How to Fill Public Service Commission Form 2007-2026

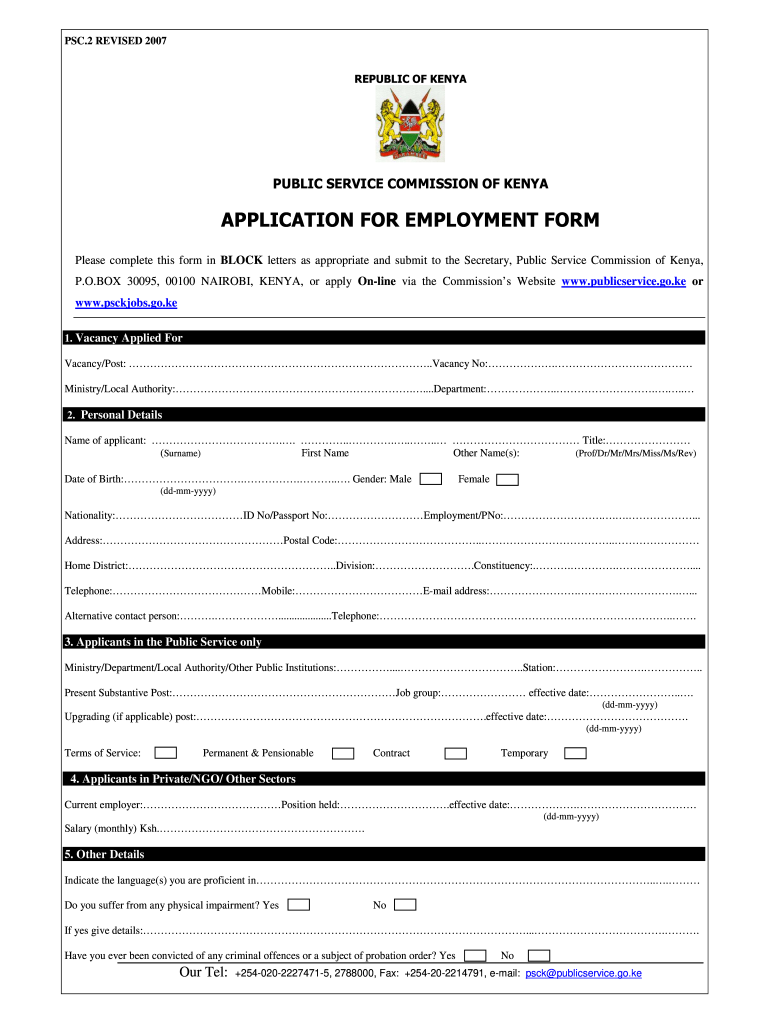

What is the public service commission form?

The public service commission form is an official document used for various administrative processes within government agencies. It serves as a means for individuals to apply for positions, submit information, or request services related to public employment. This form is essential for ensuring that applicants provide the necessary details required for processing their requests efficiently.

How to fill out the public service commission form

Filling out the public service commission form requires careful attention to detail. Begin by gathering all necessary information, including personal identification details, employment history, and any relevant qualifications. Ensure that you read the instructions carefully to understand the specific requirements for each section of the form. Fill in the information accurately, avoiding any errors that could delay processing. If applicable, sign and date the form as required.

Key elements of the public service commission form

The public service commission form typically includes several key elements that are crucial for its validity. These elements often consist of:

- Personal Information: Name, address, contact details, and social security number.

- Employment History: Previous positions held, including job titles and dates of employment.

- Qualifications: Education, certifications, and any relevant training.

- References: Contact information for individuals who can vouch for your qualifications and character.

Steps to complete the public service commission form

To successfully complete the public service commission form, follow these steps:

- Gather all required documentation and information.

- Read the instructions thoroughly to understand what is needed.

- Fill out the form, ensuring accuracy and completeness.

- Review the form for any errors or missing information.

- Sign and date the form where indicated.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the public service commission form

The public service commission form must be used in accordance with applicable laws and regulations. This includes ensuring that all information provided is truthful and accurate. Misrepresentation or falsification of information can lead to legal consequences, including disqualification from employment opportunities. It is vital to understand the legal implications of submitting this form and to comply with all relevant guidelines.

Form submission methods

The public service commission form can typically be submitted through various methods, including:

- Online Submission: Many agencies offer an online portal for submitting forms electronically.

- Mail: You can send a printed version of the form to the designated office via postal service.

- In-Person: Some applicants may choose to deliver the form directly to the agency's office.

Quick guide on how to complete pan example of personal details filled section on psckgoke for an unemployed person form

The optimal method to obtain and sign How To Fill Public Service Commission Form

On a company-wide scale, ineffective procedures surrounding paper approval can take up a signNow amount of work hours. Signing documents like How To Fill Public Service Commission Form is an intrinsic part of business operations across all sectors, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall efficiency of the organization. With airSlate SignNow, signing your How To Fill Public Service Commission Form is as straightforward and rapid as possible. This platform provides you access to the latest version of nearly any document. Even better, you can sign it immediately without needing to install external applications on your device or printing hard copies.

Steps to obtain and sign your How To Fill Public Service Commission Form

- Browse through our collection by category or use the search bar to find the document you require.

- View the document preview by clicking on Learn more to confirm it's the correct one.

- Click Get form to begin editing right away.

- Fill out your document and input any necessary information via the toolbar.

- Upon completion, click the Sign tool to sign your How To Fill Public Service Commission Form.

- Choose the signature option that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can locate, complete, modify, and even send your How To Fill Public Service Commission Form in a single tab without any difficulties. Enhance your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How is an average person expected to get through life in the US without a bureaucracy consultant to advise on how to properly fill out all the paperwork?

The lawmakers expect a reasonable average person to be able to guide self through the maze of laws and regulations.Still, some people value their time or are truthful about their abilities to comprehend things, and instead of getting a self-taught degree in taxation or legal intricacies of a company formation (and accounting/financial issues associated with that), those people choose to hire a professional specializing in those areas.I am personally an accountant (corporate accounting) which is as far away from personal taxes as you can imagine; my tax returns are tied to my spouse's and due to presence of several items which are not a common occurrence in an average person's life, I am not even trying to complete our taxes.I do my due diligence with all the information gathering, schedules, support documentation, record retention and such but I can't spend days pouring over it all to come up with a final number.So, I pay a professional to be on time, on spec, and on budget.With respect to legal advice, laws in US vary by state, so me being able to spend 3 years in law school, and then more years trying to be admitted to each of the Bar associations, and then have the ability to research cases for precedents - that's just not reasonable.Still, there are others who actually love this process, are knowledgeable, and can tell me a solution to my problem within 20 mins. Isn't this worth my money?

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

Do I need to send a physical copy of the application form for a PAN card if I had filled it out online on NSDL using e-Sign/e-KYC?

Refer the following link for detail process for online pan application.How to apply for PAN card

Create this form in 5 minutes!

How to create an eSignature for the pan example of personal details filled section on psckgoke for an unemployed person form

How to generate an eSignature for your Pan Example Of Personal Details Filled Section On Psckgoke For An Unemployed Person Form in the online mode

How to generate an eSignature for the Pan Example Of Personal Details Filled Section On Psckgoke For An Unemployed Person Form in Google Chrome

How to make an eSignature for putting it on the Pan Example Of Personal Details Filled Section On Psckgoke For An Unemployed Person Form in Gmail

How to create an electronic signature for the Pan Example Of Personal Details Filled Section On Psckgoke For An Unemployed Person Form from your mobile device

How to create an electronic signature for the Pan Example Of Personal Details Filled Section On Psckgoke For An Unemployed Person Form on iOS

How to create an eSignature for the Pan Example Of Personal Details Filled Section On Psckgoke For An Unemployed Person Form on Android OS

People also ask

-

What is a PSC form and how does it work with airSlate SignNow?

A PSC form is a document required for various purposes, including submissions to authorities or organizations. With airSlate SignNow, you can easily create, send, and eSign PSC forms digitally, ensuring a smooth and efficient handling of your important paperwork.

-

How can airSlate SignNow help streamline the signing of PSC forms?

AirSlate SignNow simplifies the process of signing PSC forms by providing a user-friendly interface and electronic signing options. This reduces the need for printing and physical signatures, saving time and enhancing workflow efficiency for businesses.

-

Is there a cost associated with using airSlate SignNow for PSC forms?

Yes, airSlate SignNow offers various pricing plans catering to different business needs, including those who frequently handle PSC forms. Depending on your requirements, you can select a plan that best fits your budget while accessing all necessary features.

-

Can I store my PSC forms securely in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your PSC forms. This ensures that your documents are protected and easily accessible whenever you need them, allowing for efficient document management.

-

What features does airSlate SignNow offer for completing PSC forms?

AirSlate SignNow offers a range of features for completing PSC forms, including templates, bulk sending capabilities, and customizable fields. These features enhance the document preparation process, making it quick and user-friendly.

-

Can I integrate airSlate SignNow with other applications for managing PSC forms?

Yes, airSlate SignNow supports integrations with various applications such as Google Drive, Salesforce, and more. This allows for seamless management of PSC forms across different platforms, improving overall efficiency in your workflow.

-

What are the benefits of using airSlate SignNow for PSC forms?

Using airSlate SignNow for PSC forms provides numerous benefits such as faster turnaround times, reduced paper usage, and enhanced document tracking. This not only saves businesses time and resources but also promotes a more sustainable approach to document management.

Get more for How To Fill Public Service Commission Form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession nebraska form

- Letter from tenant to landlord about illegal entry by landlord nebraska form

- Letter from landlord to tenant about time of intent to enter premises nebraska form

- Ne tenant landlord notice form

- Letter from tenant to landlord about sexual harassment nebraska form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children nebraska form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure nebraska form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497318075 form

Find out other How To Fill Public Service Commission Form

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe