West Virginia Lien Form

What is the West Virginia Lien

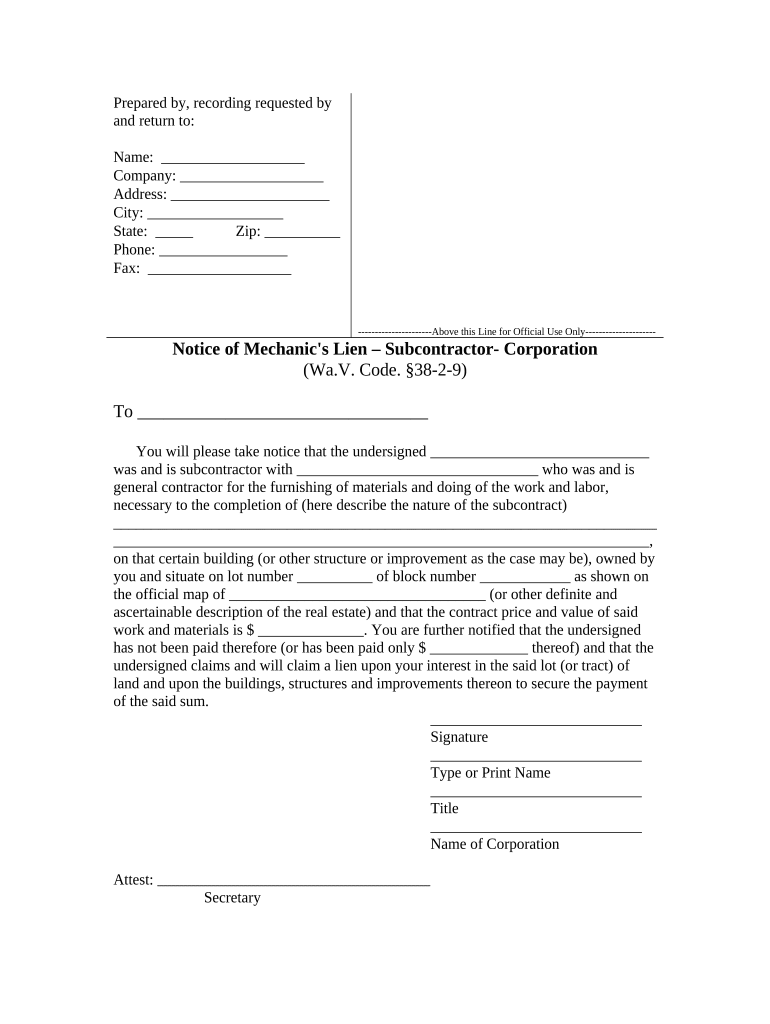

The West Virginia lien is a legal claim against an individual's property or assets, typically used to secure payment for debts or obligations. This type of lien can arise from various situations, including unpaid taxes, contractor work, or legal judgments. Understanding the nature of a lien is essential for both creditors and debtors, as it affects property ownership and the ability to sell or refinance assets. In West Virginia, the lien process is governed by state laws that outline how liens are created, enforced, and released.

How to Use the West Virginia Lien

Using the West Virginia lien involves several steps, primarily focused on ensuring that the lien is properly documented and filed. Creditors must complete the necessary forms, detailing the debt and the property involved. Once the form is filled out, it should be submitted to the appropriate local government office, typically the county clerk's office. This filing creates a public record of the lien, which can affect the debtor's credit and ability to secure future financing. It is also crucial for creditors to understand the legal implications of placing a lien, including the rights and responsibilities involved.

Steps to Complete the West Virginia Lien

Completing the West Virginia lien form requires careful attention to detail. Here are the general steps:

- Gather necessary information about the debtor and the property.

- Obtain the official West Virginia lien form from the county clerk's office or online resources.

- Fill out the form accurately, including all required details such as the amount owed and the nature of the debt.

- Sign the form to validate it, ensuring compliance with state regulations.

- Submit the completed form to the county clerk's office, along with any required fees.

Legal Use of the West Virginia Lien

The legal use of a West Virginia lien is subject to specific state laws designed to protect both creditors and debtors. Creditors must ensure that they have a valid reason for placing a lien, such as a legally enforceable debt. Additionally, they must follow proper procedures for notifying the debtor and filing the lien. Failure to comply with these legal requirements can result in the lien being deemed invalid, which may lead to legal disputes. Understanding the legal framework surrounding liens is vital for anyone involved in the process.

Key Elements of the West Virginia Lien

Several key elements define the West Virginia lien, including:

- The type of debt that gives rise to the lien, such as unpaid taxes or contractual obligations.

- The specific property or assets that are subject to the lien.

- The amount owed, which must be clearly stated in the lien documentation.

- The date of the lien filing, which establishes priority over other claims.

Filing Deadlines / Important Dates

Timeliness is crucial when dealing with liens in West Virginia. Creditors should be aware of specific filing deadlines to ensure their claims are valid. Generally, liens must be filed within a certain period after the debt becomes due. Additionally, there may be deadlines for renewing or contesting a lien. Keeping track of these important dates helps prevent complications and ensures that the lien remains enforceable.

Quick guide on how to complete west virginia lien

Prepare West Virginia Lien seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without interruptions. Manage West Virginia Lien on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign West Virginia Lien effortlessly

- Obtain West Virginia Lien and click on Get Form to commence.

- Utilize the features we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of misplaced or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and electronically sign West Virginia Lien and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a West Virginia lien?

A West Virginia lien is a legal claim against a property that ensures the payment of a debt. This document is crucial in property transactions as it secures the lender's interest in the property until the debt is paid. Understanding how liens work in West Virginia is essential for both buyers and sellers.

-

How can airSlate SignNow help with West Virginia lien documents?

airSlate SignNow streamlines the process of creating, sending, and eSigning West Virginia lien documents. Our user-friendly platform allows businesses to manage these important legal documents efficiently, ensuring that all parties can easily access and sign them. This saves time and minimizes errors in the documentation process.

-

What are the pricing options for using airSlate SignNow for West Virginia lien processing?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with affordable options that allow for essential functions. These pricing tiers provide access to features necessary for managing West Virginia lien documents effectively. You can choose a plan that best fits your business size and requirements.

-

Are there any features specific for managing West Virginia lien documents?

Yes, airSlate SignNow includes features specifically designed for managing West Virginia lien documents, such as customizable templates and automatic reminders for signers. These features help ensure that all required documentation is completed accurately and on time. Additionally, integration capabilities further enhance the document management experience.

-

Can I integrate airSlate SignNow with other tools for handling West Virginia liens?

Absolutely! airSlate SignNow supports integration with numerous other tools and platforms, making it easy to manage West Virginia liens alongside your existing business applications. This interoperability enhances workflow efficiency, allowing you to sync data and documents seamlessly across different platforms.

-

What are the benefits of eSigning West Virginia lien documents?

ESigning West Virginia lien documents offers signNow benefits such as increased efficiency, reduced paperwork, and enhanced security. By using airSlate SignNow, you can quickly obtain legally binding signatures without the need for physical meetings, which accelerates the entire lien process. This modern approach simplifies the management of lien documents for all parties involved.

-

Is airSlate SignNow secure for handling sensitive West Virginia lien documents?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive West Virginia lien documents. Our platform employs advanced encryption and security protocols to ensure that your documents are safe from unauthorized access. You can confidently manage all your lien-related paperwork knowing that it is protected by top-notch security measures.

Get more for West Virginia Lien

- Uslegal pamphlet on writ of mandateus legal forms

- Review of the federal bureau of prisons compassionate form

- Can a mother relocate a child out of state after divorce form

- A silent partner is an form

- Office of the pardon attorney form

- Uslegal pamphlet on homestead filingus legal forms

- Trespass to land legal definition of trespass to land form

- Uslegal pamphlet on modus operandius legal forms

Find out other West Virginia Lien

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure