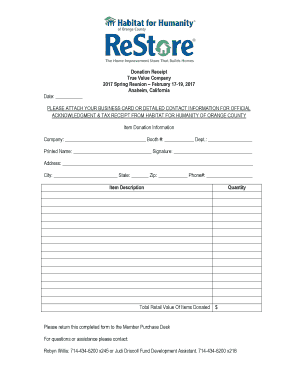

Donation Receipt True Value Company Spring Reunion Form

Understanding the Donation Receipt True Value Company Spring Reunion

The Donation Receipt True Value Company Spring Reunion serves as an essential document for individuals and organizations participating in charitable events. This receipt confirms the donation made and provides necessary details such as the donor's name, the date of the donation, and the value of the items donated. It is crucial for tax purposes, as donors may need this documentation to claim deductions on their tax returns.

Steps to Complete the Donation Receipt True Value Company Spring Reunion

Completing the Donation Receipt involves several key steps to ensure accuracy and compliance. First, gather all relevant information about the donation, including the donor's name, address, and the items being donated. Next, accurately assess the fair market value of the donated items, as this will be necessary for the receipt. Finally, fill out the receipt with all required details, ensuring that both the donor and the organization retain a copy for their records.

Legal Use of the Donation Receipt True Value Company Spring Reunion

The legal use of the Donation Receipt is vital for both donors and organizations. This document serves as proof of the donation and is recognized by the IRS for tax deduction purposes. To be legally binding, the receipt must include specific information, such as the donor's details, a description of the donated items, and the date of the donation. Failing to provide accurate information may lead to complications during tax filing.

IRS Guidelines for Donation Receipts

The IRS has established guidelines that govern the issuance and use of donation receipts. According to these guidelines, receipts must include the name of the organization, the date of the contribution, a description of the donated items, and a statement indicating whether any goods or services were provided in exchange for the donation. Donors should retain these receipts for their records, especially if they plan to claim a deduction on their tax return.

Eligibility Criteria for Donation Receipts

Eligibility for receiving a Donation Receipt typically applies to individuals or businesses that make contributions to qualified charitable organizations. To qualify, the organization must be recognized by the IRS as a tax-exempt entity under Section 501(c)(3). Donors should ensure that the organization meets these criteria before making a donation to guarantee that they can utilize the receipt for tax purposes.

Examples of Using the Donation Receipt True Value Company Spring Reunion

Examples of using the Donation Receipt include situations where individuals donate goods to local charities, participate in fundraising events, or contribute to community service projects. In each case, the receipt provides documentation that can be used when filing taxes, allowing donors to claim deductions for their charitable contributions. It is advisable for donors to keep a record of all receipts to substantiate their claims during tax season.

Quick guide on how to complete donation receipt true value company 2017 spring reunion

Complete Donation Receipt True Value Company Spring Reunion effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without hold-ups. Manage Donation Receipt True Value Company Spring Reunion on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and eSign Donation Receipt True Value Company Spring Reunion with ease

- Find Donation Receipt True Value Company Spring Reunion and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your selection. Modify and eSign Donation Receipt True Value Company Spring Reunion while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it benefit businesses in Mesa, CA?

airSlate SignNow is a comprehensive eSignature solution that streamlines document management for businesses in Mesa, CA. By offering an easy-to-use and cost-effective platform, it empowers companies to send and sign documents quickly, boosting efficiency and reducing turnaround times.

-

How much does airSlate SignNow cost for businesses in Mesa, CA?

The pricing for airSlate SignNow is designed to be budget-friendly for businesses in Mesa, CA. Various plans are available, including free trials, allowing you to choose the package that best fits your needs and check out the features without commitment.

-

What are the key features of airSlate SignNow for users in Mesa, CA?

airSlate SignNow offers various features that cater to users in Mesa, CA, including customizable templates, real-time tracking, and team collaboration tools. These features are designed to enhance productivity and make document signing a seamless experience.

-

Is airSlate SignNow compliant with California laws for eSignatures?

Yes, airSlate SignNow is fully compliant with California laws regarding eSignatures, including the ESIGN Act and UETA. Businesses in Mesa, CA can confidently use our platform to ensure that their electronic signatures are legally binding and secure.

-

Can airSlate SignNow integrate with other software used in Mesa, CA?

Absolutely! airSlate SignNow provides robust integrations with various popular software applications, making it easy for businesses in Mesa, CA to streamline their workflows. Connect with tools like Google Drive, Salesforce, and Dropbox for a more integrated experience.

-

What benefits can Mesa, CA businesses expect from using airSlate SignNow?

Mesa, CA businesses using airSlate SignNow can expect signNow time savings and cost reduction. By eliminating paper documents and simplifying the signing process, companies can focus on their core activities while enhancing customer satisfaction.

-

How secure is airSlate SignNow for businesses operating in Mesa, CA?

Security is a top priority for airSlate SignNow. Businesses in Mesa, CA can rest assured knowing that our platform provides encryption and compliance with industry standards, ensuring that all documents are stored and transmitted securely.

Get more for Donation Receipt True Value Company Spring Reunion

Find out other Donation Receipt True Value Company Spring Reunion

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation