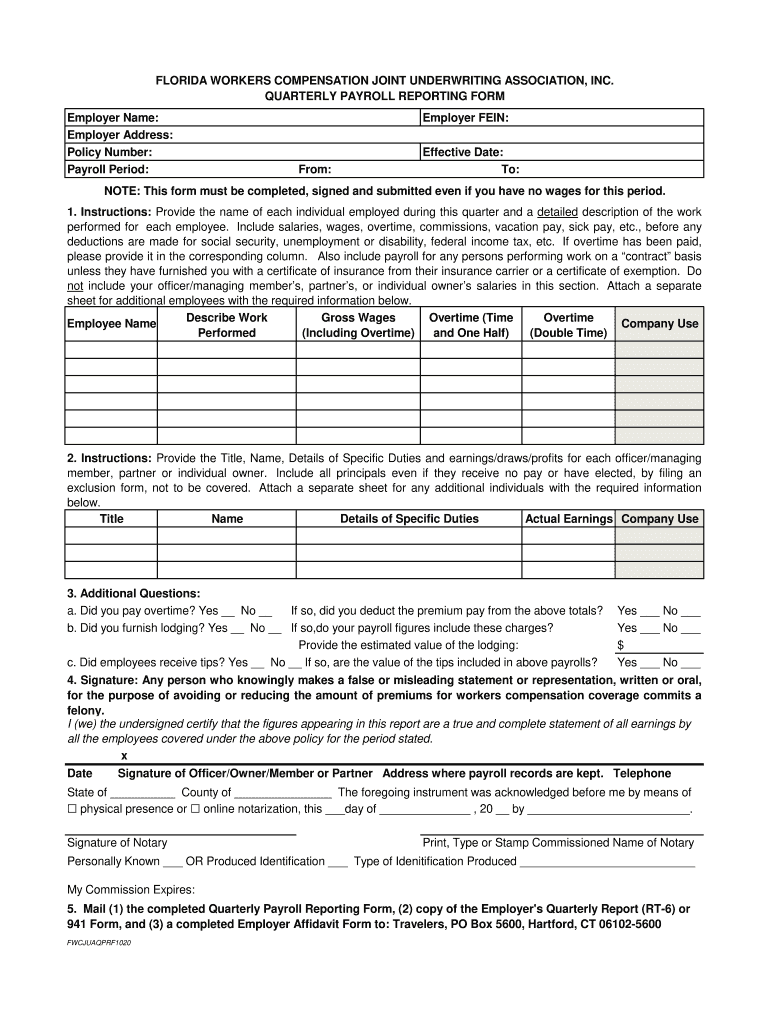

QUARTERLY PAYROLL REPORTING FORM

What is the quarterly payroll reporting form?

The quarterly payroll reporting form is a critical document used by employers in Florida to report wages paid to employees and the associated taxes withheld. This form is essential for maintaining compliance with state and federal regulations concerning payroll taxes. It typically includes information such as total wages, employee details, and tax contributions. Accurate reporting ensures that employers meet their obligations and helps prevent penalties associated with non-compliance.

Steps to complete the quarterly payroll reporting form

Completing the quarterly payroll reporting form involves several key steps to ensure accuracy and compliance:

- Gather employee wage information: Collect data on total wages, hours worked, and any deductions.

- Calculate taxes withheld: Determine the amount of federal, state, and local taxes withheld from employee wages.

- Fill out the form: Input the gathered information into the appropriate sections of the form, ensuring all details are accurate.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties.

- Submit the form: File the completed form with the appropriate state agency by the deadline.

Legal use of the quarterly payroll reporting form

The quarterly payroll reporting form is legally binding and must be completed in accordance with state and federal laws. This includes adhering to guidelines set forth by the Florida Workers Compensation Association and other regulatory bodies. Accurate and timely submission of this form is crucial, as it serves as a record of compliance with tax obligations and can be referenced in audits or legal proceedings.

Filing deadlines / Important dates

Employers must be aware of specific filing deadlines for the quarterly payroll reporting form to avoid penalties. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadlines for the first three quarters are:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

Failure to meet these deadlines can result in fines and interest on unpaid taxes.

Who issues the form

The quarterly payroll reporting form is issued by the Florida Department of Revenue. This agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Employers can obtain the form directly from the department's website or through authorized state offices. It is essential for employers to use the most current version of the form to ensure compliance.

Penalties for non-compliance

Non-compliance with the quarterly payroll reporting form requirements can lead to significant penalties for employers. These may include:

- Fines for late submission or failure to file.

- Interest on unpaid taxes.

- Increased scrutiny from tax authorities, potentially leading to audits.

To avoid these consequences, employers should prioritize timely and accurate completion of the form.

Quick guide on how to complete quarterly payroll reporting form

Easily Create QUARTERLY PAYROLL REPORTING FORM on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage QUARTERLY PAYROLL REPORTING FORM on any device using airSlate SignNow's Android or iOS applications and enhance your document-focused operations today.

The Easiest Way to Modify and eSign QUARTERLY PAYROLL REPORTING FORM

- Find QUARTERLY PAYROLL REPORTING FORM and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether it be through email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your device of choice. Modify and eSign QUARTERLY PAYROLL REPORTING FORM to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is FL workers compensation joint and how does it work?

FL workers compensation joint refers to the collaborative efforts between employers and employees in managing workers' compensation claims in Florida. It involves utilizing tools like airSlate SignNow to streamline the paperwork process, ensuring that all necessary documents are signed and filed efficiently.

-

How can airSlate SignNow assist with FL workers compensation joint documentation?

airSlate SignNow helps automate the signing process for FL workers compensation joint documentation, enabling faster approvals and reducing the time spent on paperwork. With its user-friendly interface, businesses can easily prepare and send documents for eSigning, maintaining compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for FL workers compensation joint forms?

Yes, airSlate SignNow offers various pricing options to suit different business needs when handling FL workers compensation joint forms. These plans provide access to essential features, including unlimited eSignatures and document templates, allowing you to choose the right solution that fits your budget.

-

What are the main features of airSlate SignNow related to FL workers compensation joint?

Key features of airSlate SignNow for FL workers compensation joint include customizable templates, in-person signing, and robust security measures to protect sensitive information. Additionally, the platform integrates with various applications, further enhancing workflow efficiency in processing workers' compensation claims.

-

How does airSlate SignNow improve workflow for FL workers compensation joint processes?

By utilizing airSlate SignNow, businesses can signNowly enhance their workflow efficiency in FL workers compensation joint processes. The platform allows for real-time tracking of document status, automated reminders, and the ability to collect signatures quickly, minimizing delays in claims processing.

-

Can airSlate SignNow be integrated with other software solutions for FL workers compensation joint?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions commonly used in managing FL workers compensation joint claims, such as HR and payroll systems. This integration streamlines processes further, ensuring that all related documents are synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for small businesses handling FL workers compensation joint?

Small businesses can greatly benefit from using airSlate SignNow by reducing administrative burdens associated with FL workers compensation joint. The platform not only saves time and resources but also ensures compliance with legal standards, making it an essential tool for effectively managing workers' compensation claims.

Get more for QUARTERLY PAYROLL REPORTING FORM

- Alabama complaint for slip and fall form

- Alabama defendants motion to dismiss form

- Alabama general answer to tort complaints form

- Alabama certificate of divorce form

- Al agreement form contract

- Alabama closing form

- Alabama uifsa instructions for uniform support petition

- Alabama petition for vacation of a road filed with city vacate road or street form

Find out other QUARTERLY PAYROLL REPORTING FORM

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy