Vermont Chapter 13 Form

What is the Vermont Chapter 13?

The Vermont Chapter 13 is a legal framework that allows individuals to reorganize their debts under the supervision of a bankruptcy court. This form is specifically designed for those who wish to create a repayment plan to pay off their debts over a period of three to five years. It is particularly beneficial for individuals who have a regular income and want to retain their property while managing their financial obligations. By filing for Chapter 13, debtors can stop foreclosure proceedings, repossessions, and wage garnishments, providing a structured approach to regaining financial stability.

Steps to complete the Vermont Chapter 13

Completing the Vermont Chapter 13 form involves several critical steps to ensure accuracy and compliance with legal requirements. First, gather all necessary financial documents, including income statements, tax returns, and a list of debts. Next, fill out the Vermont Chapter 13 form, detailing your income, expenses, and debts. It is essential to create a repayment plan that outlines how you intend to pay off your creditors over the specified period. Once completed, submit the form to the appropriate bankruptcy court in Vermont. After submission, attend the required court hearings to confirm your repayment plan.

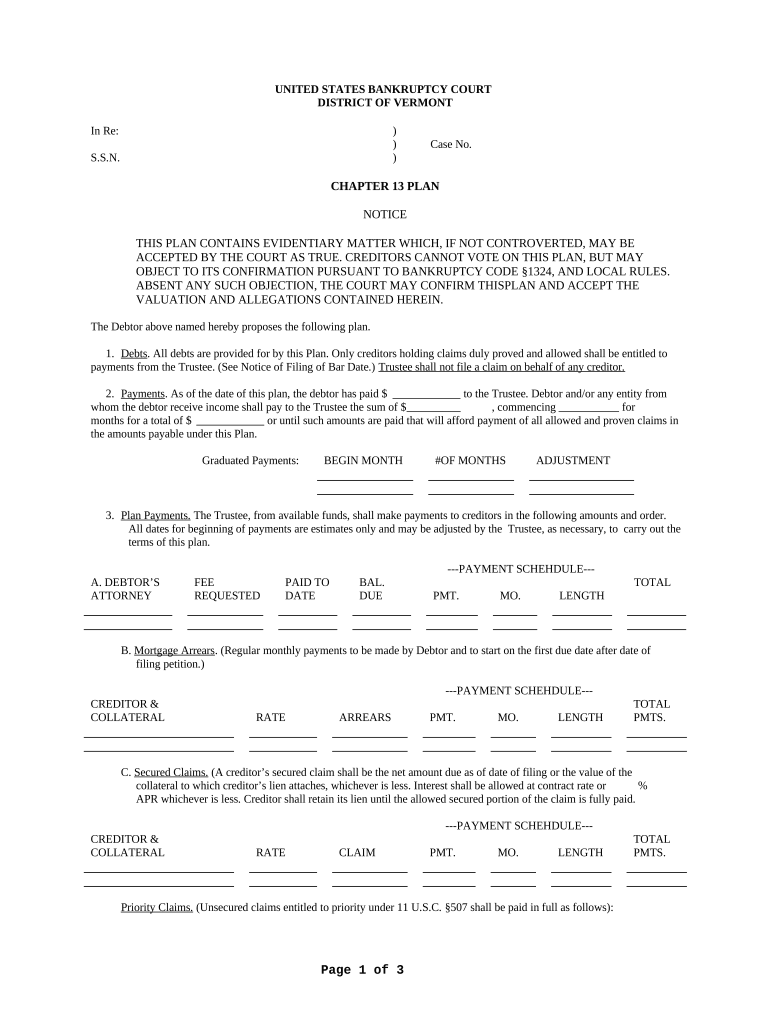

Key elements of the Vermont Chapter 13

The Vermont Chapter 13 form includes several key elements that are crucial for its validity. These elements consist of personal information, a comprehensive list of debts, a detailed budget, and a proposed repayment plan. The repayment plan must demonstrate how the debtor intends to allocate their disposable income towards repaying creditors. Additionally, the form requires the debtor to disclose any property owned and its value, as well as any secured debts. Ensuring that all information is accurate and complete is vital for the approval of the Chapter 13 plan.

Eligibility Criteria

To qualify for the Vermont Chapter 13, individuals must meet specific eligibility criteria. Primarily, the debtor must have a regular income, which can be from employment, self-employment, or other sources. Additionally, there are limits on the amount of secured and unsecured debt a debtor can have, which are adjusted periodically. It is important for individuals to assess their financial situation against these criteria to determine if Chapter 13 is a suitable option for their debt relief needs.

Required Documents

When filing the Vermont Chapter 13 form, several documents are required to support the application. These documents typically include proof of income, such as pay stubs or tax returns, a list of all debts, and a detailed account of monthly expenses. Additionally, debtors may need to provide documentation of any assets they own, including real estate and personal property. Having these documents organized and readily available can streamline the filing process and facilitate a smoother court review.

Form Submission Methods

The Vermont Chapter 13 form can be submitted through various methods, including online filing, mail, or in-person submission at the local bankruptcy court. Each method has its own requirements and processing times. Online filing is often the quickest option, allowing for immediate confirmation of submission. Mail submissions should be sent with sufficient time to ensure they are received by the court by the filing deadline. In-person submissions can provide an opportunity to ask questions directly to court staff, but may require waiting in line.

Legal use of the Vermont Chapter 13

The legal use of the Vermont Chapter 13 form is governed by federal bankruptcy laws, which provide a structured process for debtors seeking relief. This form must be filled out accurately and submitted in accordance with court rules to be considered valid. The legal framework ensures that debtors have the opportunity to reorganize their debts while protecting their rights and interests. Understanding the legal implications of filing for Chapter 13 is essential for individuals to navigate the bankruptcy process effectively.

Quick guide on how to complete vermont chapter 13

Complete Vermont Chapter 13 easily on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed forms, enabling you to access the necessary template and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Vermont Chapter 13 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-based process today.

How to modify and eSign Vermont Chapter 13 effortlessly

- Obtain Vermont Chapter 13 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choice. Modify and eSign Vermont Chapter 13 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Vermont Chapter 13 and how can airSlate SignNow assist with it?

Vermont Chapter 13 is a type of bankruptcy filing that allows individuals to reorganize their debts under the supervision of a court. airSlate SignNow can streamline the document preparation and signing process, making it easier for clients and attorneys to manage Chapter 13 filings efficiently.

-

How much does airSlate SignNow cost for handling Vermont Chapter 13 documents?

airSlate SignNow offers a cost-effective solution for managing Vermont Chapter 13 documents, with various pricing plans tailored to meet different business needs. You can choose from flexible subscription options, ensuring you only pay for what you need while keeping your budget in check.

-

What features does airSlate SignNow offer for Vermont Chapter 13 clients?

For Vermont Chapter 13 clients, airSlate SignNow provides features like secure eSigning, customizable templates, and document tracking. These features help streamline the legal document process, ensuring that all necessary paperwork is handled efficiently and securely.

-

Are there integrations available with airSlate SignNow for Vermont Chapter 13?

Yes, airSlate SignNow offers a variety of integrations with popular tools and platforms that can assist with Vermont Chapter 13 processes. This allows users to sync their data and enhance their workflows seamlessly, ensuring a smoother experience during the bankruptcy filing.

-

What benefits does airSlate SignNow provide for Vermont Chapter 13 bankruptcy attorneys?

airSlate SignNow empowers Vermont Chapter 13 bankruptcy attorneys by simplifying the document workflow through electronic signatures and streamlined processes. This results in reduced administrative tasks, allowing attorneys to focus more on their clients and case strategies.

-

Can individual debtors use airSlate SignNow for Vermont Chapter 13 filings?

Absolutely! Individual debtors can utilize airSlate SignNow to manage their Vermont Chapter 13 filings effortlessly. The platform makes it easy to complete, sign, and send necessary documents, ensuring that individuals stay organized throughout the bankruptcy process.

-

Is airSlate SignNow secure for Vermont Chapter 13 legal documents?

Yes, airSlate SignNow prioritizes security, ensuring that all Vermont Chapter 13 documents are safely handled. The platform uses secure encryption, compliance with legal standards, and audit trails, allowing users to trust that their sensitive information is protected.

Get more for Vermont Chapter 13

- Fraud claims and forms

- Electronics cars fashion collectibles ampampamp moreebay form

- Corporate lender form

- Control number ca s124 form

- Free small claims information sheet what is a small claims

- Other plaintiffs name form

- Sc 101 attorney fee dispute after arbitration attachment to form

- This form is attached to

Find out other Vermont Chapter 13

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free