Claim Exemption Form

What is the Claim Exemption Form

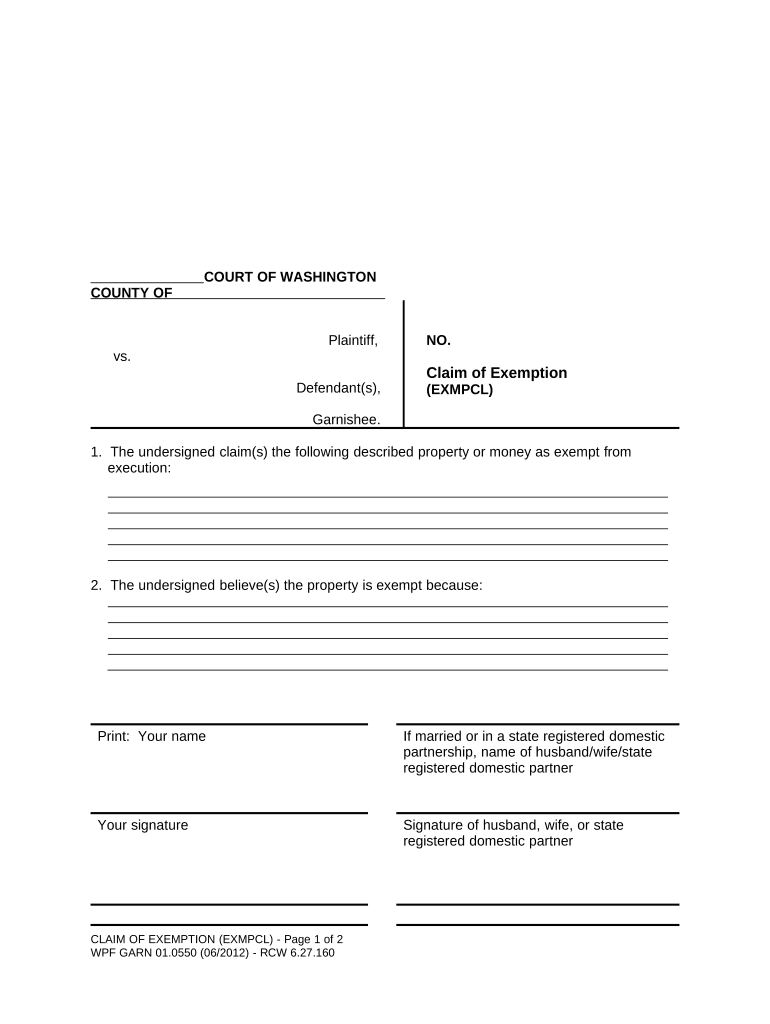

The claim exemption form is a crucial document used by individuals or businesses to request exemption from certain taxes or fees. This form serves as a formal declaration, allowing taxpayers to assert their eligibility for specific exemptions under U.S. tax laws. It is essential for ensuring compliance with federal and state regulations while also providing a means to reduce tax liabilities. Understanding the purpose and implications of the claim exemption form is vital for effective tax planning and compliance.

How to Use the Claim Exemption Form

Using the claim exemption form involves several straightforward steps. First, ensure you have the correct version of the form, as there may be variations depending on the state or specific exemption type. Next, carefully fill out the required fields, providing accurate information regarding your eligibility for the exemption. Once completed, review the form for any errors before submission. It is advisable to keep a copy for your records. Depending on the jurisdiction, you may submit the form online, by mail, or in person.

Steps to Complete the Claim Exemption Form

Completing the claim exemption form requires attention to detail. Follow these steps for successful submission:

- Obtain the correct form from the relevant tax authority.

- Fill in your personal or business information accurately.

- Specify the type of exemption you are claiming and provide supporting documentation if necessary.

- Review the form thoroughly to ensure all information is correct.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal Use of the Claim Exemption Form

The legal use of the claim exemption form is essential for ensuring that the document is recognized by tax authorities. To be legally valid, the form must be completed accurately and submitted within the required timeframes. Compliance with relevant laws and regulations, such as the Internal Revenue Code, is crucial. Additionally, the use of digital signatures can enhance the legal standing of the form, provided that the signing process adheres to eSignature laws.

Eligibility Criteria

Eligibility for filing a claim exemption form varies based on the specific exemption being sought. Generally, individuals or businesses must meet certain criteria, such as income thresholds, type of business entity, or specific circumstances that warrant an exemption. It is important to review the guidelines provided by the IRS or state tax authorities to determine if you qualify. Failing to meet the eligibility criteria may result in denial of the claim or potential penalties.

Required Documents

When submitting a claim exemption form, certain documents may be required to support your request. These can include identification, proof of income, previous tax returns, or any other documentation that verifies your eligibility for the exemption. Ensuring that you have all necessary documents ready can streamline the submission process and reduce the likelihood of delays or rejections.

Filing Deadlines / Important Dates

Filing deadlines for the claim exemption form can vary based on the type of exemption and the jurisdiction in which you are filing. It is crucial to be aware of these deadlines to avoid penalties or missed opportunities for tax savings. Typically, deadlines align with tax filing dates, but specific exemptions may have unique timelines. Always check with the relevant tax authority for the most accurate and up-to-date information on filing deadlines.

Quick guide on how to complete claim exemption form 497429541

Effortlessly prepare Claim Exemption Form on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delay. Manage Claim Exemption Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Claim Exemption Form with ease

- Find Claim Exemption Form and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your edits.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device of your preference. Modify and electronically sign Claim Exemption Form and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a claim exemption sample?

A claim exemption sample is a template that businesses use to communicate their tax-exempt status. This sample simplifies the process of providing necessary documentation for exempt transactions. Utilizing a claim exemption sample can help ensure compliance and streamline document management.

-

How can airSlate SignNow assist with claim exemption samples?

airSlate SignNow offers a user-friendly platform that enables businesses to create, send, and eSign claim exemption samples efficiently. With customizable templates, you can easily prepare documents that meet your specific needs. This saves time and reduces errors in the exemption submission process.

-

Is there a cost associated with using claim exemption samples on airSlate SignNow?

While airSlate SignNow provides a range of pricing options, using claim exemption samples falls under standard document management services. You can select a plan that fits your budget, ensuring that creating and managing these samples is both cost-effective and hassle-free.

-

What features does airSlate SignNow offer for managing claim exemption samples?

airSlate SignNow includes features like customizable templates, automated workflows, and secure eSigning for managing claim exemption samples. These tools make it easy to streamline your document processes and enhance collaboration among team members. Additionally, you can track document status in real-time.

-

Can I integrate airSlate SignNow with other applications for handling claim exemption samples?

Yes, airSlate SignNow supports integration with various applications to better manage claim exemption samples. This includes popular software like CRM systems, project management tools, and cloud storage services. Integrations ensure seamless workflows and enhanced productivity.

-

What are the benefits of using airSlate SignNow for claim exemption samples?

Using airSlate SignNow for claim exemption samples enhances efficiency, reduces paperwork, and improves compliance. The platform's ease of use allows businesses to focus on core operations rather than document management. Additionally, the secure eSigning feature ensures that your documents are legally binding and protected.

-

Are there any templates available for claim exemption samples in airSlate SignNow?

Absolutely! airSlate SignNow provides several pre-built templates for claim exemption samples to help you get started quickly. These templates can be customized to fit your business requirements, ensuring that you have a professional and compliant document ready for use in no time.

Get more for Claim Exemption Form

- Artist portal sony fill online printable fillable blank form

- Interior design questionnaire form

- Australia human rights commission form

- Application form for the returning officer position

- New zealand vacancy work form

- Form 151 work health and safety checklist working

- Green dot dispute form 488191053

- Employment court draft eoi form crown law office

Find out other Claim Exemption Form

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free