Partial Release of Property from Mortgage by Individual Holder Vermont Form

What is the Partial Release Of Property From Mortgage By Individual Holder Vermont

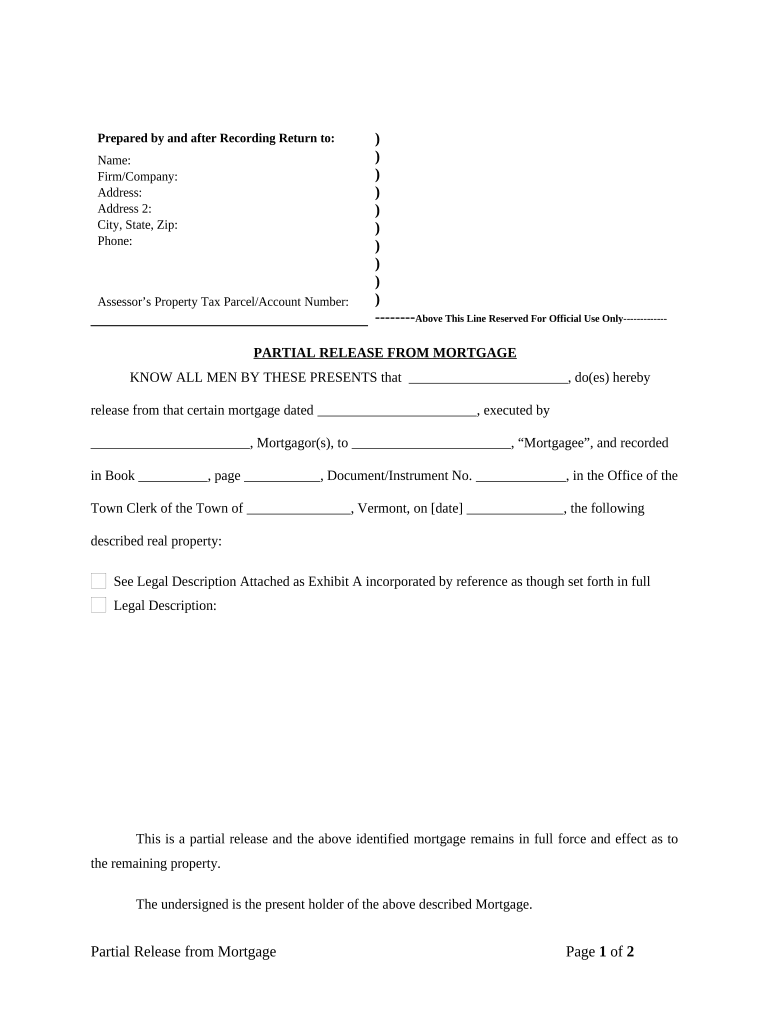

The Partial Release Of Property From Mortgage By Individual Holder in Vermont is a legal document that allows a property owner to remove a portion of their property from the encumbrance of a mortgage. This process is often necessary when a property is being subdivided or when a portion is being sold while the remaining property still serves as collateral for the mortgage. The release ensures that the lender acknowledges the removal of the specified portion from the mortgage agreement, thereby clarifying ownership rights and responsibilities.

How to use the Partial Release Of Property From Mortgage By Individual Holder Vermont

Steps to complete the Partial Release Of Property From Mortgage By Individual Holder Vermont

Completing the Partial Release Of Property From Mortgage By Individual Holder in Vermont involves several key steps:

- Identify the specific property portion to be released from the mortgage.

- Gather necessary documentation, including the original mortgage agreement and any amendments.

- Consult with the lender to understand their requirements for the release.

- Fill out the Partial Release form accurately, ensuring all details are correct.

- Obtain the necessary signatures from all parties involved, including the lender.

- Submit the completed form to the county recorder's office for recording.

Key elements of the Partial Release Of Property From Mortgage By Individual Holder Vermont

Several key elements must be included in the Partial Release Of Property From Mortgage By Individual Holder in Vermont:

- The legal description of the property being released.

- The original mortgage details, including the date and parties involved.

- A statement indicating the lender's consent to the release.

- Signatures of the property owner and the lender.

- The date of execution of the release.

State-specific rules for the Partial Release Of Property From Mortgage By Individual Holder Vermont

In Vermont, specific rules govern the Partial Release Of Property From Mortgage. The document must comply with state laws regarding property transactions and must be recorded in the county where the property is located. Additionally, the lender's consent is crucial, as they hold the mortgage rights. It is advisable to check for any local regulations that may affect the release process, as these can vary by county.

Legal use of the Partial Release Of Property From Mortgage By Individual Holder Vermont

The legal use of the Partial Release Of Property From Mortgage By Individual Holder in Vermont ensures that the property owner can manage their real estate effectively without jeopardizing the lender's interests. By formally releasing a portion of the property from the mortgage, the owner can sell, transfer, or develop that part of the property without the mortgage encumbrance. This legal process is crucial for maintaining clear property titles and protecting the rights of all parties involved.

Quick guide on how to complete partial release of property from mortgage by individual holder vermont

Prepare Partial Release Of Property From Mortgage By Individual Holder Vermont easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Partial Release Of Property From Mortgage By Individual Holder Vermont on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to alter and electronically sign Partial Release Of Property From Mortgage By Individual Holder Vermont effortlessly

- Obtain Partial Release Of Property From Mortgage By Individual Holder Vermont and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Partial Release Of Property From Mortgage By Individual Holder Vermont and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Partial Release Of Property From Mortgage By Individual Holder in Vermont?

A Partial Release Of Property From Mortgage By Individual Holder in Vermont is a legal process that allows a property owner to remove a portion of their property from a mortgage obligation. This typically benefits the owner when selling part of the property or refinancing. In this way, you can manage your property more effectively without the need to pay off the entire mortgage.

-

How does airSlate SignNow facilitate the Partial Release Of Property From Mortgage By Individual Holder in Vermont?

airSlate SignNow provides an easy-to-use platform to eSign and manage the documents necessary for a Partial Release Of Property From Mortgage By Individual Holder in Vermont. With secure features and a straightforward document workflow, users can efficiently finalize agreements and accelerate the release process.

-

What are the cost implications of a Partial Release Of Property From Mortgage By Individual Holder in Vermont?

The costs associated with a Partial Release Of Property From Mortgage By Individual Holder in Vermont can vary based on your lender’s fees and legal costs. Utilizing airSlate SignNow can help reduce costs by simplifying the signing process and minimizing the need for physical document handling, ultimately saving time and money.

-

Can I integrate airSlate SignNow with other applications for managing a Partial Release Of Property From Mortgage By Individual Holder in Vermont?

Yes, airSlate SignNow offers integrations with various applications that help streamline the process of handling a Partial Release Of Property From Mortgage By Individual Holder in Vermont. By connecting to tools like CRM systems or document storage services, you can enhance your document management efficiency and keep everything organized.

-

What are the benefits of using airSlate SignNow for a Partial Release Of Property From Mortgage By Individual Holder in Vermont?

Using airSlate SignNow for a Partial Release Of Property From Mortgage By Individual Holder in Vermont enhances efficiency, security, and ease of use. The platform allows for quick document access, ensures secure eSigning, and provides a user-friendly experience that simplifies the entire process for both property owners and lenders.

-

What documents are needed for a Partial Release Of Property From Mortgage By Individual Holder in Vermont?

For a Partial Release Of Property From Mortgage By Individual Holder in Vermont, you typically need the original mortgage documents, proof of ownership, and any related agreements or requests. airSlate SignNow helps you prepare and manage these documents electronically, reducing the risk of loss and ensuring a smoother process.

-

Is electronic signing valid for a Partial Release Of Property From Mortgage By Individual Holder in Vermont?

Yes, electronic signing is valid for a Partial Release Of Property From Mortgage By Individual Holder in Vermont, provided it adheres to state laws and regulations. airSlate SignNow complies with legal standards, ensuring that your eSigned documents hold the same legal weight as traditional signatures.

Get more for Partial Release Of Property From Mortgage By Individual Holder Vermont

- Certificate of payment to the contractor form

- Notice of contest of payment corporation form

- By this bond we as principal and form

- Services or materials furnished through 20 to form

- Hereby waives and releases its lien and right to claim a lien for labor form

- Florida property lien statutes florida mechanics lien law form

- Demand for reclamation individual form

- Bankruptcy law news reclamation or section 503b9 claim form

Find out other Partial Release Of Property From Mortgage By Individual Holder Vermont

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document