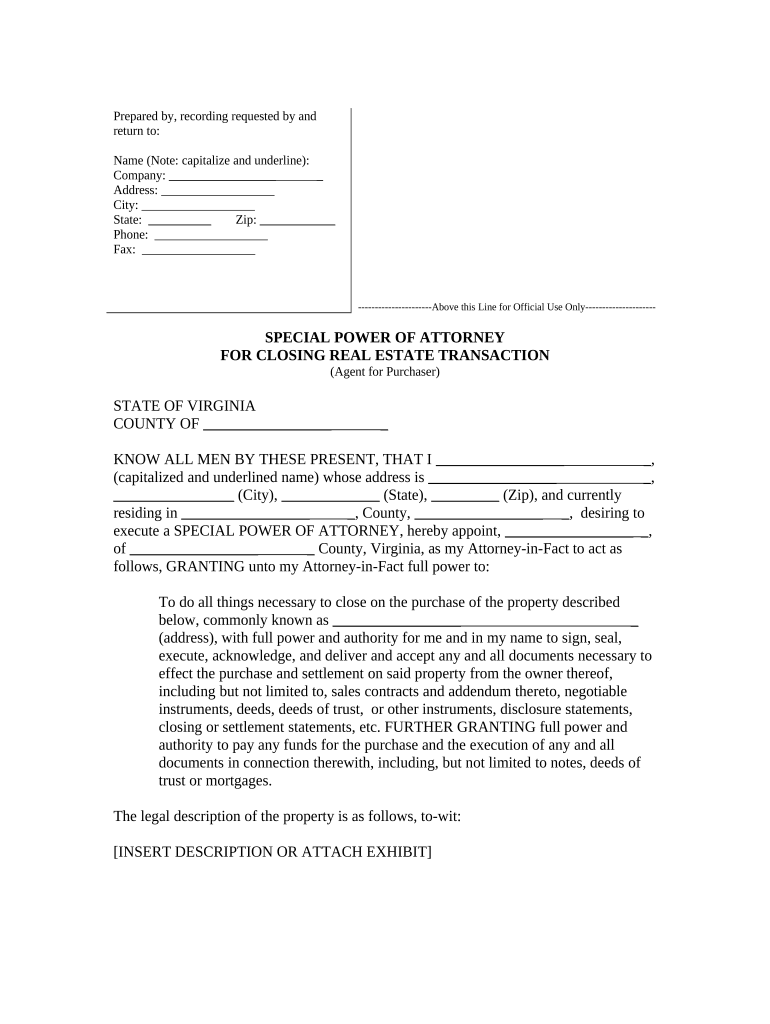

Closing Estate Transaction Form

What is the Closing Estate Transaction

The closing estate transaction refers to the final steps involved in the transfer of property ownership. This process culminates in the signing of various legal documents that finalize the sale or transfer of real estate. It typically involves the buyer, seller, and various professionals such as real estate agents and attorneys. The closing estate transaction ensures that all legal requirements are met, and ownership is officially transferred from one party to another.

Steps to complete the Closing Estate Transaction

Completing a closing estate transaction involves several key steps:

- Preparation: Gather all necessary documents, including the purchase agreement, title report, and any disclosures.

- Title Search: Conduct a title search to ensure there are no liens or claims against the property.

- Closing Disclosure: Review the closing disclosure, which outlines the final terms of the loan and all closing costs.

- Final Walkthrough: Perform a final walkthrough of the property to ensure it is in the agreed-upon condition.

- Signing Documents: Sign all required documents, including the deed and settlement statement.

- Transfer of Funds: Ensure that funds are transferred to the seller and any outstanding fees are paid.

- Recording the Transaction: Record the transaction with the appropriate local government office to make the transfer official.

Legal use of the Closing Estate Transaction

The legal use of the closing estate transaction is crucial for ensuring that the transfer of property is valid and enforceable. This process must comply with state and federal laws, including regulations surrounding eSignatures. When using digital tools for signing documents, it is essential to adhere to the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws provide the framework for the legal acceptance of electronic signatures, ensuring that documents signed electronically hold the same weight as those signed in person.

Required Documents

Several documents are essential for completing a closing estate transaction. These include:

- Purchase Agreement: A contract outlining the terms of the sale between the buyer and seller.

- Title Report: A document that shows the legal ownership of the property and any liens or encumbrances.

- Closing Disclosure: A detailed account of all costs associated with the transaction.

- Deed: The legal document that transfers ownership from the seller to the buyer.

- Identification: Valid identification for all parties involved in the transaction.

How to use the Closing Estate Transaction

Using the closing estate transaction effectively involves understanding the steps and requirements involved. Start by compiling all necessary documents and ensuring they are accurate and complete. Utilize digital tools to facilitate the signing process, ensuring compliance with legal standards. After gathering signatures, ensure that the documents are filed with the appropriate authorities to finalize the transfer of ownership. This process can be streamlined using eSignature solutions, making it easier to manage and execute the transaction securely.

State-specific rules for the Closing Estate Transaction

Each state in the U.S. has its own rules and regulations governing closing estate transactions. These can include specific requirements for documentation, disclosure obligations, and the process for recording the transaction. It is essential to familiarize yourself with the laws applicable in your state to ensure compliance. This may involve consulting with a local real estate attorney or agent who can provide guidance tailored to your jurisdiction.

Quick guide on how to complete closing estate transaction 497428495

Complete Closing Estate Transaction effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Closing Estate Transaction on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Closing Estate Transaction without hassle

- Find Closing Estate Transaction and then click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign Closing Estate Transaction and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it assist in closing estate transactions?

airSlate SignNow is a digital document management platform that simplifies the process of closing estate transactions. It allows users to send, sign, and manage important documents electronically, ensuring that all necessary paperwork is completed quickly and efficiently, which is crucial in the estate closing process.

-

How does airSlate SignNow ensure the security of documents when closing estate transactions?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents involved in closing estate transactions. The platform employs robust encryption methods, secure cloud storage, and complies with industry standards to protect user data and maintain confidentiality throughout the signing process.

-

What are the pricing plans for airSlate SignNow tailored for closing estate transactions?

airSlate SignNow offers flexible pricing plans to cater to different business needs when closing estate transactions. Users can choose from various tiers that fit their budget, and each plan includes a range of features designed to streamline the signing process, making it a cost-effective solution.

-

What features does airSlate SignNow provide to streamline the closing estate transaction process?

airSlate SignNow has a suite of features designed to facilitate the closing estate transaction process, including templates for common documents, automated reminders, and real-time tracking of document status. These tools help ensure that every step of the transaction is transparent and efficiently managed.

-

Can airSlate SignNow integrate with other tools I use for closing estate transactions?

Yes, airSlate SignNow supports integrations with a variety of popular software and services frequently used in closing estate transactions. This includes CRM systems, accounting software, and document storage solutions, allowing for a more cohesive workflow and enhancing productivity.

-

How can airSlate SignNow help reduce delays in closing estate transactions?

By utilizing airSlate SignNow, businesses can signNowly reduce delays in closing estate transactions. The platform facilitates instant document access, electronic signatures, and faster communication, which helps to expedite the process and keeps all parties informed and involved.

-

Is airSlate SignNow user-friendly for clients involved in closing estate transactions?

Absolutely! airSlate SignNow is designed to be user-friendly, ensuring that clients involved in closing estate transactions can easily navigate the platform. With an intuitive interface and straightforward instructions, even those who are not tech-savvy can manage their documents with ease.

Get more for Closing Estate Transaction

- Ct 1040 ext 2014 application for extension of time to file ct form

- Ct 1040nrpy booklet 2016 connecticut nonresident and ctgov form

- Supplemental schedule ct 1040wh connecticut income ctgov form

- New transfer renewal form

- Telephone 614 644 2431 httpwww form

- Mainform ce 1207 calculation of impervious percentage city of houston texas pdf

- Horse lease agreementpdf fox trot farm form

- Pdf form 26a north carolina industrial commission nc gov

Find out other Closing Estate Transaction

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT