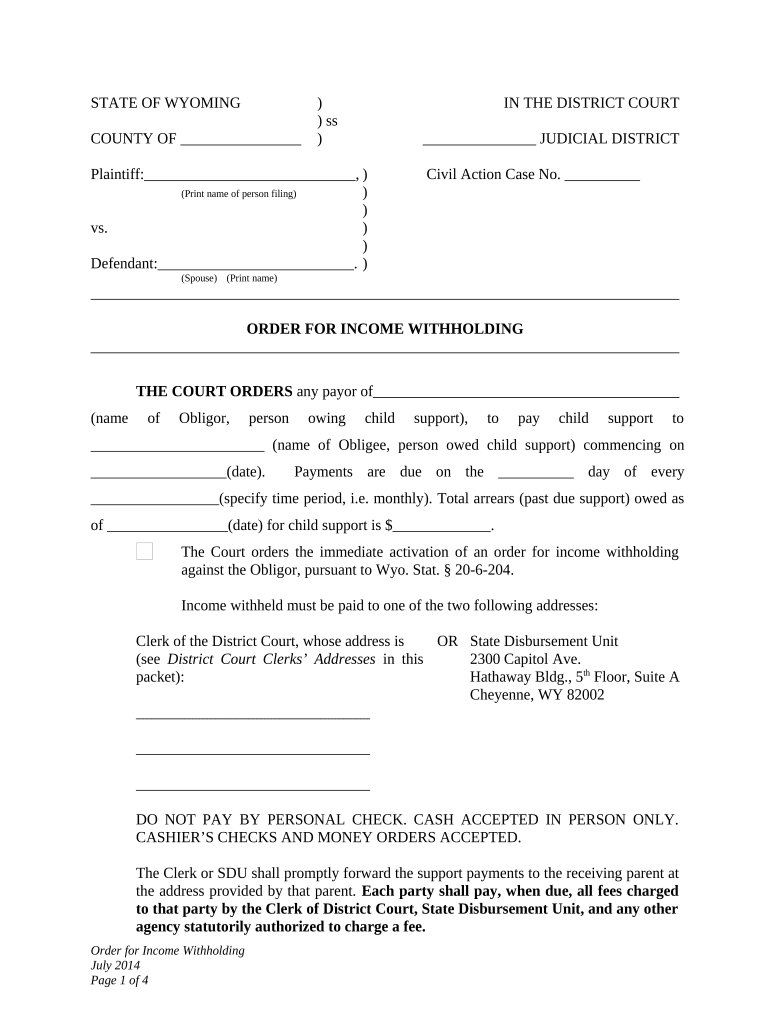

Wyoming Withholding Form

What is the Wyoming Withholding Form

The Wyoming withholding form is a crucial document used by employers to report and withhold state income taxes from employee wages. This form ensures that the correct amount of taxes is deducted from employees' paychecks, helping them meet their state tax obligations. It is essential for both employers and employees to understand the importance of this form in maintaining compliance with Wyoming tax laws.

How to Use the Wyoming Withholding Form

To effectively use the Wyoming withholding form, employers should first ensure they have the correct version of the form. The form must be filled out accurately, including the employee's personal information, such as name, address, and Social Security number. Employers should also indicate the appropriate withholding allowances based on the employee's tax situation. Once completed, the form should be kept on file for record-keeping and submitted to the state as required.

Steps to Complete the Wyoming Withholding Form

Completing the Wyoming withholding form involves several key steps:

- Gather necessary employee information, including full name, address, and Social Security number.

- Determine the number of withholding allowances the employee is eligible for, which affects the amount withheld.

- Fill out the form accurately, ensuring all information is correct.

- Review the completed form for any errors before submission.

- Keep a signed copy for your records and provide a copy to the employee.

Legal Use of the Wyoming Withholding Form

The legal use of the Wyoming withholding form is governed by state tax regulations. Employers are required to withhold state income tax from employee wages and report this information accurately. Failure to comply with these regulations can result in penalties for both the employer and the employee. It is vital for employers to stay informed about any changes in state tax laws to ensure ongoing compliance.

Key Elements of the Wyoming Withholding Form

Key elements of the Wyoming withholding form include:

- Employee Information: Full name, address, and Social Security number.

- Withholding Allowances: The number of allowances claimed by the employee, which impacts tax deductions.

- Employer Information: The employer's name, address, and identification number.

- Signature: The employee's signature is required to validate the form.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines related to the Wyoming withholding form. Employers must submit the form within a specific timeframe to ensure compliance with state tax laws. Typically, the form should be submitted when an employee starts or changes their withholding status. Keeping track of these deadlines helps prevent potential penalties and ensures that employees' tax withholdings are accurate.

Quick guide on how to complete wyoming withholding form

Complete Wyoming Withholding Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Wyoming Withholding Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Wyoming Withholding Form with ease

- Obtain Wyoming Withholding Form and click Get Form to begin.

- Utilize the tools provided to finalize your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Wyoming Withholding Form while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is wyoming withholding and how does it affect my business?

Wyoming withholding refers to the state income tax that employers are required to withhold from employees' wages. Understanding wyoming withholding is crucial for businesses to ensure compliance with state tax laws and avoid penalties. airSlate SignNow simplifies the document management process, enabling businesses to easily manage payroll documents and stay on top of withholding requirements.

-

How can airSlate SignNow help me manage wyoming withholding forms?

With airSlate SignNow, businesses can digitally sign and manage wyoming withholding forms securely and efficiently. The platform allows you to create, send, and store these documents, eliminating the need for physical paperwork. This streamlined process not only enhances productivity but also ensures that you remain compliant with wyoming withholding requirements.

-

What are the pricing options for using airSlate SignNow for wyoming withholding documentation?

airSlate SignNow offers several pricing plans designed to accommodate businesses of all sizes. Whether you need basic features or advanced functionality to handle wyoming withholding documents, there’s a plan suited for your needs. Our cost-effective solutions ensure that managing your wyoming withholding is both efficient and affordable.

-

Does airSlate SignNow integrate with payroll software to assist with wyoming withholding?

Yes, airSlate SignNow seamlessly integrates with a variety of payroll software solutions to simplify managing wyoming withholding. By connecting your payroll system with our platform, you can automate the creation and signing of required documents. This integration ensures accuracy and helps streamline workflows related to wyoming withholding.

-

Can airSlate SignNow assist with compliance regarding wyoming withholding laws?

Absolutely! airSlate SignNow helps businesses stay compliant with wyoming withholding laws by providing easy access to the latest forms and templates. Our platform also allows you to track and manage signatures, ensuring that all necessary documentation is properly executed, thus minimizing the risk of compliance issues.

-

What features does airSlate SignNow offer for managing wyoming withholding documents?

airSlate SignNow offers a range of features to manage wyoming withholding documents, including eSigning, document templates, and reminders for important deadlines. These features enhance efficiency, allowing you to send, sign, and store documents with ease. This ensures that your wyoming withholding paperwork is organized and accessible whenever needed.

-

Is it secure to use airSlate SignNow for wyoming withholding documentation?

Yes, airSlate SignNow prioritizes security and compliance, ensuring your wyoming withholding documentation is protected. Our platform uses advanced encryption and secure storage solutions to safeguard sensitive information. You can trust that your documents are safe while you manage your business's wyoming withholding needs.

Get more for Wyoming Withholding Form

- Appeared known to me or proved to me on the form

- Control number sd 08 78 form

- Acknowledgement of satisfacton of lien corporation 490218003 form

- Harmless from any and all claims demands causes of action damages judgments orders costs form

- Ap human geography ap exam practice questions and answers form

- Press and journal 92414 by press and journal issuu form

- State of south dakota circuit court form

- Demand to file suit corporation form

Find out other Wyoming Withholding Form

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors