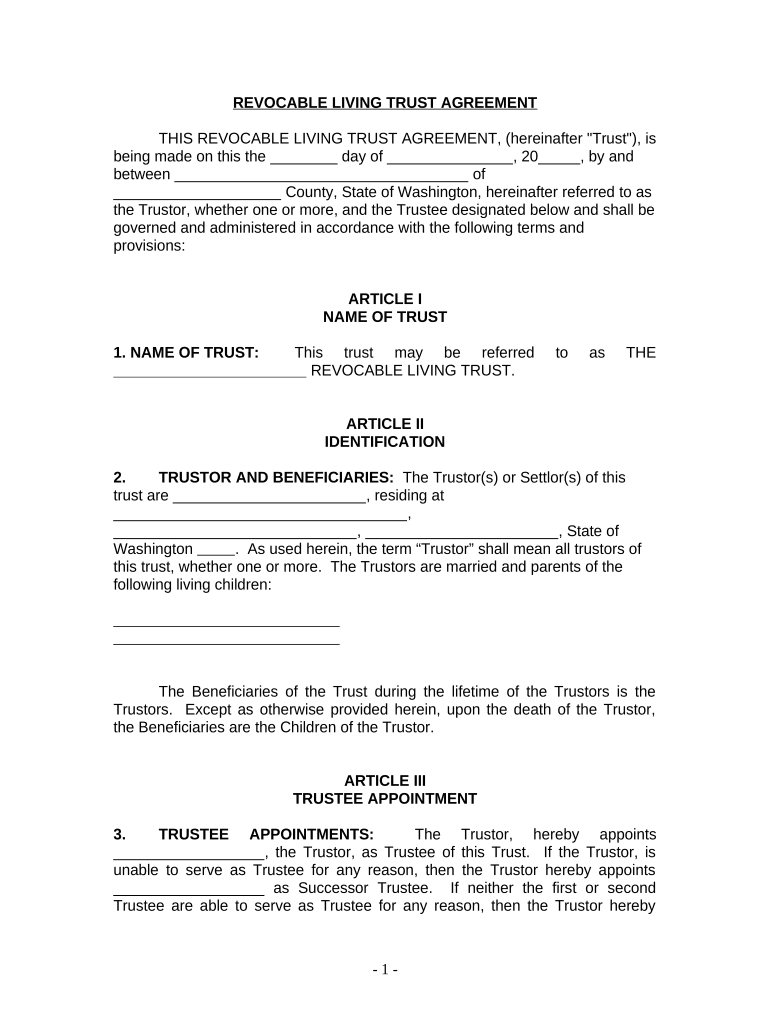

Living Trust for Husband and Wife with Minor and or Adult Children Washington Form

Understanding the Wife Application PDF

The wife application PDF serves as a formal document used in various legal and administrative contexts, particularly in marriage-related matters. This form is essential for couples seeking to formalize their marital status or address specific legal requirements associated with marriage. It typically requires personal information, including names, addresses, and identification details of both partners. Understanding the purpose and requirements of this form is crucial for ensuring compliance with legal standards.

Steps to Complete the Wife Application PDF

Filling out the wife application PDF involves several important steps to ensure accuracy and completeness. Begin by gathering all necessary personal information for both partners, including identification numbers and contact details. Next, carefully read through the instructions provided with the form to understand the specific requirements. Fill in the application with accurate information, making sure to double-check for any errors. Once completed, sign the document where required, and prepare it for submission according to the guidelines specified.

Legal Use of the Wife Application PDF

The wife application PDF holds legal significance, as it may be required for various purposes, including marriage registration and legal recognition of marital status. When completed correctly, this form can serve as a binding document in legal proceedings or administrative processes. It is important to ensure that the application complies with state-specific regulations to avoid any legal complications. Familiarizing yourself with the legal implications of this form is essential for its proper use.

Required Documents for the Wife Application PDF

When preparing to submit the wife application PDF, certain documents may be required to accompany the form. Commonly required documents include government-issued identification, proof of residency, and, in some cases, previous marriage dissolution papers if applicable. Gathering these documents beforehand can streamline the application process and help avoid delays. Ensure that all documents are current and meet the specifications outlined in the application instructions.

Eligibility Criteria for the Wife Application PDF

Eligibility criteria for submitting the wife application PDF can vary based on state laws and regulations. Typically, both partners must be of legal age to marry, which is usually eighteen years in most states. Additionally, individuals must not be currently married to another person unless they are legally divorced. Understanding these criteria is vital to ensure that the application is accepted and processed without issues.

Form Submission Methods for the Wife Application PDF

Submitting the wife application PDF can be done through various methods, depending on local regulations. Common submission methods include online submission via designated government portals, mailing the completed form to the appropriate office, or delivering it in person. Each method may have specific guidelines and requirements, so it is important to follow the instructions provided with the application to ensure timely processing.

Quick guide on how to complete living trust for husband and wife with minor and or adult children washington

Effortlessly Prepare Living Trust For Husband And Wife With Minor And Or Adult Children Washington on Any Device

Digital document management has gained traction among businesses and individuals. It offers a sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Living Trust For Husband And Wife With Minor And Or Adult Children Washington on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Washington seamlessly

- Locate Living Trust For Husband And Wife With Minor And Or Adult Children Washington and click Get Form to begin.

- Use the tools provided to fill out your form.

- Mark important sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to secure your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or missing files, tedious form searches, or mistakes requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Living Trust For Husband And Wife With Minor And Or Adult Children Washington and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a wife application PDF and how can I use it?

A wife application PDF is a document template that can be used to apply for spousal benefits or services. You can easily fill out, sign, and send this PDF using airSlate SignNow, making the application process quick and efficient.

-

How much does it cost to use airSlate SignNow for wife application PDF?

AirSlate SignNow offers various pricing plans, including a free trial that allows you to start using the service with no initial cost. Our plans are designed to cater to individual and business needs, ensuring you can affordably handle your wife application PDF and other documents.

-

What features does airSlate SignNow offer for editing a wife application PDF?

AirSlate SignNow provides a range of features for editing your wife application PDF, including the ability to fill in fields, add signatures, and insert dates. Our user-friendly interface ensures that you can make changes easily and efficiently.

-

Can I integrate airSlate SignNow with other applications when using a wife application PDF?

Yes, airSlate SignNow integrates seamlessly with numerous applications like Google Drive, Dropbox, and CRM systems. This allows you to manage your documents, including your wife application PDF, in an organized and efficient manner.

-

Is it safe to upload my wife application PDF to airSlate SignNow?

Absolutely! AirSlate SignNow employs high-level security measures, including encryption and secure cloud storage, to protect your documents, such as the wife application PDF. Your data privacy and security are our top priorities.

-

Can I send my wife application PDF for signature to multiple recipients?

Yes, airSlate SignNow allows you to send your wife application PDF to multiple recipients for signature. This feature streamlines the document signing process, making it faster for collaborative applications.

-

What are the benefits of using airSlate SignNow for a wife application PDF?

Using airSlate SignNow for your wife application PDF offers several benefits, including faster processing times and a paperless workflow. It also enhances the professional appearance of your documentation and ensures that all signatures are legally binding.

Get more for Living Trust For Husband And Wife With Minor And Or Adult Children Washington

- Plaintiffs and file this their complaint against form

- Order regarding pretrial motions 19th judicial circuit court form

- Final judgment of dismissal as to form

- Fathermother and next friend form

- Separate answer of form

- Johnson v thomas polatsidisfindlaw form

- Ruth crowder mother and next friend of walter paul form

- Order overruling motion for j n 0 v form

Find out other Living Trust For Husband And Wife With Minor And Or Adult Children Washington

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template