Wisconsin Garnishment Form

What is the Wisconsin Garnishment?

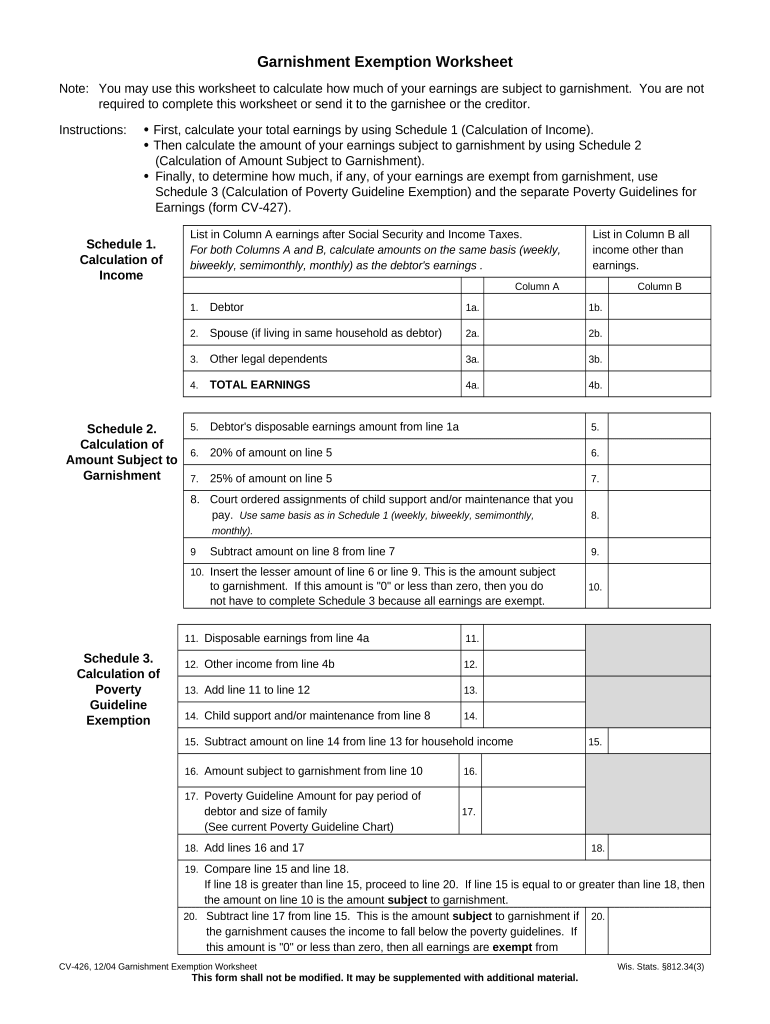

The Wisconsin garnishment refers to a legal process that allows creditors to collect debts by obtaining a portion of a debtor's wages or bank account funds. This process is governed by state law and involves specific procedures that creditors must follow to legally garnish an individual's earnings or assets. The garnishment exemption worksheet in Wisconsin helps individuals determine their eligibility for exemptions, which may protect certain income or assets from being garnished.

Steps to Complete the Wisconsin Garnishment

Completing the Wisconsin garnishment exemption worksheet involves several key steps:

- Gather necessary financial information, including income sources and expenses.

- Fill out the garnishment exemption worksheet accurately, ensuring all details are correct.

- Review the completed worksheet to confirm eligibility for any exemptions that may apply.

- Submit the worksheet to the appropriate court or creditor as required by Wisconsin law.

Key Elements of the Wisconsin Garnishment

Understanding the key elements of the Wisconsin garnishment is essential for individuals facing this process. Important aspects include:

- The types of income that can be garnished, such as wages, bank accounts, and certain benefits.

- Exemption amounts that may apply to protect a portion of income or assets from garnishment.

- The rights of debtors, including the ability to contest a garnishment or claim exemptions.

Eligibility Criteria

Eligibility for exemptions in the Wisconsin garnishment process is determined by various factors, including:

- Income level and type, such as Social Security, unemployment benefits, or child support.

- Number of dependents and overall financial situation.

- Specific state laws that outline what income or assets may be exempt from garnishment.

Legal Use of the Wisconsin Garnishment

The legal use of the Wisconsin garnishment process is strictly regulated. Creditors must follow specific legal procedures to initiate garnishment, which includes:

- Obtaining a court order to garnish wages or bank accounts.

- Providing proper notice to the debtor about the garnishment action.

- Complying with state laws regarding the amount that can be garnished and the timeline for payments.

Form Submission Methods

Individuals can submit the Wisconsin garnishment exemption worksheet through various methods, including:

- Online submission via the court's designated electronic filing system.

- Mailing the completed worksheet to the appropriate court or creditor.

- In-person submission at the local courthouse or creditor's office.

Quick guide on how to complete wisconsin garnishment

Effortlessly Prepare Wisconsin Garnishment on Any Device

Digital document management has become widely embraced by companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly without any hassles. Handle Wisconsin Garnishment on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and eSign Wisconsin Garnishment with Ease

- Obtain Wisconsin Garnishment and click Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Craft your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to preserve your changes.

- Select your preferred method to share your form, whether through email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Wisconsin Garnishment to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a garnishment exemption worksheet in Wisconsin?

A garnishment exemption worksheet in Wisconsin is a form that allows individuals to claim certain income exemptions from garnishment. By using the garnishment exemption worksheet Wisconsin, you can accurately assess which exemptions apply to your income and help protect your funds from creditors.

-

How can airSlate SignNow help with the garnishment exemption worksheet in Wisconsin?

airSlate SignNow facilitates the creation and signing of legal documents, including the garnishment exemption worksheet Wisconsin. Our platform provides an easy-to-use interface for filling out and eSigning these forms efficiently, ensuring you can submit your worksheet quickly.

-

Is there a cost associated with using airSlate SignNow for my garnishment exemption worksheet Wisconsin?

Yes, airSlate SignNow offers various subscription plans that cater to different needs and budgets. We strive to provide a cost-effective solution for businesses and individuals needing to manage their garnishment exemption worksheet Wisconsin documentation seamlessly.

-

Can I customize my garnishment exemption worksheet Wisconsin with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily customize your garnishment exemption worksheet Wisconsin. Our platform allows users to modify templates, add necessary fields, and ensure that all essential information is captured.

-

What features does airSlate SignNow offer for managing legal documents like the garnishment exemption worksheet Wisconsin?

AirSlate SignNow provides several features tailored to managing legal documents, such as templates for the garnishment exemption worksheet Wisconsin, advanced eSigning capabilities, and cloud storage. These features help streamline your documentation process, ensuring access and efficiency.

-

Are there integrations available with airSlate SignNow for processing garnishment exemption worksheets in Wisconsin?

Yes, airSlate SignNow offers various integrations with tools that can simplify your workflow, particularly regarding the garnishment exemption worksheet Wisconsin. You can integrate it with CRM systems, file storage services, and other essential business applications to enhance productivity.

-

Can businesses benefit from using airSlate SignNow for garnishment exemption worksheets in Wisconsin?

Absolutely! Businesses can greatly benefit from using airSlate SignNow for managing garnishment exemption worksheets Wisconsin as it streamlines the signing process, offers legal validity, and ensures compliance. This efficiency saves time and resources, allowing you to focus on core business activities.

Get more for Wisconsin Garnishment

- When due contractor may suspend work on the job until such time as all payments due have been form

- Stairway railings custom woodworking built in shelving cabinetry countertops entry door form

- Insurance contractor shall maintain general liability and workers compensation as well as form

- Kitchen vent form

- Made without breach of the contract pending payment or resolution of any dispute form

- Progress payments form

- Water drainage form

- Owner agrees form

Find out other Wisconsin Garnishment

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself