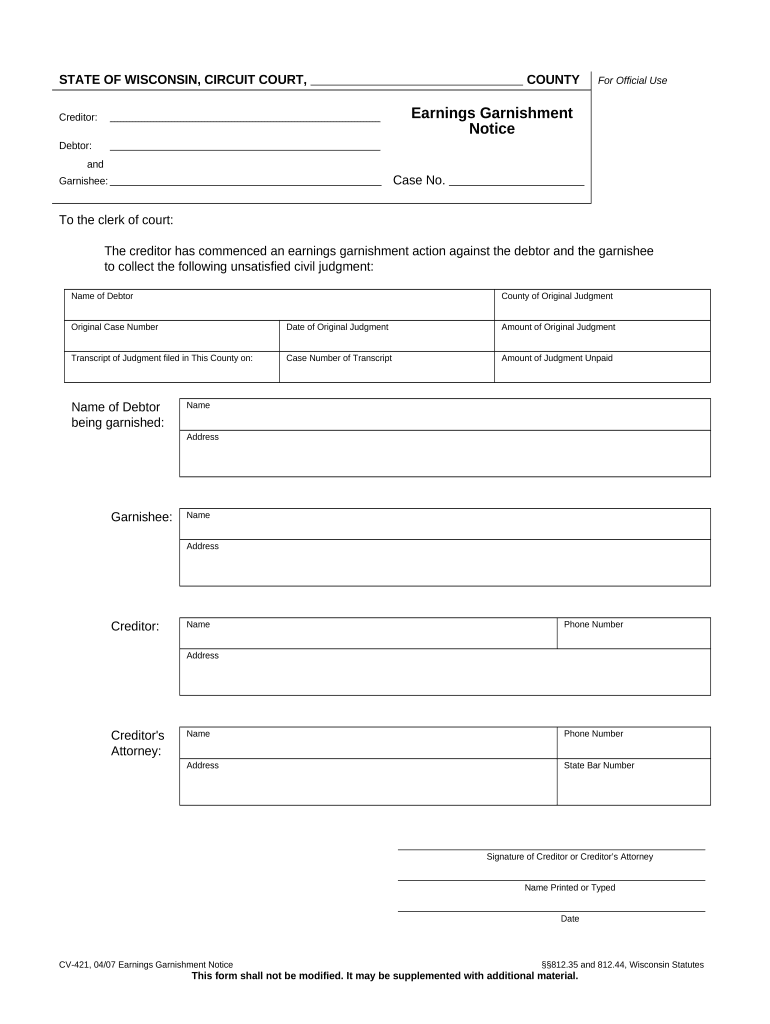

Earnings Garnishment Form

What is the earnings garnishment?

An earnings garnishment is a legal procedure that allows a creditor to collect a portion of a debtor's wages directly from their employer. This process is typically initiated when a court issues a garnishment order, which mandates the employer to withhold a specified amount from the employee's paycheck. The withheld funds are then sent to the creditor until the debt is satisfied. Earnings garnishments are commonly used for various types of debts, including child support, student loans, and unpaid taxes.

Steps to complete the earnings garnishment

Completing an earnings garnishment involves several key steps to ensure compliance with legal requirements. Here is a general outline of the process:

- Obtain a garnishment notice template: This document serves as the basis for notifying the employer and the debtor about the garnishment.

- Fill out the garnishment notice: Include essential details such as the debtor's information, the amount to be garnished, and the reason for the garnishment.

- File the notice with the court: Submit the completed garnishment notice to the appropriate court to obtain a legal judgment.

- Serve the notice to the employer: Deliver the garnishment notice to the debtor's employer, ensuring they understand their obligation to withhold the specified amount from the employee's wages.

- Monitor compliance: Follow up with the employer to ensure that the garnishment is being executed as ordered.

Key elements of the earnings garnishment

Understanding the key elements of an earnings garnishment is vital for both creditors and debtors. The primary components include:

- Garnishment amount: This is the specific portion of the debtor's earnings that will be withheld, often limited by federal and state laws.

- Duration: The garnishment will typically remain in effect until the debt is fully paid or the court orders its termination.

- Notification requirements: Creditors must provide proper notice to both the debtor and their employer before garnishment can begin.

- Exemptions: Certain types of income and specific amounts may be exempt from garnishment, depending on state laws.

Legal use of the earnings garnishment

The legal use of earnings garnishments is governed by various federal and state laws. These regulations ensure that garnishments are conducted fairly and that debtors retain a portion of their income for living expenses. Under the Consumer Credit Protection Act, for example, the maximum amount that can be garnished from an employee's disposable earnings is limited to twenty-five percent or the amount by which their weekly earnings exceed thirty times the federal minimum wage, whichever is less. Understanding these legal frameworks is essential for both creditors seeking to collect debts and debtors wanting to protect their rights.

State-specific rules for the earnings garnishment

Each state has its own rules and regulations regarding earnings garnishment, which can significantly impact the process. It's important to be aware of these state-specific guidelines, as they dictate factors such as:

- The maximum allowable garnishment amount.

- Notification procedures for employers and debtors.

- Exemptions that may apply to certain types of income.

- The duration of the garnishment and any required court hearings.

Consulting state statutes or legal resources can provide valuable insights into these specific rules.

How to use the earnings garnishment

Utilizing an earnings garnishment effectively requires a clear understanding of the process and legal obligations. Creditors should follow the established legal steps, ensuring that all documentation is accurate and submitted timely. Debtors, on the other hand, should be aware of their rights and the protections afforded to them under the law. Engaging with legal counsel can help both parties navigate the complexities of garnishment and ensure compliance with all applicable regulations.

Quick guide on how to complete earnings garnishment

Accomplish Earnings Garnishment seamlessly on any device

Digital document management has become favored among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to generate, modify, and eSign your documents swiftly without delays. Manage Earnings Garnishment on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Earnings Garnishment effortlessly

- Find Earnings Garnishment and click on Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from your preferred device. Alter and eSign Earnings Garnishment and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a garnishment notice template?

A garnishment notice template is a pre-designed document that outlines the legal requirements for notifying an employee or debtor about wage garnishment. It ensures compliance with legal standards and provides necessary information about the garnishment process.

-

How can airSlate SignNow help with garnishment notice templates?

airSlate SignNow offers an easy-to-use platform for creating, sending, and eSigning garnishment notice templates. Our solution allows you to customize templates to fit your needs, ensuring accuracy and efficiency in the garnishment process.

-

Is there a cost associated with using garnishment notice templates?

airSlate SignNow provides a cost-effective solution with pricing plans that can fit various budgets. You can access garnishment notice templates at a competitive price, which helps eliminate the need for expensive legal consultations.

-

What features are included with airSlate SignNow for garnishment notices?

When using airSlate SignNow for garnishment notice templates, you benefit from features like real-time editing, tracking, and secure storage. Additionally, our platform enhances collaboration by allowing multiple users to work on a document simultaneously.

-

Can I integrate airSlate SignNow with other software for managing garnishment notices?

Yes, airSlate SignNow offers integration with various software applications, making it easy to manage garnishment notice templates alongside your other business processes. This capability ensures seamless collaboration and data sharing across platforms.

-

What are the benefits of using a garnishment notice template?

Using a garnishment notice template streamlines the process of notifying debtors about wage garnishment. It saves time and ensures that you consistently meet legal requirements, reducing the risk of errors or compliance issues.

-

How secure is my information when using airSlate SignNow for garnishment notices?

airSlate SignNow prioritizes the security of your information with advanced encryption and secure storage options. This means that your garnishment notice templates and any associated data are protected against unauthorized access.

Get more for Earnings Garnishment

- Whose address is city rhode form

- Rhode island short form power of attorney poa forms and

- Control number ri p109 pkg form

- Rhode island property form

- How to dissolve a corporation in rhode island how to close form

- Ri pc bl form

- Open meetings rhode island department of state rigov form

- Ri rid policy ampamp procedure manual ri registry of interpreters form

Find out other Earnings Garnishment

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement