property ownership without the need for probate proceedings. This document is recognized under state laws, allowing widowers to assert their rights to the property of their deceased spouse. It is important to ensure that the form complies with state-specific regulations to avoid any legal disputes or complications in the future.

Key elements of the Deed Widower

Several key elements must be included in the deed widower to ensure its validity:

- The full names of both the widower and the deceased spouse.

- A clear legal description of the property being transferred.

- The date of the spouse's death.

- A statement confirming the widower's right to transfer the property.

- Signatures of the widower and a notary public.

State-specific rules for the Deed Widower

Each state may have unique rules and requirements regarding the deed widower. It is essential for the widower to familiarize themselves with the specific regulations in their state, including any necessary forms, filing fees, and deadlines. Consulting with a legal professional can provide clarity on these requirements and ensure compliance with state laws.

Quick guide on how to complete deed widower

Complete Deed Widower effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without any delays. Manage Deed Widower on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Deed Widower effortlessly

- Locate Deed Widower and click on Get Form to initiate.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Deed Widower and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed widower, and how does it differ from a standard deed?

A deed widower refers to a legal document designed to transfer ownership of property after the death of a spouse. Unlike a standard deed, which may involve multiple parties in a transaction, a deed widower typically simplifies the process for the surviving spouse.

-

How can airSlate SignNow help me create a deed widower?

With airSlate SignNow, you can effortlessly create a deed widower using our user-friendly platform. Our templates are designed to guide you through the specific language and requirements needed for a legally binding document, ensuring a smooth process.

-

What are the costs associated with using airSlate SignNow for a deed widower?

airSlate SignNow offers flexible pricing options to accommodate your needs, with plans that are cost-effective for creating documents like a deed widower. We provide various subscription tiers, allowing you to choose a plan that fits your budget and usage frequency.

-

Is electronic signing valid for a deed widower?

Yes, electronic signing is valid for a deed widower, provided the signers comply with state laws regarding electronic signatures. airSlate SignNow ensures that all signatures are secure and legally compliant, giving you peace of mind when executing a deed.

-

Can I collaborate with others when drafting a deed widower on airSlate SignNow?

Absolutely! airSlate SignNow allows for seamless collaboration when drafting a deed widower. You can invite other parties to review and comment on the document, ensuring that all necessary input is considered before finalizing the deed.

-

What features does airSlate SignNow offer for a deed widower?

airSlate SignNow offers a range of features to help you with a deed widower, including customizable templates, electronic signatures, and secure document storage. These tools streamline the process of creating and managing your legal documents efficiently.

-

How does airSlate SignNow ensure the security of my deed widower?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and two-factor authentication to protect your deed widower and any sensitive information, ensuring that only authorized individuals have access to your documents.

Get more for Deed Widower

- Owen sitole college of agriculture admission requirements form

- Venda nursing college thohoyandou form

- Flisp application online form

- Basic ambulance assistant course at unisa form

- 28 day calendar 2020 form

- 3114p exhibit b declaration of intent to provide home based instruction form

- Mary belle and dee mcstay scholarship classroom vernonisd form

- City of beaumont police department records managem form

Find out other Deed Widower

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple