Surety Company Letter of Credit Form

What is the Surety Company Letter Of Credit Form

The Surety Company Letter Of Credit Form is a crucial document used in various financial transactions, particularly in construction and real estate. This form serves as a guarantee from a bank or financial institution that a specified amount of money will be paid to a beneficiary upon demand, provided that the terms of the letter are met. It is commonly utilized to secure obligations, ensuring that parties involved in a contract are protected against potential defaults.

Key elements of the Surety Company Letter Of Credit Form

Understanding the key elements of the Surety Company Letter Of Credit Form is essential for effective use. The primary components include:

- Beneficiary Information: Details of the individual or entity entitled to receive the funds.

- Applicant Information: Information about the party requesting the letter of credit.

- Amount: The total sum guaranteed by the letter of credit.

- Expiration Date: The date until which the letter of credit is valid.

- Terms and Conditions: Specific requirements that must be fulfilled for the payment to be made.

Steps to complete the Surety Company Letter Of Credit Form

Completing the Surety Company Letter Of Credit Form involves several key steps to ensure accuracy and compliance:

- Gather necessary information about the beneficiary and applicant.

- Clearly state the amount to be guaranteed.

- Define the expiration date of the letter of credit.

- Outline the terms and conditions that govern the letter.

- Review the completed form for accuracy and completeness.

- Submit the form to the issuing bank or financial institution for processing.

Legal use of the Surety Company Letter Of Credit Form

The legal use of the Surety Company Letter Of Credit Form is governed by various regulations and standards. It is essential to ensure that the form complies with the Uniform Commercial Code (UCC) and any relevant state laws. This compliance helps to protect all parties involved and ensures that the letter of credit is enforceable in a court of law. Proper legal use also involves understanding the rights and obligations of all parties, including the beneficiary, applicant, and issuer.

Required Documents

When applying for a Surety Company Letter Of Credit, several documents may be required to support the application. These typically include:

- Business License: Proof of the applicant's legal status to operate.

- Financial Statements: Recent financial documents that demonstrate the applicant's creditworthiness.

- Contractual Agreements: Any contracts that necessitate the use of the letter of credit.

- Identification Documents: Personal identification for individuals involved in the transaction.

Form Submission Methods (Online / Mail / In-Person)

The submission of the Surety Company Letter Of Credit Form can typically be done through various methods, depending on the issuing bank's policies. Common submission methods include:

- Online Submission: Many banks offer digital platforms for submitting forms securely.

- Mail: Traditional postal service can be used to send physical copies of the form.

- In-Person: Applicants may also choose to submit the form directly at a bank branch.

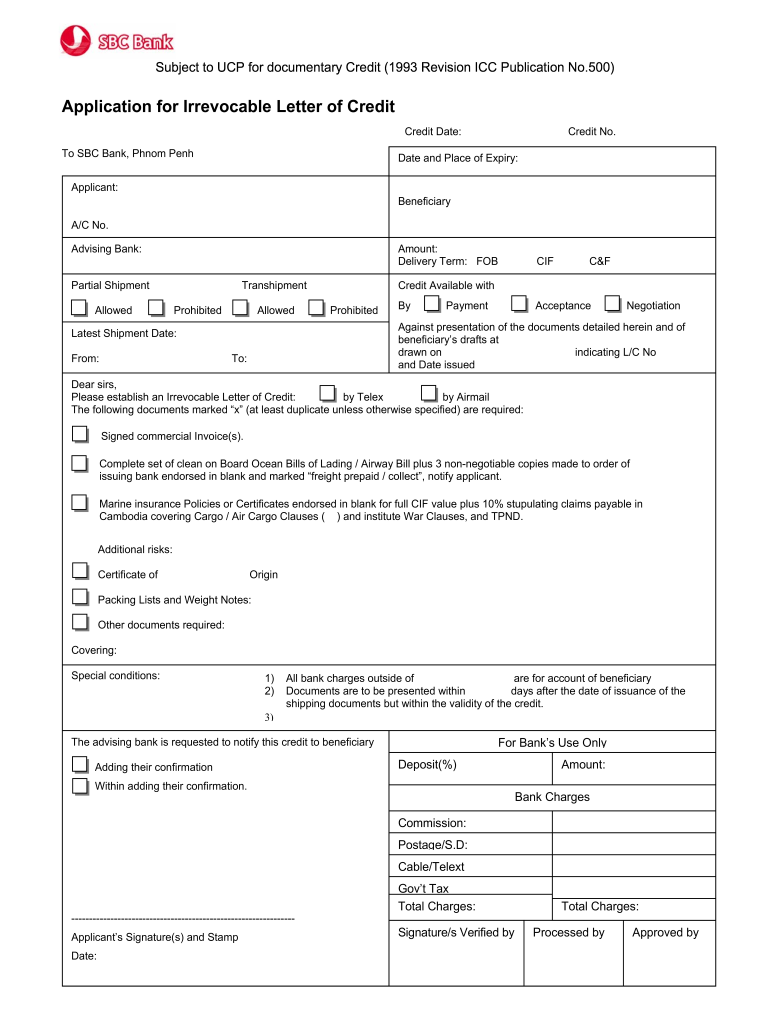

Quick guide on how to complete letter of credit application form sbc bank

The simplest method to locate and endorse Surety Company Letter Of Credit Form

On the scale of your entire organization, ineffective procedures surrounding paper authorization can devour a signNow amount of work hours. Endorsing documents such as Surety Company Letter Of Credit Form is an integral aspect of operations across all sectors, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall productivity of the company. With airSlate SignNow, endorsing your Surety Company Letter Of Credit Form can be as straightforward and swift as possible. This platform offers you the latest version of nearly any form. Even better, you can endorse it immediately without needing to install external software on your computer or print anything on paper.

Steps to obtain and endorse your Surety Company Letter Of Credit Form

- Explore our library by category or utilize the search function to locate the document you require.

- Check the form preview by clicking on Learn more to ensure it’s the correct one.

- Click Get form to begin editing right away.

- Fill out your form and include any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Surety Company Letter Of Credit Form.

- Select the signature option that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options as required.

With airSlate SignNow, you have everything you need to manage your paperwork efficiently. You can discover, complete, edit, and even send your Surety Company Letter Of Credit Form all within a single tab without any inconvenience. Enhance your processes with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

Do I need a bank account to fill out the MHT CET application form?

To apply, you need to pay through online mode. This doesn't necessarily need you to have a bank account. You can ask anyone kind-hearted who is having a bank account to pay and handover the hard cash to that person.Hope this helps.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

What is the success rate of getting a Schengen visa if you provide a valid passport, filled out application form, one-month valid travel insurance, bank statements of the applicant/sponsor, employment contract, cover letter and flight itinerary?

I would say more than 90 percent if your entire documentation is correct and you don’t have any history in your passport. I have travelled to Europe twice since 2016 and my friends too keep travelling. Myself or even they have never faced any issue with schengen Visa.

-

How much does it cost to get a letter of credit from a bank?

Here is an article at Zacks about the fees for letters of credit. One reason people are so excited about the potential of bitcoin is that it could serve as a lower cost way of providing value transfer internationally, particularly in support of smaller company supply chains.

-

Is it necessary for a working bank professional to get permission from the bank zonal office to fill out any further application forms for the competitive exams?

No it's not required at the time of filling the application form but if you mention about your last job in the application form then you definitely need to carry a NOC from your last institution while appearing for dv or interview.

Create this form in 5 minutes!

How to create an eSignature for the letter of credit application form sbc bank

How to create an eSignature for the Letter Of Credit Application Form Sbc Bank in the online mode

How to create an eSignature for the Letter Of Credit Application Form Sbc Bank in Google Chrome

How to create an electronic signature for putting it on the Letter Of Credit Application Form Sbc Bank in Gmail

How to create an eSignature for the Letter Of Credit Application Form Sbc Bank from your smartphone

How to generate an electronic signature for the Letter Of Credit Application Form Sbc Bank on iOS devices

How to generate an electronic signature for the Letter Of Credit Application Form Sbc Bank on Android

People also ask

-

What is a Surety Company Letter Of Credit Form?

A Surety Company Letter Of Credit Form is a financial document issued by a surety company that guarantees payment to a third party in the event of a default. This form is essential for businesses that need to demonstrate financial credibility when entering contracts or agreements.

-

How can airSlate SignNow help with the Surety Company Letter Of Credit Form?

airSlate SignNow simplifies the process of creating, sending, and eSigning your Surety Company Letter Of Credit Form. With our user-friendly platform, you can quickly generate the form, ensuring all necessary details are included for seamless transactions.

-

Is there a cost associated with using airSlate SignNow for the Surety Company Letter Of Credit Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when dealing with the Surety Company Letter Of Credit Form. Our plans are designed to be cost-effective, ensuring you get the most value while streamlining your document processes.

-

What features does airSlate SignNow offer for managing the Surety Company Letter Of Credit Form?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSignature capabilities for your Surety Company Letter Of Credit Form. These tools enhance efficiency and improve accuracy, making the documentation process smoother.

-

Can I integrate airSlate SignNow with my existing systems for the Surety Company Letter Of Credit Form?

Absolutely! airSlate SignNow offers integration capabilities with various software applications, allowing you to incorporate the Surety Company Letter Of Credit Form into your existing workflows. This ensures a seamless experience and enhances productivity.

-

What are the benefits of using airSlate SignNow for the Surety Company Letter Of Credit Form?

Using airSlate SignNow for your Surety Company Letter Of Credit Form provides benefits such as increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed easily whenever needed.

-

How secure is the airSlate SignNow platform for handling the Surety Company Letter Of Credit Form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and authentication measures to protect your Surety Company Letter Of Credit Form and other sensitive documents, ensuring your information remains confidential and secure.

Get more for Surety Company Letter Of Credit Form

- Letter from tenant to landlord with demand that landlord repair plumbing problem nebraska form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497318061 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring nebraska form

- Ne tenant landlord form

- Letter landlord demand sample 497318064 form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles nebraska form

- Letter from tenant to landlord about landlords failure to make repairs nebraska form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497318067 form

Find out other Surety Company Letter Of Credit Form

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement