Vrt 17 Form

What is the Vrt 17?

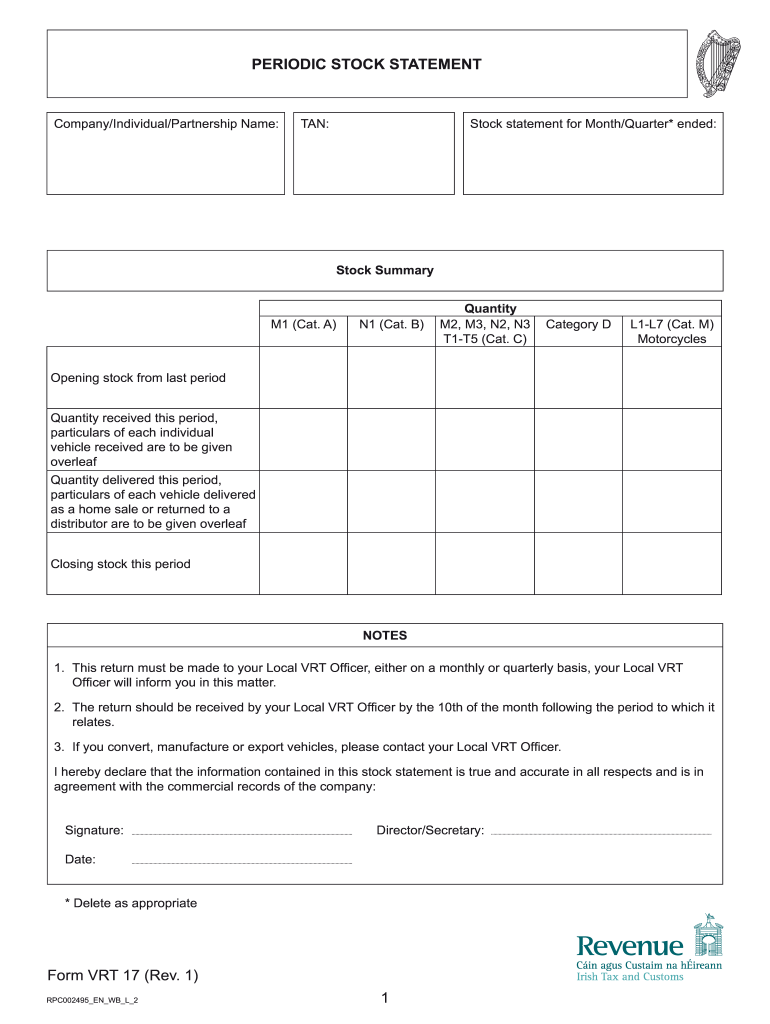

The Vrt 17 form is a crucial document used in the United States for reporting specific financial information. It is often utilized by individuals and businesses to declare their periodic stock statements. This form helps ensure compliance with various tax regulations and provides necessary data to relevant authorities. Understanding the purpose and requirements of the Vrt 17 is essential for accurate financial reporting.

How to use the Vrt 17

Using the Vrt 17 form involves several steps to ensure that all required information is accurately reported. Begin by gathering all necessary financial documents that pertain to your stock holdings. Next, carefully fill out each section of the form, ensuring that all data is correct and complete. It is advisable to review the form for any errors or omissions before submission. Once completed, the form can be submitted electronically or through traditional mail, depending on your preference and the specific requirements of your local authorities.

Steps to complete the Vrt 17

Completing the Vrt 17 form requires attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including previous stock statements.

- Fill in personal information accurately, including your name, address, and identification number.

- Provide details about your stock holdings, including quantities and values.

- Review all entries for accuracy and completeness.

- Submit the form electronically or via mail, as per your preference.

Legal use of the Vrt 17

The Vrt 17 form must be used in compliance with applicable laws and regulations. This includes ensuring that all information provided is truthful and accurate. Falsifying data on the form can lead to legal penalties, including fines or other repercussions. It is important to understand the legal implications of submitting this form and to seek guidance if there are uncertainties regarding its use.

Required Documents

To successfully complete the Vrt 17 form, you will need several key documents. These typically include:

- Previous stock statements for reference.

- Identification documents, such as a driver's license or social security number.

- Financial records that detail stock purchases and sales.

- Any other relevant documentation that supports the information reported on the form.

Form Submission Methods

The Vrt 17 form can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online submission via a secure portal, which is often the fastest option.

- Mailing the completed form to the appropriate agency, ensuring it is sent via a reliable service.

- In-person submission at designated offices, which may be necessary for certain circumstances.

Quick guide on how to complete form vrt 17 period stock statement periodic stock statement revenue

A concise guide on how to prepare your Vrt 17

Finding the appropriate template can be difficult when you need to submit official international documents. Even with the correct form in hand, it can be cumbersome to swiftly prepare it according to all the specifications if you are using physical copies instead of handling everything digitally. airSlate SignNow is the web-based eSignature solution that assists you in overcoming these challenges. It allows you to obtain your Vrt 17 and efficiently complete and sign it on the spot without needing to reprint documents whenever you make an error.

Follow these steps to prepare your Vrt 17 using airSlate SignNow:

- Click the Get Form button to upload your document to our editor instantly.

- Begin with the first empty field, enter your information, and proceed with the Next tool.

- Fill in the empty fields using the Cross and Check tools from the menu above.

- Choose the Highlight or Line options to mark the most crucial details.

- Click on Image and upload one if your Vrt 17 needs it.

- Make use of the right-side panel to add more fields for you or others to complete if needed.

- Review your responses and validate the template by selecting Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

Once your Vrt 17 is ready, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Don’t waste time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

How do you file an election 83(b) form/statement to the IRS for a foreign founder that has no SSN? Do we have to somehow register these founders with the IRS before they are granted restricted stock?

Okay, I'm going to answer my own question here now that I know the answer.First of all, foreigners technically don't need to file an 83(b) since they are not liable for US taxes. If there is no chance that those foreign founders will ever live in the US during the vesting period, you can safely forego the 83(b)However, you should file the 83(b) anyways by putting "Applied for" in the field where the 83(b) election asks for the SSN/Taxpayer Identification Number. Technically, you don't even need to apply for an SSN/TIN until the founder actually needs it (i.e. they move to the US to work for the startup there). All you need to defend the 83(b) election in the case a founder becomes subject to US taxes is the stamped/signNowd 83(b) election back from the IRS. You can just hold on to that in case you ever need it and whenever you do happen to file for an SSN/TIN, you simply include it with your SSN/TIN filing. So, in summary, you should:1) File the 83(b) election for everyone within 30-days of the equity/options grant, always, placing "applied for" in the space where you'd normally put the SSN/TIN2) Hold onto the IRS stamped/signNowd 83(b) election form that you get back from the IRS. 3) If the founder ever does apply for a US SSN/TIN during the vesting period, include the stamped/signNowd 83(b) election among all the paperwork being submitted.Disclaimer: I'm not an attorney, but I got this advice directly from one of Silicon Valley startup lawyers that was very highly upvoted here: Who are some of the best startup lawyers in Silicon Valley?

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

Create this form in 5 minutes!

How to create an eSignature for the form vrt 17 period stock statement periodic stock statement revenue

How to generate an electronic signature for the Form Vrt 17 Period Stock Statement Periodic Stock Statement Revenue in the online mode

How to generate an eSignature for your Form Vrt 17 Period Stock Statement Periodic Stock Statement Revenue in Chrome

How to generate an electronic signature for putting it on the Form Vrt 17 Period Stock Statement Periodic Stock Statement Revenue in Gmail

How to generate an electronic signature for the Form Vrt 17 Period Stock Statement Periodic Stock Statement Revenue straight from your smartphone

How to create an electronic signature for the Form Vrt 17 Period Stock Statement Periodic Stock Statement Revenue on iOS

How to create an electronic signature for the Form Vrt 17 Period Stock Statement Periodic Stock Statement Revenue on Android

People also ask

-

What is the form vrt17 form and what is its primary purpose?

The form vrt17 form is a document used primarily for vehicle registration and tax purposes. It helps streamline the process by providing all necessary information in one concise format, ensuring compliance with local regulations.

-

How does airSlate SignNow simplify the signing process for the form vrt17 form?

airSlate SignNow offers a user-friendly interface that allows you to upload, edit, and send the form vrt17 form for electronic signatures. The platform ensures that signing is quick and secure, saving you time and hassle compared to traditional paper methods.

-

Is there a free trial available for the airSlate SignNow service for the form vrt17 form?

Yes, airSlate SignNow provides a free trial that allows you to test the features related to the form vrt17 form. This trial period helps you evaluate the solution's benefits before committing to a paid plan.

-

What features does airSlate SignNow offer for managing the form vrt17 form?

airSlate SignNow offers numerous features for the form vrt17 form, including template creation, real-time tracking of document status, and integration with other applications. These features enhance efficiency and ensure smooth document management.

-

Can I integrate airSlate SignNow with other software for handling the form vrt17 form?

Absolutely, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and Salesforce. This allows you to streamline workflows and manage the form vrt17 form across different platforms effortlessly.

-

What are the pricing options for using airSlate SignNow for the form vrt17 form?

airSlate SignNow offers competitive pricing plans based on user needs for managing documents like the form vrt17 form. You can choose from individual, business, or enterprise plans, each with tailored features and capabilities.

-

What security measures does airSlate SignNow implement for the form vrt17 form?

Security is a top priority at airSlate SignNow. When handling the form vrt17 form, the platform employs advanced encryption, ensuring that all documents are protected against unauthorized access and bsignNowes.

Get more for Vrt 17

- Agreement for payment of unpaid rent montana form

- Commercial lease assignment from tenant to new tenant montana form

- Tenant consent to background and reference check montana form

- Residential lease or rental agreement for month to month montana form

- Residential rental lease agreement montana form

- Tenant welcome letter montana form

- Warning of default on commercial lease montana form

- Warning of default on residential lease montana form

Find out other Vrt 17

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template