Quitclaim Deed from Corporation to Two Individuals Washington Form

What is the Quitclaim Deed From Corporation To Two Individuals Washington

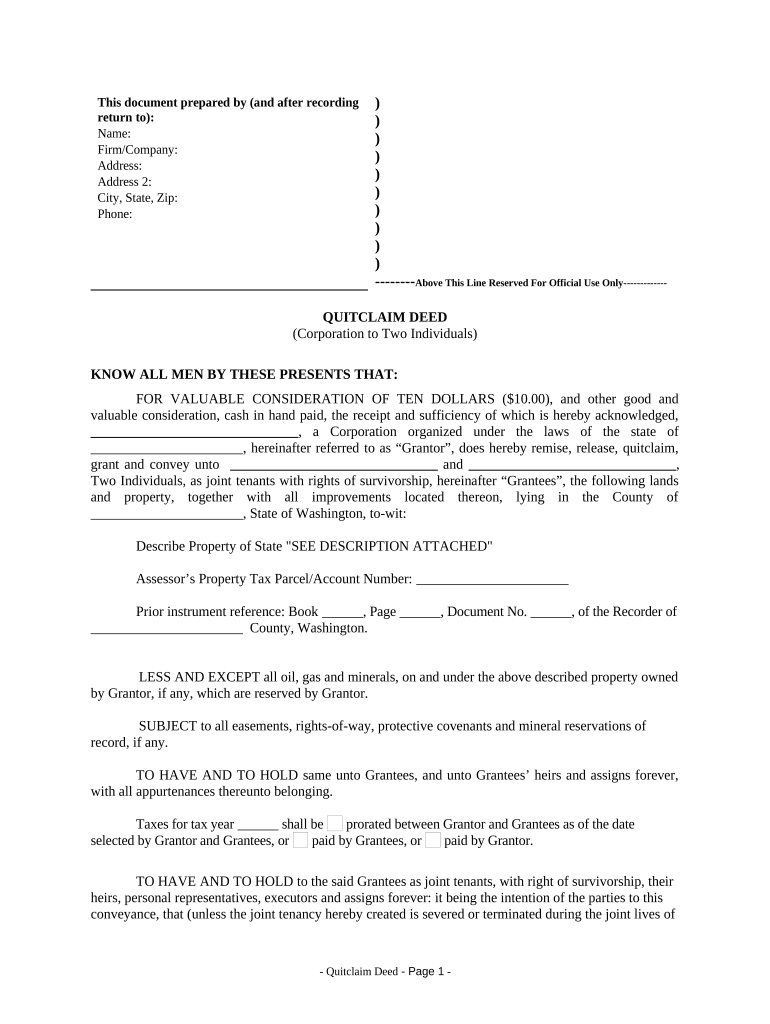

A quitclaim deed from a corporation to two individuals is a legal document that allows a corporation to transfer its interest in a property to two individuals without making any guarantees about the title. This type of deed is often used in real estate transactions where the grantor (the corporation) does not wish to be held liable for any claims against the property. It is essential in Washington to ensure that the deed is executed correctly to avoid potential disputes over property ownership.

Steps to Complete the Quitclaim Deed From Corporation To Two Individuals Washington

Completing a quitclaim deed in Washington involves several important steps:

- Gather necessary information, including the names of the corporation and the individuals, the legal description of the property, and the date of the transfer.

- Obtain the appropriate quitclaim deed form, which can be found through legal resources or local government offices.

- Fill out the form accurately, ensuring all parties' names and property details are correct.

- Have the deed signed by an authorized representative of the corporation in the presence of a notary public.

- Record the completed quitclaim deed with the county recorder’s office where the property is located to make the transfer official.

Key Elements of the Quitclaim Deed From Corporation To Two Individuals Washington

When preparing a quitclaim deed, several key elements must be included to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of the corporation (grantor) and the two individuals (grantees).

- Property Description: A detailed legal description of the property being transferred, including parcel numbers and boundaries.

- Consideration: The amount paid for the property, if applicable, or a statement indicating that the transfer is a gift.

- Execution: Signatures of the authorized corporate representative and a notary public to validate the deed.

- Recording Information: A statement indicating where the deed will be recorded to provide public notice of the transfer.

State-Specific Rules for the Quitclaim Deed From Corporation To Two Individuals Washington

In Washington, specific rules govern the execution and recording of quitclaim deeds. It is crucial to comply with these regulations to ensure the deed is legally binding:

- The deed must be signed by an authorized officer of the corporation.

- Notarization is required for the deed to be valid.

- The deed must be recorded within a specific time frame to protect the interests of the grantees.

- Washington law mandates that the property description must be precise and accurate to avoid future disputes.

Legal Use of the Quitclaim Deed From Corporation To Two Individuals Washington

The quitclaim deed serves a specific legal purpose in property transactions. It is commonly used for:

- Transferring property ownership between family members or business partners.

- Clearing up title issues by relinquishing any claims the corporation may have on the property.

- Facilitating property transfers in divorce settlements or estate planning.

How to Obtain the Quitclaim Deed From Corporation To Two Individuals Washington

To obtain a quitclaim deed in Washington, follow these steps:

- Visit a local legal stationery store or search online for a downloadable quitclaim deed template specific to Washington.

- Consult with a real estate attorney to ensure the form meets all legal requirements.

- Contact your local county recorder’s office for guidance on any specific forms or requirements they may have.

Quick guide on how to complete quitclaim deed from corporation to two individuals washington

Prepare Quitclaim Deed From Corporation To Two Individuals Washington effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without hindrance. Manage Quitclaim Deed From Corporation To Two Individuals Washington on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Quitclaim Deed From Corporation To Two Individuals Washington without any hassle

- Obtain Quitclaim Deed From Corporation To Two Individuals Washington and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Alter and eSign Quitclaim Deed From Corporation To Two Individuals Washington to ensure excellent communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Corporation To Two Individuals in Washington?

A Quitclaim Deed From Corporation To Two Individuals in Washington is a legal document that transfers ownership of property from a corporation to two individuals. This type of deed does not guarantee that the property title is clear or free of claims; it merely conveys whatever interest the corporation may have in the property.

-

What are the benefits of using a Quitclaim Deed From Corporation To Two Individuals in Washington?

Using a Quitclaim Deed From Corporation To Two Individuals in Washington simplifies the transfer process, making it fast and straightforward. It is particularly beneficial when a corporation is dissolving or reallocating assets to individuals, as it allows for the immediate transfer of ownership without extensive legal complications.

-

How do I obtain a Quitclaim Deed From Corporation To Two Individuals in Washington?

To obtain a Quitclaim Deed From Corporation To Two Individuals in Washington, visit an online service like airSlate SignNow to create and eSign your document easily. You’ll need to provide the necessary details about the property and the individuals involved to generate a valid deed.

-

What is the cost associated with a Quitclaim Deed From Corporation To Two Individuals in Washington?

The cost for a Quitclaim Deed From Corporation To Two Individuals in Washington can vary depending on the service provider you choose. airSlate SignNow offers an affordable solution for eSigning and sending documents efficiently, ensuring you can complete your deed transfer without breaking the bank.

-

Can I customize a Quitclaim Deed From Corporation To Two Individuals in Washington?

Absolutely! With airSlate SignNow, you can easily customize your Quitclaim Deed From Corporation To Two Individuals in Washington to meet your specific needs. The platform provides templates that allow you to insert the relevant details and tailor the document to your requirements.

-

Is a Quitclaim Deed From Corporation To Two Individuals legally binding in Washington?

Yes, a Quitclaim Deed From Corporation To Two Individuals is legally binding in Washington as long as it is executed correctly. Ensure that the deed is signed, signNowd, and recorded with the county to ensure its enforceability.

-

What features does airSlate SignNow offer for eSigning a Quitclaim Deed From Corporation To Two Individuals in Washington?

airSlate SignNow provides a range of features for eSigning documents, including customizable templates, secure cloud storage, and real-time tracking. These features facilitate a smooth experience when handling a Quitclaim Deed From Corporation To Two Individuals in Washington, ensuring all parties are informed and engaged.

Get more for Quitclaim Deed From Corporation To Two Individuals Washington

- Liable for damages suffered by an injury to or the death of a form

- Pension task force report on public employee retirement form

- Said pets within days or face eviction form

- I reserve all legal rights and remedies with form

- Signature of tenant date form

- Bathroom area form

- Remedies to which i am entitled under our lease agreement and applicable law form

- Remedies under applicable law and our lease agreement form

Find out other Quitclaim Deed From Corporation To Two Individuals Washington

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF