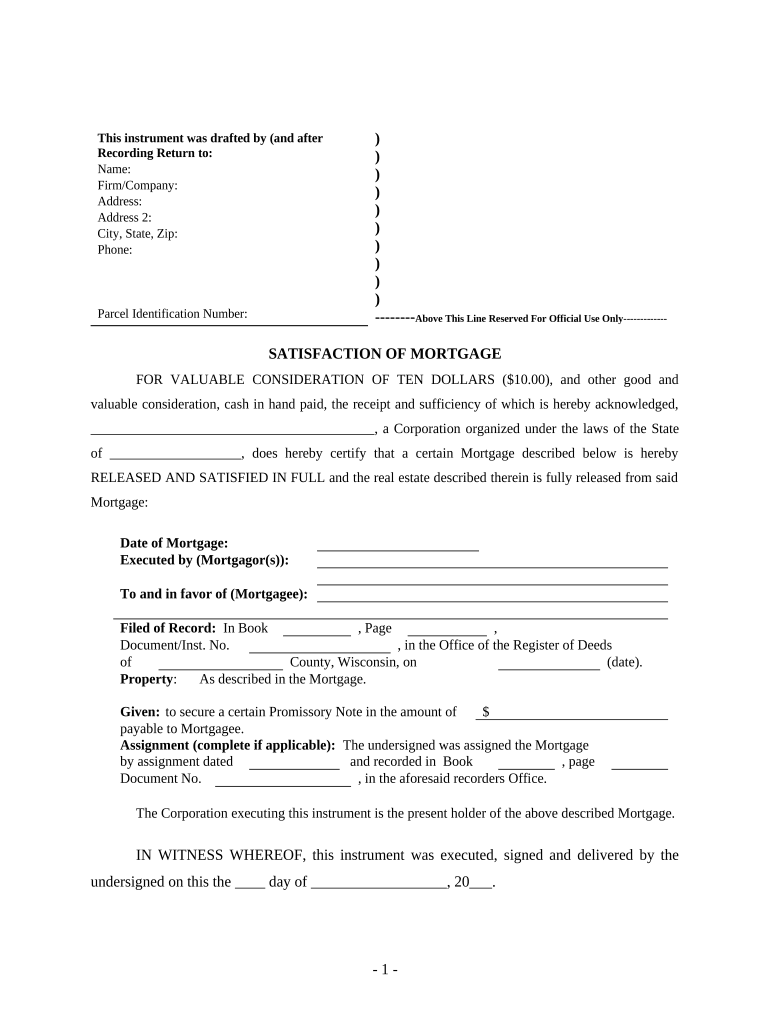

Satisfaction, Release or Cancellation of Mortgage by Corporation Wisconsin Form

Understanding the cancellation of mortgage

The cancellation of mortgage is a legal process that officially releases a borrower from their mortgage obligations. This process is crucial once a mortgage is paid off, as it ensures that the lender no longer has a claim on the property. In the United States, this cancellation is often documented through a Satisfaction of Mortgage form, which serves as proof that the debt has been settled. This document is essential for homeowners seeking to clear their property title and avoid any future claims from the lender.

Steps to complete the cancellation of mortgage

Completing the cancellation of mortgage involves several key steps:

- Gather necessary documents, including the original mortgage agreement and proof of payment.

- Fill out the Satisfaction of Mortgage form accurately, ensuring all details match the original mortgage.

- Obtain signatures from all parties involved, including the lender, to validate the cancellation.

- Submit the completed form to the appropriate state or local office for recording.

- Keep a copy of the recorded document for your records, as it serves as proof of the mortgage cancellation.

Legal use of the cancellation of mortgage

Legally, the cancellation of mortgage is recognized as a formal release of the borrower from their obligations under the mortgage agreement. This process is governed by state laws, which dictate how the cancellation must be documented and recorded. The Satisfaction of Mortgage form must meet specific legal requirements to be valid, including proper notarization and recording with the appropriate government office. Failure to follow these legal guidelines may result in complications regarding property ownership.

Key elements of the cancellation of mortgage

Several key elements must be included in the cancellation of mortgage documentation:

- Property Description: A clear description of the property being released from the mortgage.

- Borrower Information: Full names and addresses of all borrowers involved in the mortgage.

- Lender Information: Details of the lender, including their name and address.

- Mortgage Details: Information about the original mortgage, including the date it was executed and the loan number.

- Signature Section: Space for signatures of the lender and borrowers, along with notarization if required.

Obtaining the cancellation of mortgage form

The Satisfaction of Mortgage form can typically be obtained from various sources, including:

- Your lender, who may provide a standard form for their mortgages.

- State or local government websites that offer downloadable forms.

- Legal document preparation services that can assist in creating the necessary documentation.

It is important to ensure that the form used complies with your state’s legal requirements to avoid any issues during the cancellation process.

State-specific rules for the cancellation of mortgage

Each state in the U.S. has its own regulations regarding the cancellation of mortgage. These rules dictate how the Satisfaction of Mortgage form should be completed, signed, and submitted. For instance, some states may require notarization, while others may have specific filing fees or deadlines. It is advisable to consult your state’s real estate or mortgage regulatory authority to understand the specific requirements applicable to your situation.

Digital vs. paper version of the cancellation of mortgage

In today’s digital age, the cancellation of mortgage can be completed using electronic documents, provided they meet legal standards. Digital versions can offer convenience, allowing for quicker processing and easier storage. However, it is essential to ensure that the eSignature used is compliant with laws such as ESIGN and UETA. Paper versions remain valid and may be preferred in certain situations, particularly where traditional notarization is required.

Quick guide on how to complete satisfaction release or cancellation of mortgage by corporation wisconsin

Effortlessly Prepare Satisfaction, Release Or Cancellation Of Mortgage By Corporation Wisconsin on Any Device

Digital document management has gained signNow traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Satisfaction, Release Or Cancellation Of Mortgage By Corporation Wisconsin on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and eSign Satisfaction, Release Or Cancellation Of Mortgage By Corporation Wisconsin with Ease

- Locate Satisfaction, Release Or Cancellation Of Mortgage By Corporation Wisconsin and select Get Form to begin.

- Leverage the tools we provide to complete your document.

- Mark pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Satisfaction, Release Or Cancellation Of Mortgage By Corporation Wisconsin and ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for the cancellation of mortgage using airSlate SignNow?

The cancellation of mortgage using airSlate SignNow involves uploading your mortgage cancellation document, eSigning it, and securely sending it to the relevant parties. Our platform ensures that the document is legally binding and compliant with local regulations. With a few clicks, you can streamline the entire process, making it quicker and more efficient.

-

How much does it cost to use airSlate SignNow for cancellation of mortgage documents?

airSlate SignNow offers a variety of pricing plans that cater to different needs, starting from a free trial to paid subscriptions. The cost-effective nature of our solution means you can handle the cancellation of mortgage documents without breaking the bank. Explore our pricing page for detailed options that best fit your requirements.

-

What features does airSlate SignNow provide for cancellation of mortgage?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSigning, specifically designed to aid in the cancellation of mortgage processes. Our platform allows users to track document status, ensuring you never miss an important step. Additionally, you can easily manage multiple documents, making it versatile for all your signing needs.

-

Is airSlate SignNow legally recognized for the cancellation of mortgage?

Yes, airSlate SignNow is legally recognized for the cancellation of mortgage documents. Our platform complies with electronic signature laws, and every signed document is secured with advanced encryption. This ensures that your cancellation of mortgage is valid and enforceable in a court of law.

-

Can I integrate airSlate SignNow with other applications for cancellation of mortgage?

Absolutely! airSlate SignNow offers a range of integrations with popular business applications, making it easy to manage the cancellation of mortgage documents seamlessly. Whether you need to connect with your CRM, project management tools, or cloud storage services, our integrations simplify workflow and enhance productivity.

-

What benefits do I gain from using airSlate SignNow for cancellation of mortgage?

Using airSlate SignNow for the cancellation of mortgage offers numerous benefits, including time savings, cost-effectiveness, and improved accuracy. You'll enjoy a streamlined process, reducing the need for paperwork and manual handling. Plus, our user-friendly interface makes it accessible for everyone, regardless of technical expertise.

-

Are there any security measures in place when using airSlate SignNow for cancellation of mortgage?

Yes, security is a top priority at airSlate SignNow. When processing the cancellation of mortgage documents, we utilize advanced encryption and secure storage to protect your information. Additionally, we comply with industry standards to ensure your sensitive data remains safe during the signing process.

Get more for Satisfaction, Release Or Cancellation Of Mortgage By Corporation Wisconsin

- Bill text ab 588 animal shelters disclosure dog bites form

- Preferred content license agreement form

- Service reseller agreement between intelligent information

- Intelligent designthe first amendment encyclopedia form

- Collateral assignment agreement first union national form

- Real estate commercial leasing lexology form

- Special deliveryspecial offer agreement lycos inc and form

- Agreement ford motor co and bolt inc sample form

Find out other Satisfaction, Release Or Cancellation Of Mortgage By Corporation Wisconsin

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free